Converting Partnership To C Corporation

Description

How to fill out Agreement And Plan Of Merger For Conversion Of Corporation Into Maryland Real Estate Investment Trust?

Dealing with legal documents and procedures can be a time-consuming addition to your entire day. Converting Partnership To C Corporation and forms like it usually require you to search for them and navigate the way to complete them effectively. As a result, regardless if you are taking care of economic, legal, or personal matters, using a thorough and convenient web catalogue of forms at your fingertips will go a long way.

US Legal Forms is the top web platform of legal templates, offering over 85,000 state-specific forms and a variety of resources that will help you complete your documents easily. Check out the catalogue of relevant documents available to you with just one click.

US Legal Forms gives you state- and county-specific forms offered at any moment for downloading. Shield your document management procedures by using a high quality service that allows you to make any form within minutes without extra or hidden cost. Simply log in to the account, locate Converting Partnership To C Corporation and acquire it immediately from the My Forms tab. You may also gain access to previously downloaded forms.

Is it your first time utilizing US Legal Forms? Register and set up up your account in a few minutes and you’ll gain access to the form catalogue and Converting Partnership To C Corporation. Then, follow the steps listed below to complete your form:

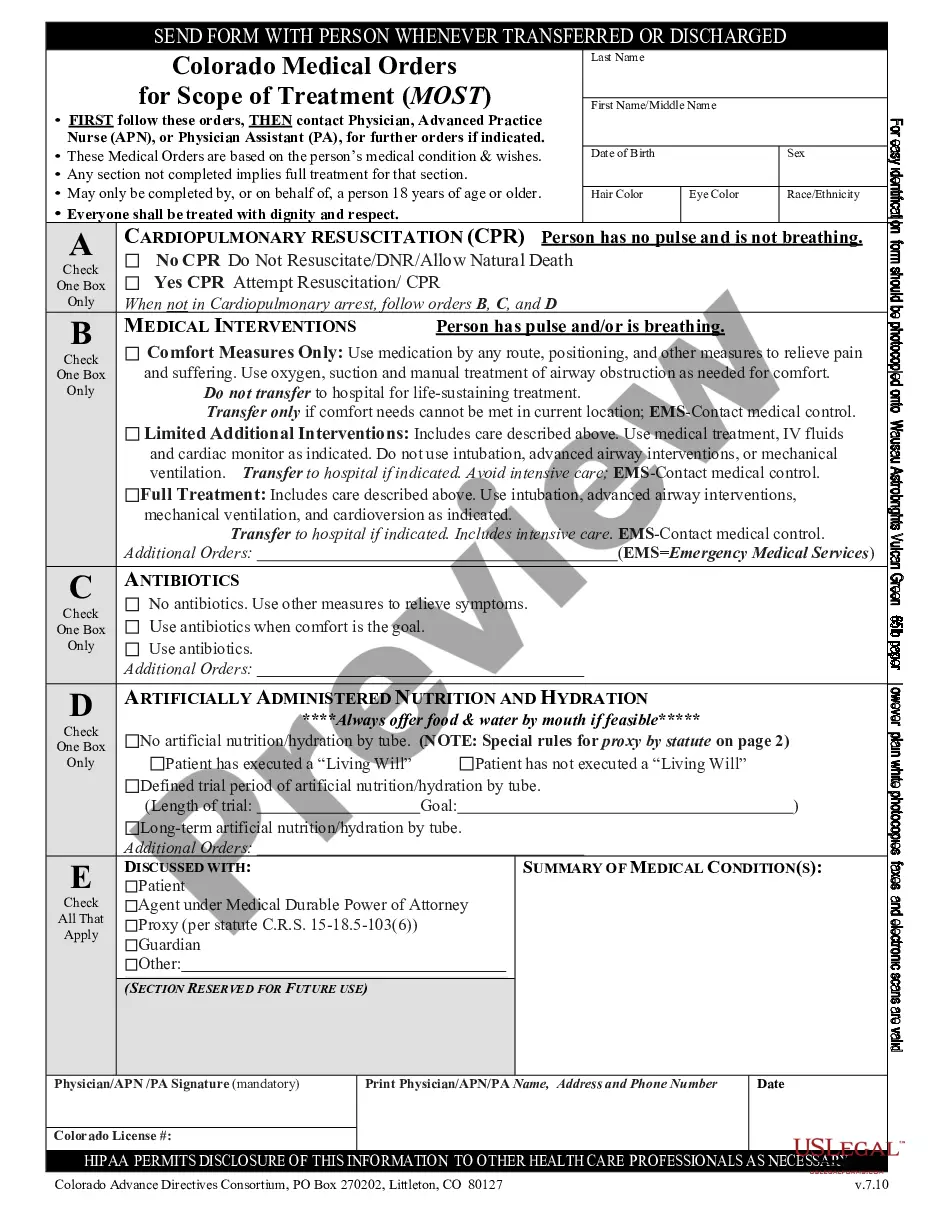

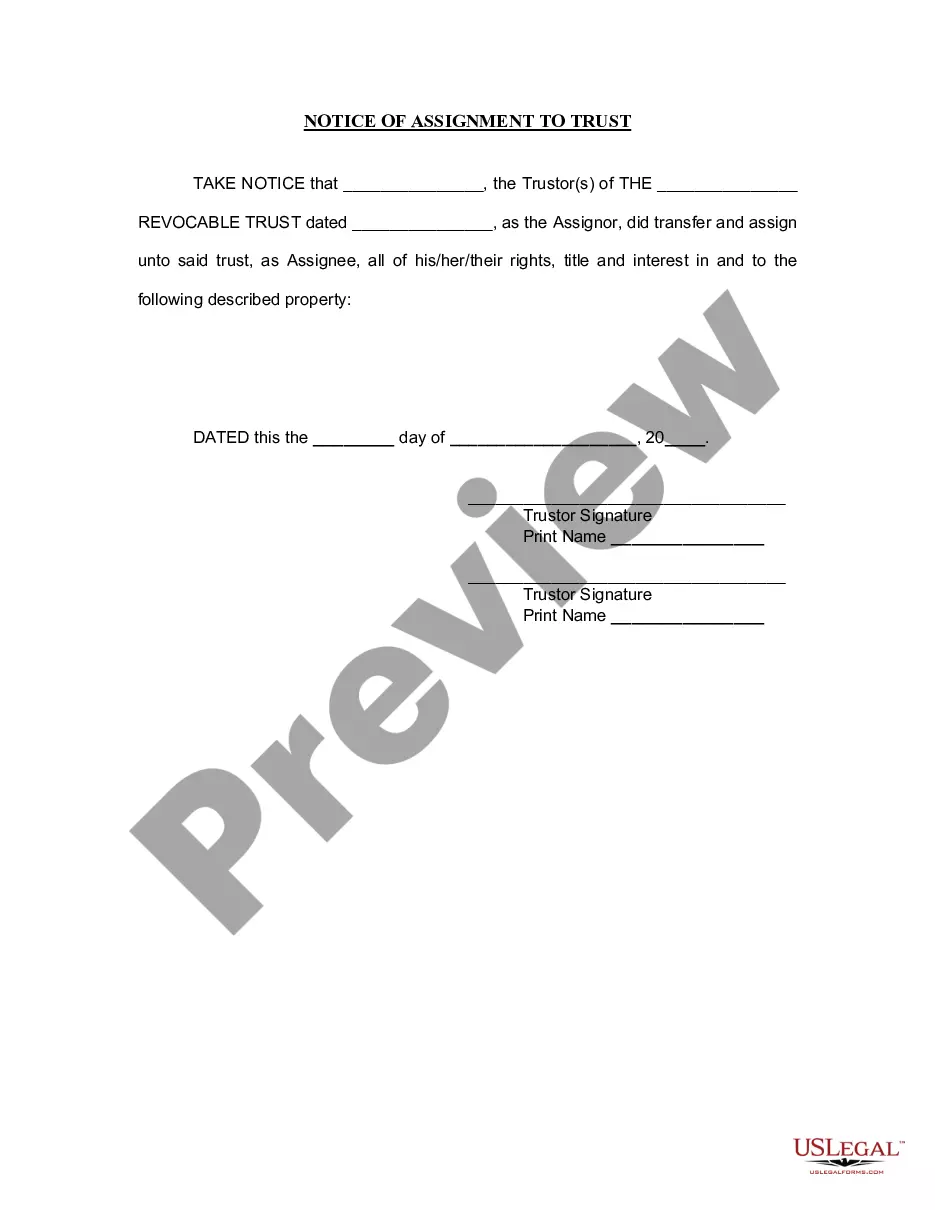

- Ensure you have the right form by using the Preview option and reading the form description.

- Choose Buy Now as soon as all set, and select the monthly subscription plan that fits your needs.

- Select Download then complete, sign, and print the form.

US Legal Forms has twenty five years of experience assisting consumers handle their legal documents. Find the form you want today and improve any process without having to break a sweat.

Form popularity

FAQ

The? check-the-box regulations permit an LLC to be taxed as a C corporation. There are no tax consequences of a partnership converting to a C corporation. Section 351 applies to an exchange if the contributing shareholders own more than? 50% of a? corporation's stock after the transfer.

The reason might be to reduce exposure for you and the other owners to Social Security and Medicare taxes, which come in the form of the self-employment tax for partners. Specifically, each partner's share of net partnership income is usually fully exposed to the self-employment tax.

It remains an LLC for state charter purposes, but files taxes like a C corporation (both federal and state). In this specific case of conversion, since the LLC wants to re-form as a C corp, it will be viewed as a new entity. This means a new charter from the state, and it must get its unique EIN number.

Finally, the conversion of an LLC into a C Corp may be taxable for some LLCs: This can occur in LLCs that spend money borrowed and then deduct the money spent as expenses. As a result, LLC members may experience an income gain based on LLC profits caused by the conversion.

Yes, ing to IRS guidelines, you'll need to get a new EIN when you convert from an LLC to a corporation.