Connecticut New Employee Survey

Description

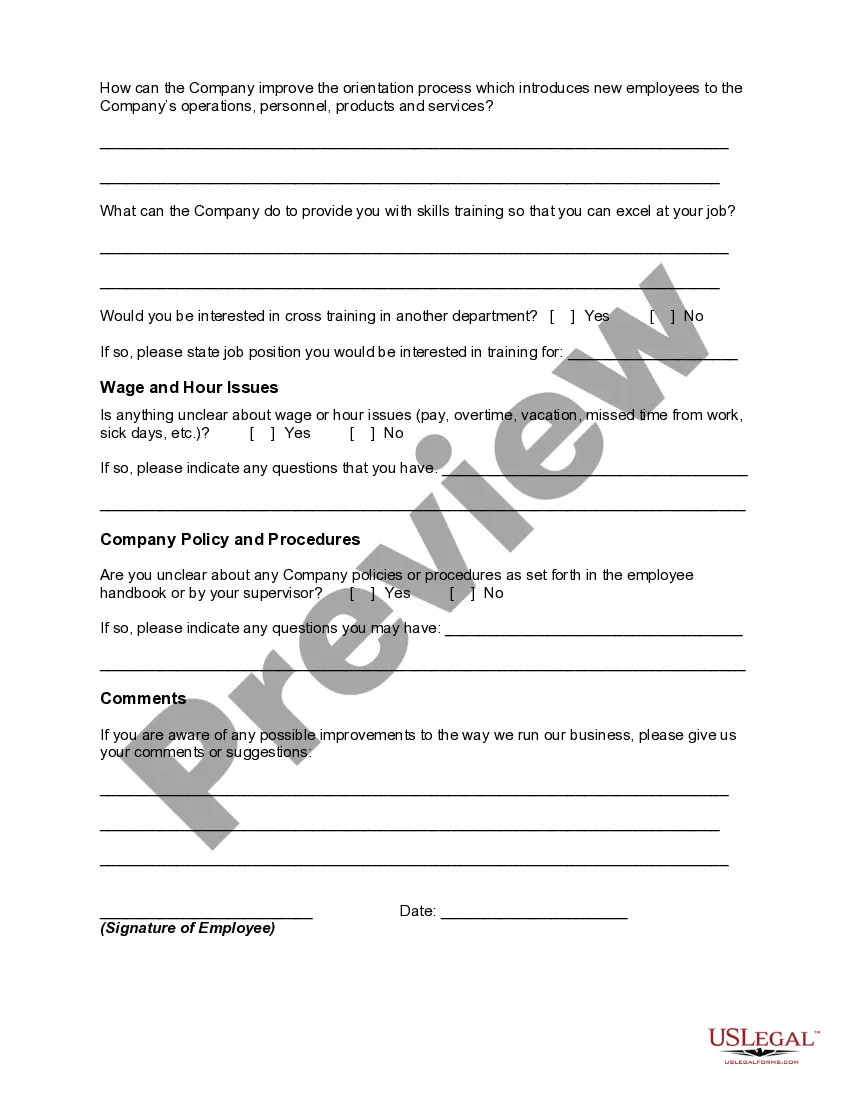

New employee surveys can be done for many purposes. One of them is the new employee orientation survey. This survey is generally done after a few days of orientation to determine any potential issues relating to productivity, turnover, attitudes and other aspects. It would also help the management to understand the productivity of the orientation or training program that the new employee went through in the initial days. The employee's experiences in the early days of employment are also important determinants, since they represent the company's image through the eyes of a new person.

Another kind of new employee survey can be undertaken to know whether the employee has completely understood all the aspects of the new job or not. This can include the job analysis and description, the basics of the job, the most enjoyable and least enjoyable parts of the job, and so on. New employee survey can include information relating to corporate culture, training, supervisor relations, work environment, pay and benefits, communications, feedback, leadership, corporate vision, and overall satisfaction.

How to fill out New Employee Survey?

You might spend hours online attempting to locate the legal template that fulfills the state and federal requirements you need.

US Legal Forms offers a multitude of legal documents that are reviewed by professionals.

It is easy to obtain or print the Connecticut New Employee Survey from the platform.

If available, utilize the Review button to examine the template as well. If you wish to obtain an extra version of the document, use the Search field to find the format that suits your needs and requirements.

- If you already have a US Legal Forms account, you can Log In and click on the Obtain button.

- Afterward, you can complete, modify, print, or sign the Connecticut New Employee Survey.

- Every legal template you download is yours forever.

- To acquire an additional copy of a purchased document, go to the My documents tab and click on the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions provided below.

- Firstly, ensure you have selected the correct format for the state/city of your choice.

- Check the document description to confirm you have selected the correct form.

Form popularity

FAQ

For new hire reporting, employers are required to submit forms, including the W-4 and the I-9. Additionally, states may have their specific reporting requirements that could include state tax forms. These forms are vital for compliance and reporting in the Connecticut New Employee Survey, and employing a resource like USLegalForms can streamline the submission process.

Make sure you and new hires complete employment forms required by law.W-4 form (or W-9 for contractors)I-9 Employment Eligibility Verification form.State Tax Withholding form.Direct Deposit form.E-Verify system: This is not a form, but a way to verify employee eligibility in the U.S.

Hiring processFind your candidates. Ask your best employees if they know anyone who might be a good fit for the role.Conduct interviews. You should try to have at least a couple of employees interview the candidates, if possible.Run a background check.Make sure they're eligible to work in the U.S.

Steps to Hiring your First Employee in ConnecticutStep 1 Register as an Employer.Step 2 Employee Eligibility Verification.Step 3 Employee Withholding Allowance Certificate.Step 4 New Hire Reporting.Step 5 Payroll Taxes.Step 6 Workers' Compensation Insurance.Step 7 Labor Law Posters and Required Notices.More items...?

Before you can add an employee to your team, you are legally responsible for confirming the employee is eligible to work in the United States.Form I-9.Form W-4.State W-4.Emergency contact form.Employee handbook acknowledgment form.Bank account information form.Benefits forms.

Advertise Locally In this case, traditional job posting websites may not be necessary. Instead, consider using a more grassroots approach to hiring. Try posting your job on local job boards, Facebook Groups, or websites like Craigslist.

Employees fill out a W-4 form to inform employers how much tax to withhold from their paycheck based on filing status, dependents, anticipated tax credits, and deductions. If the form is filled out incorrectly, you may end up owing taxes when you file your return. The IRS simplified the form in 2020.

Steps to Hiring your First Employee in ConnecticutStep 1 Register as an Employer.Step 2 Employee Eligibility Verification.Step 3 Employee Withholding Allowance Certificate.Step 4 New Hire Reporting.Step 5 Payroll Taxes.Step 6 Workers' Compensation Insurance.Step 7 Labor Law Posters and Required Notices.More items...?

Hiring your first employee: Steps to takeObtain your EIN.Get your taxes in order.Set up your insurance.Write a job description and post the opening.Interview and hire.7 Startup Business Loan Options for Entrepreneurs.

state employer can report all its new hires to us electronically, via FTP. For information on reporting multistate new hires to Connecticut, please call the Connecticut Department of Labor at (860) 2636310 or visit our FAQ on electronic reporting.