Wisconsin Tod Form For Indiana

Description

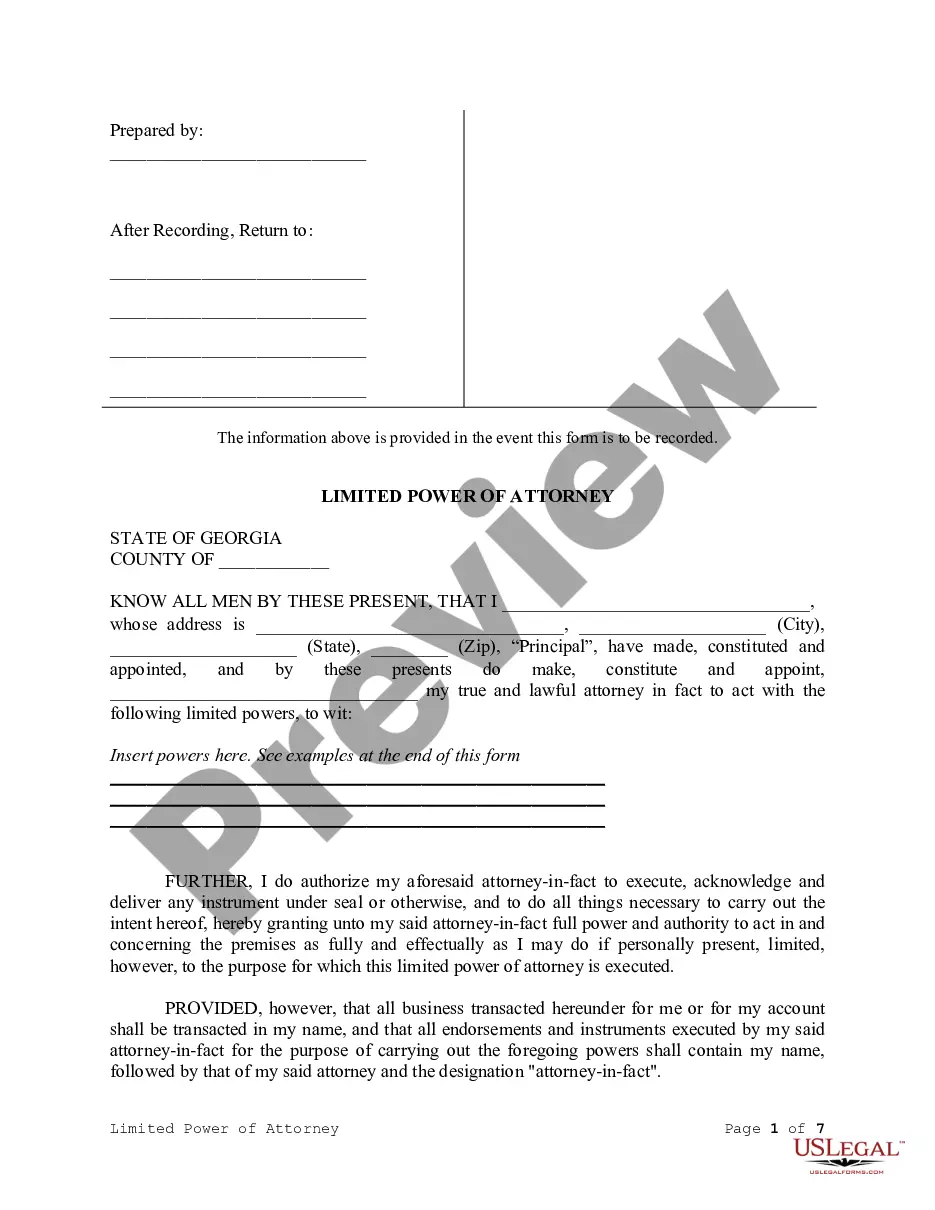

How to fill out Wisconsin Transfer On Death Or TOD To Beneficiary - Official Form Used To Record Beneficiary's Interest Following Death Of Grantor?

Managing legal documents can be exasperating, even for the most adept experts.

When you are looking for a Wisconsin Tod Form For Indiana and lack the time to search for the correct and updated version, the tasks can be challenging.

Access state- or county-specific legal and business documents.

US Legal Forms addresses any requirements you might have, ranging from personal to business paperwork, all in one location.

If this is your first experience with US Legal Forms, create an account and gain unlimited access to all the platform's features. Here are the steps to follow after locating the form you require: Verify that it is the correct form by previewing it and examining its details. Ensure that the sample is valid in your state or county. Click Buy Now when you are prepared. Choose a monthly subscription option. Select the format you need, and Download, fill out, sign, print, and submit your document. Take advantage of the US Legal Forms online catalog, backed by 25 years of experience and reliability. Transform your daily document management into a straightforward and user-friendly process today.

- Employ cutting-edge tools to complete and oversee your Wisconsin Tod Form For Indiana.

- Access a wealth of articles, tutorials, handbooks, and materials pertinent to your situation and requirements.

- Save time and effort searching for the documents you need, and utilize US Legal Forms’ advanced search and Review feature to locate Wisconsin Tod Form For Indiana and obtain it.

- If you have a subscription, Log In to your US Legal Forms account, look for the form, and obtain it.

- Check your My documents tab to view the documents you have previously downloaded and manage your folders as needed.

- A comprehensive online form repository can revolutionize the way anyone handles these circumstances effectively.

- US Legal Forms stands out as a leader in online legal documentation, offering over 85,000 state-specific legal forms at your disposal at any time.

- With US Legal Forms, you can.

Form popularity

FAQ

You must sign the deed and get your signature notarized, and then record (file) the deed with the county recorder's office before your death. Otherwise, it won't be valid.

In Indiana, real estate can be transferred via a TOD deed, which allows a property owner to designate a beneficiary who will automatically inherit the property upon the owner's death, avoiding probate.

Over 31 States currently allow the use of TOD Deeds. Indiana allows the use of POD (payable on death)/TOD (transfer on death) on any type of property interest including bank accounts, investments, and even titles to vehicles since 2009.

A transfer on death (TOD) deed is like a regular deed you might use to transfer your Indiana real estate, but with a crucial difference: It doesn't take effect until your death.

A Wisconsin TOD deed must include: The name of the property owner or owners whose interest a TOD deed will transfer; The TOD beneficiary's name; and. A statement that the transfer only becomes effective upon the owner's death.