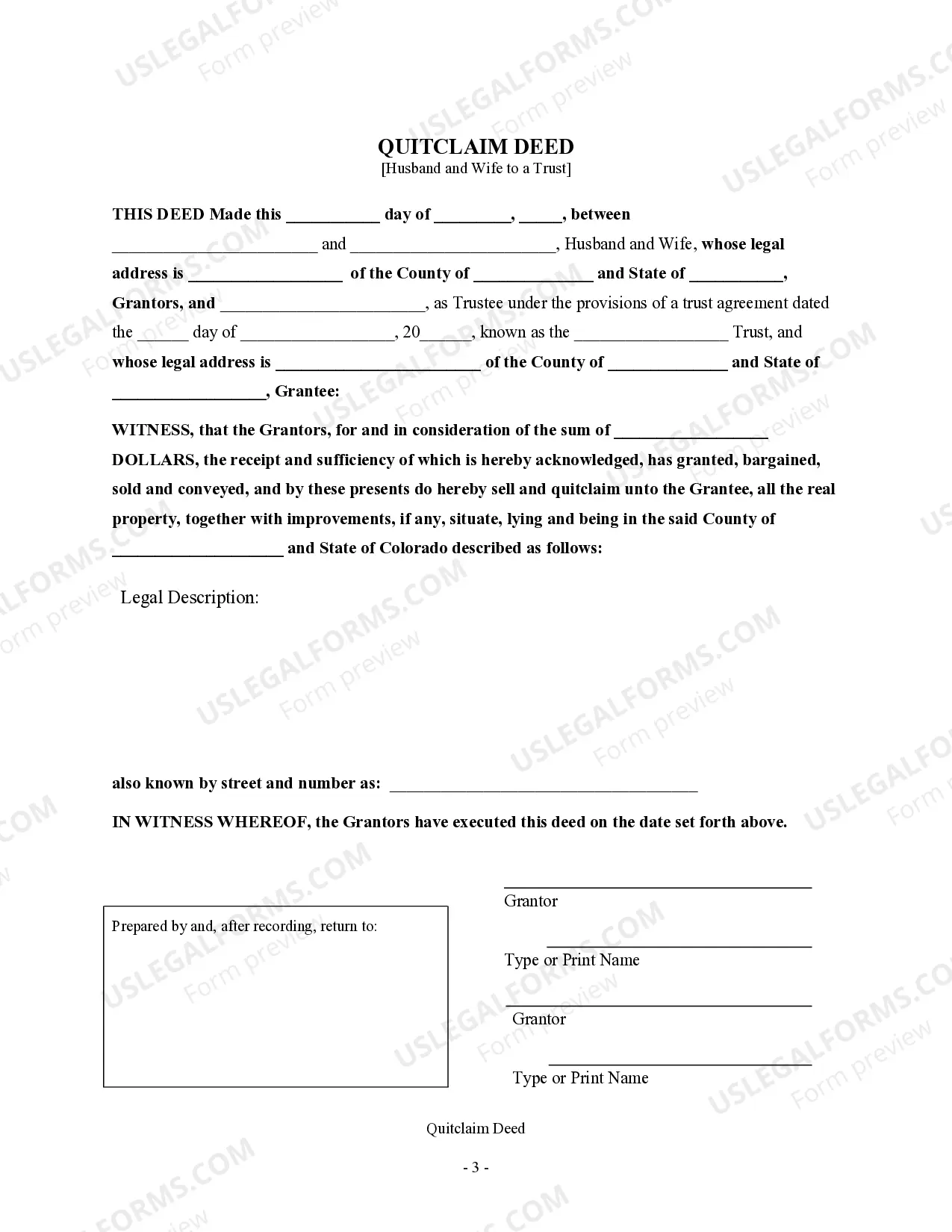

This form is a Quitclaim Deed where the Grantors are husband and wife and the Grantee is a Trust. Grantors convey and quitclaim the described property to grantee. This deed complies with all state statutory laws.

Quitclaim Deed Husband Estate

Description

How to fill out Colorado Quitclaim Deed - Husband And Wife To A Trust?

The more papers you have to make - the more stressed you are. You can get a huge number of Colorado Quitclaim Deed - Husband and Wife to a Trust blanks on the web, nevertheless, you don't know which ones to rely on. Remove the headache and make detecting samples more straightforward with US Legal Forms. Get expertly drafted documents that are published to meet state demands.

If you currently have a US Legal Forms subscribing, log in to your account, and you'll find the Download button on the Colorado Quitclaim Deed - Husband and Wife to a Trust’s web page.

If you have never tried our website earlier, finish the registration procedure with the following directions:

- Make sure the Colorado Quitclaim Deed - Husband and Wife to a Trust applies in the state you live.

- Re-check your choice by studying the description or by using the Preview function if they’re available for the selected record.

- Click on Buy Now to get started on the signing up procedure and select a costs plan that meets your expectations.

- Insert the requested data to make your account and pay for your order with your PayPal or bank card.

- Select a convenient file formatting and get your copy.

Access every file you get in the My Forms menu. Simply go there to prepare fresh version of the Colorado Quitclaim Deed - Husband and Wife to a Trust. Even when preparing properly drafted templates, it is nevertheless crucial that you think about requesting your local lawyer to re-check filled out form to ensure that your document is accurately filled out. Do more for less with US Legal Forms!