Inheritance Tax Waiver Form For Pa

Description

How to fill out Renunciation And Disclaimer Of Right To Inheritance Or To Inherit Property From Deceased - Specific Property?

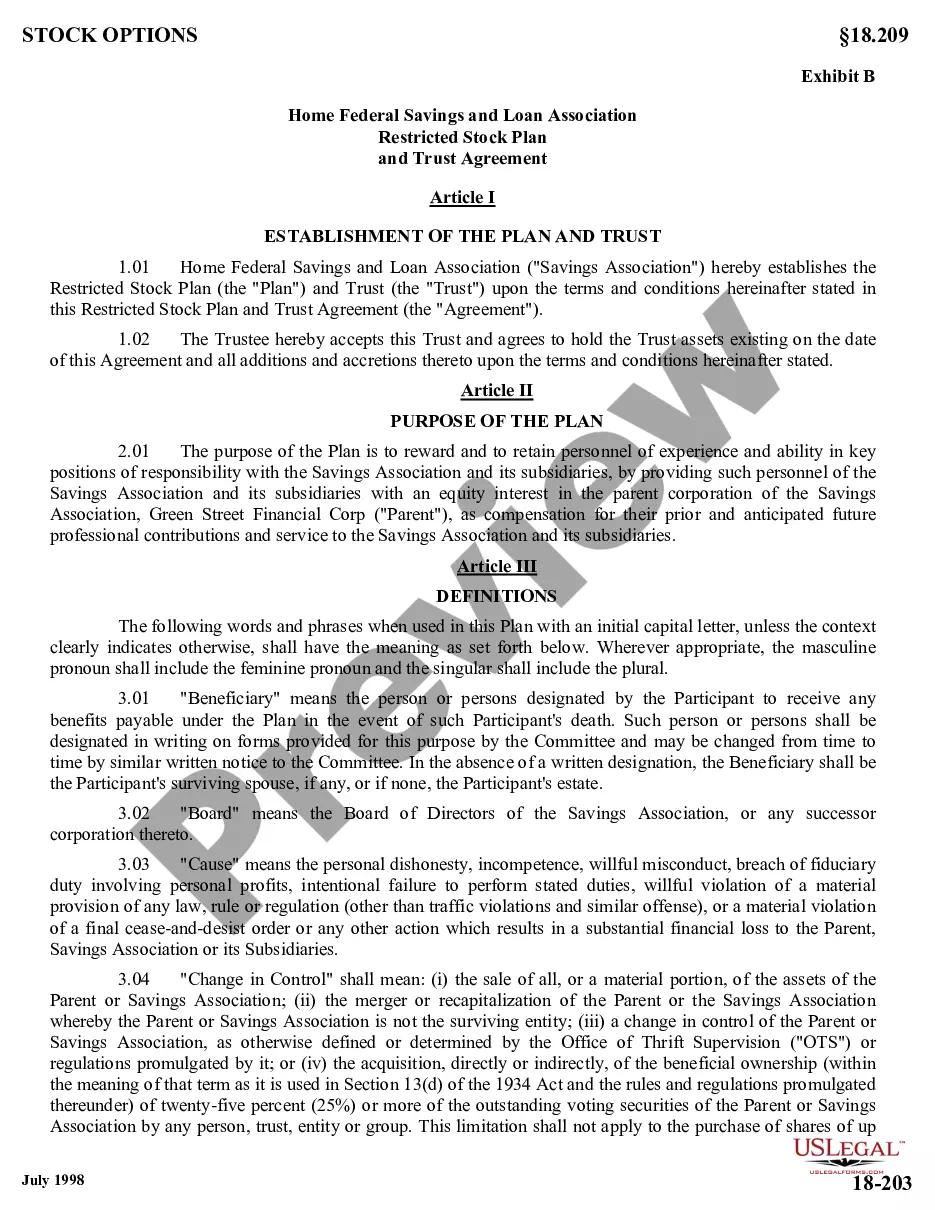

The Inheritance Tax Waiver Document For Pa displayed on this page is a reusable official template crafted by expert attorneys in accordance with federal and state laws.

For over 25 years, US Legal Forms has supplied individuals, businesses, and lawyers with more than 85,000 authenticated, state-specific templates for any business and personal needs. It’s the quickest, simplest, and most dependable method to secure the documents you require, as the service assures the utmost level of data protection and anti-virus safeguarding.

Select the format you desire for your Inheritance Tax Waiver Document For Pa (PDF, Word, RTF) and save the example on your device.

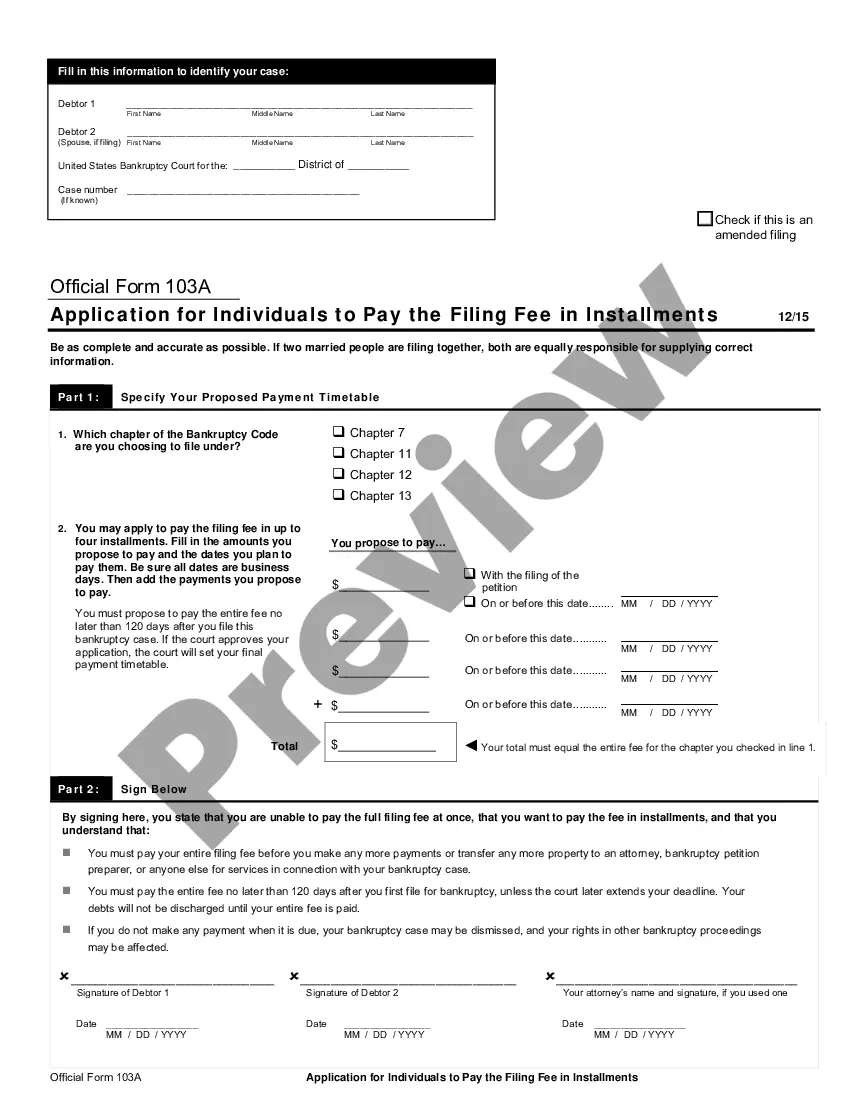

- Search for the document you require and verify it.

- Browse the sample you located and preview it or read the form description to ensure it meets your criteria. If it doesn’t, utilize the search feature to find the appropriate one. Click Buy Now when you have identified the template you require.

- Register and sign in.

- Choose the pricing option that fits you and create an account. Use PayPal or a credit card for a swift payment. If you already possess an account, Log In and verify your subscription to continue.

- Acquire the editable template.

Form popularity

FAQ

There are practical ways to minimize or avoid PA inheritance tax without needing to move to a state without estate tax or inheritance tax. #1 - Gifting. Either to individuals, charities, or irrevocable trusts. #2 - Buying real property in a state without estate or inheritance tax.

Preparing the Pennsylvania Inheritance Tax Return The Probate Attorney typically prepares the Inheritance Tax Return. An accountant can prepare the return but many accountants are unfamiliar with the return.

The family exemption is a right given to specific individuals to retain or claim certain types of a decedent's property in ance with Section 3121 of the Probate, Estate and Fiduciaries Code. For decedents dying after January 29, 1995, the family exemption is $3,500.

If inheritance tax is paid within three months of the decedent's death, a 5 percent discount is allowed. For further information and answers to commonly asked questions, please review the brochure, Pennsylvania Inheritance Tax and Safe Deposit Boxes.

Property owned jointly between husband and wife is exempt from inheritance tax, while property inherited from a spouse, or from a child aged 21 or younger by a parent, is taxed a rate of 0%.