Form Independent Contractors Withholding Tax

Description

How to fill out Acknowledgment Form For Consultants Or Self-Employed Independent Contractors?

It is well known that you cannot transform into a legal expert in a single night, nor can you quickly learn how to efficiently create Form Independent Contractors Withholding Tax without possessing a specialized background. Assembling legal documents is a lengthy undertaking that necessitates particular training and expertise. So why not entrust the preparation of the Form Independent Contractors Withholding Tax to the experts.

With US Legal Forms, one of the most comprehensive libraries of legal templates, you can access everything from court documents to templates for internal corporate correspondence. We recognize how vital compliance and conformity to federal and state regulations are. Hence, on our platform, all forms are region-specific and current.

Here’s how you can begin using our website to obtain the form you need in just a few moments.

You can regain access to your documents from the My documents tab at any time. If you are an existing customer, you can simply Log In, and locate and download the template from the same tab.

Whatever the purpose of your forms—whether financial and legal, or personal—our website has you covered. Try US Legal Forms today!

- Find the document you require by utilizing the search bar at the top of the page.

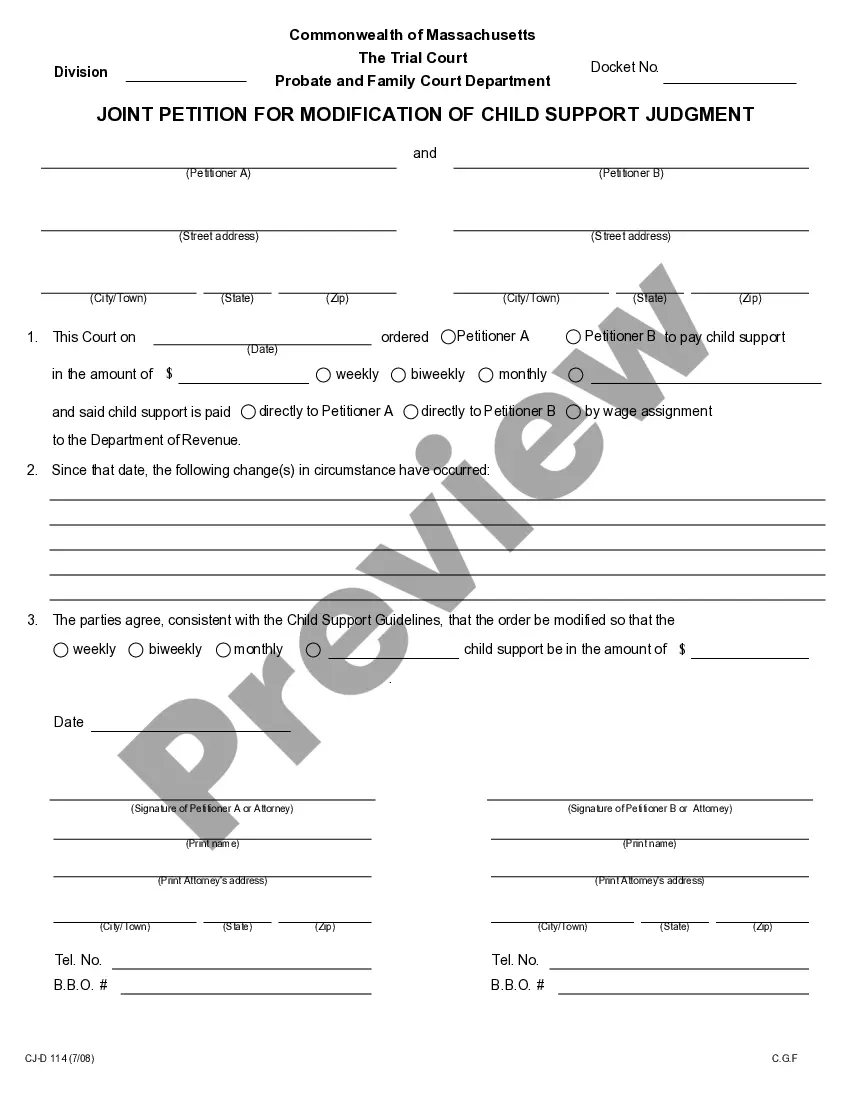

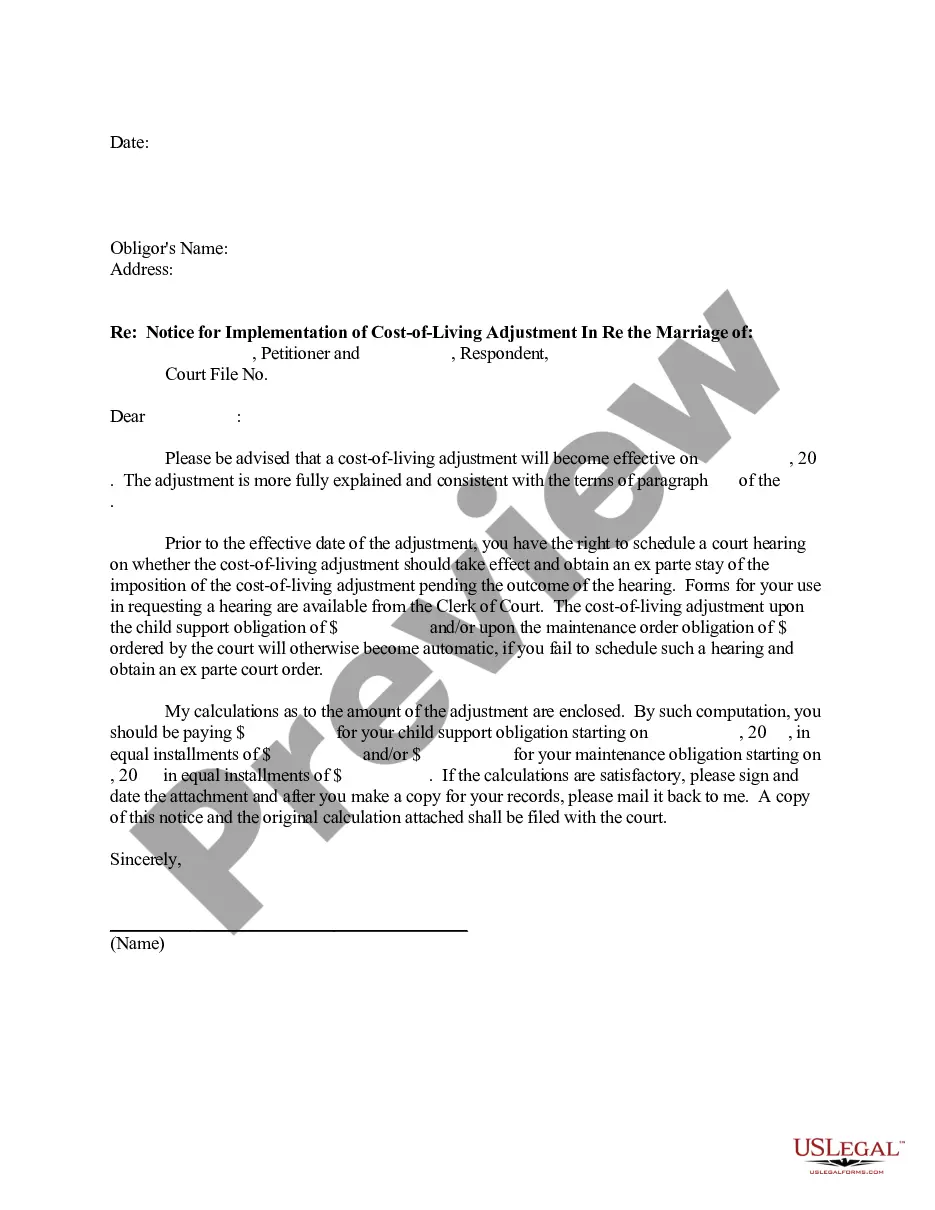

- Preview it (if this option is accessible) and read the accompanying description to determine if Form Independent Contractors Withholding Tax is what you are looking for.

- Initiate your search again if you require a different template.

- Create a free account and select a subscription plan to purchase the form.

- Click Buy now. Once the payment is completed, you can receive the Form Independent Contractors Withholding Tax, fill it out, print it, and deliver it by mail or send it to the appropriate individuals or entities.

Form popularity

FAQ

The creditor can often place a lien on your property, such as a house or car. The lien must usually be paid off before you can sell the property. Seize assets. Sometimes, a creditor can get a court order to seize other assets or personal property you own, such as a vehicle or real estate, to satisfy the debt.

What Is the Special Civil Part? Special Civil is a court in which you may sue a person or a business (the defendant) to collect an amount of money up to $20,000 that you believe is owed to you. If your claim is $5,000 or less, you may sue in the Small Claims Section.

Proposed Form of Order - A proposed order is a form that the judge can use to either grant or deny the relief sought in the motion. Every motion must be accompanied by a proposed form of order. Return date - The return date is the date on which the court will consider the motion.

Small Claims Section Small claims handles cases in which the demand is not more than $5,000. These are the monetary limits of small claims. If the amount of money you are trying to recover is more than the monetary limits but less than $20,000, your case should be filed in the regular Special Civil Part.

The Application/Cross Application to Modify a Court Order is a written request in which you ask the court to change or enforce an existing court order. The court will change an order only if important facts or circumstances have changed from the time the order was issued.

Collecting a Judgment You should contact the person who owes you the money, the judgment debtor, to talk about payment. Note: The court cannot guarantee payment. Although the court will try to help you collect the money owed to you, it cannot guarantee the debt will be paid.

Filing Fees and Waivers To sue one defendant$35Each additional defendant$5