Self Evaluation Examples For Customer Service

Description

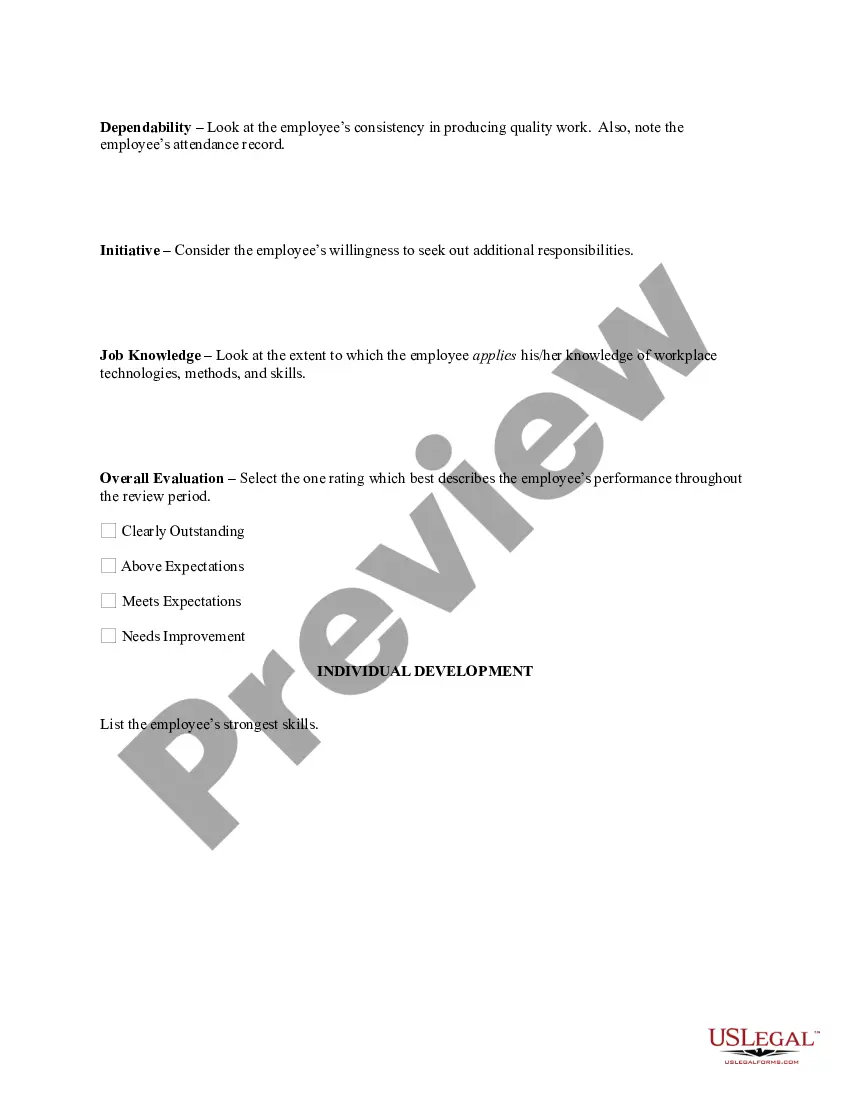

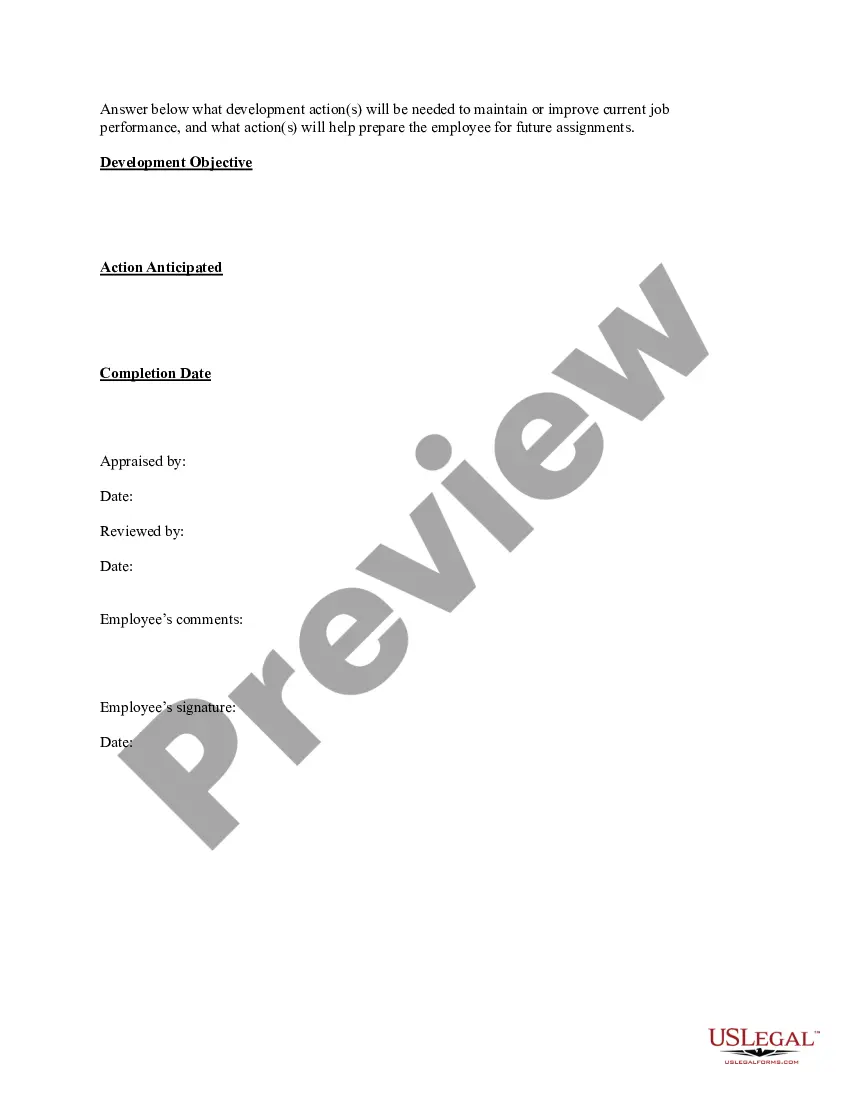

How to fill out Sample Performance Review For Nonexempt Employees?

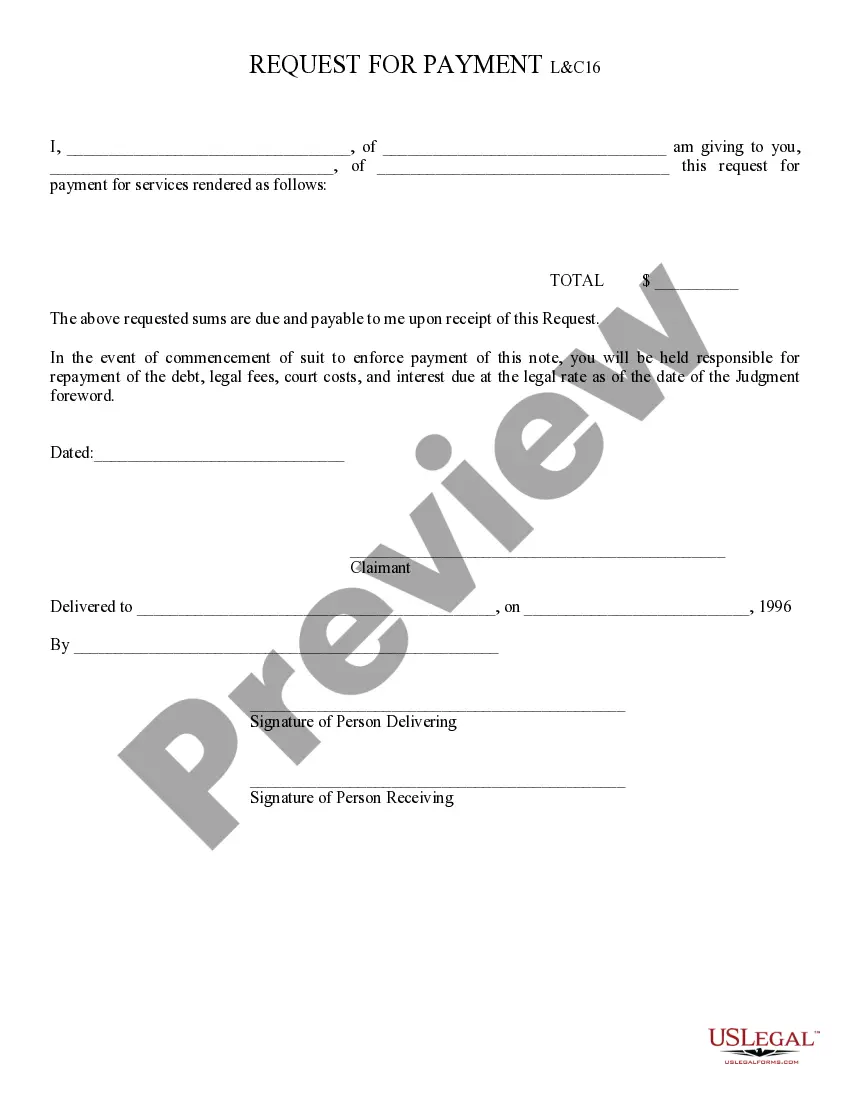

The Self Assessment Samples For Customer Support you observe on this page is a versatile legal framework crafted by experienced attorneys in compliance with national and regional laws and regulations.

For over 25 years, US Legal Forms has offered individuals, entities, and legal practitioners more than 85,000 authenticated, state-specific documents for any commercial and personal event. It is the fastest, simplest, and most dependable method to acquire the paperwork you require, as the service assures the utmost level of data security and anti-malware defense.

Opt for the format you desire for your Self Assessment Samples For Customer Support (PDF, Word, RTF) and download the example to your device.

- Search for the document you require and examine it.

- Browse the file you searched and either preview it or review the form description to validate that it meets your requirements. If it does not, employ the search feature to find the correct one. Click Buy Now when you have found the template you need.

- Choose and Log In to your account.

- Select the subscription plan that best fits you and create an account. Use PayPal or a credit card for a swift payment process. If you already possess an account, Log In and check your subscription to continue.

- Obtain the editable template.

Form popularity

FAQ

Federal Legislative Activity in 2023 Amend Section 604(c) of the FCRA to address the treatment of pre-screening report requests. Section 604(c) governs the furnishing of reports in connection with credit or insurance transactions that are not initiated by the consumer. [1]

Section 623(a)(1)(B). If a consumer notifies a furnisher that the consumer disputes the completeness or accuracy of any information reported by the furnisher, the furnisher may not subsequently report that information to a CRA without providing notice of the dispute.

Section 609 of the FCRA gives consumers the right to request all information in their credit files and the source of that information. Consumers also have the right to know any prospective employer who has accessed their credit report within the last two years.

The FCRA specifies those with a valid need for access. ? You must give your consent for reports to be provided to employers. A consumer. reporting agency may not give out information about you to your employer, or a potential employer, without your written consent given to the employer.

The Dodd-Frank Act also amended two provisions of the FCRA to require the disclosure of a credit score and related information when a credit score is used in taking an adverse action or in risk-based pricing.

Under the Act, all credit reporting agencies are required to: Only collect and report accurate credit information. Maintain accurate files. Provide individuals with a copy of their credit file upon request and free of charge if a report is inaccurate.

Four Basic Steps to FCRA Compliance Step 1: Disclosure & Written Consent. Before requesting a consumer or investigative report, an employer must: ... Step 2: Certification To The Consumer Reporting Agency. ... Step 3: Provide Applicant With Pre-Adverse Action Documents. ... Step 4: Notify Applicant Of Adverse Action.

[15 U.S.C. § 1681] (1) The banking system is dependent upon fair and accurate credit report- ing. Inaccurate credit reports directly impair the efficiency of the banking system, and unfair credit reporting methods undermine the public confidence which is essential to the continued functioning of the banking system.