Sample Email For Job Application With Attachment

Description

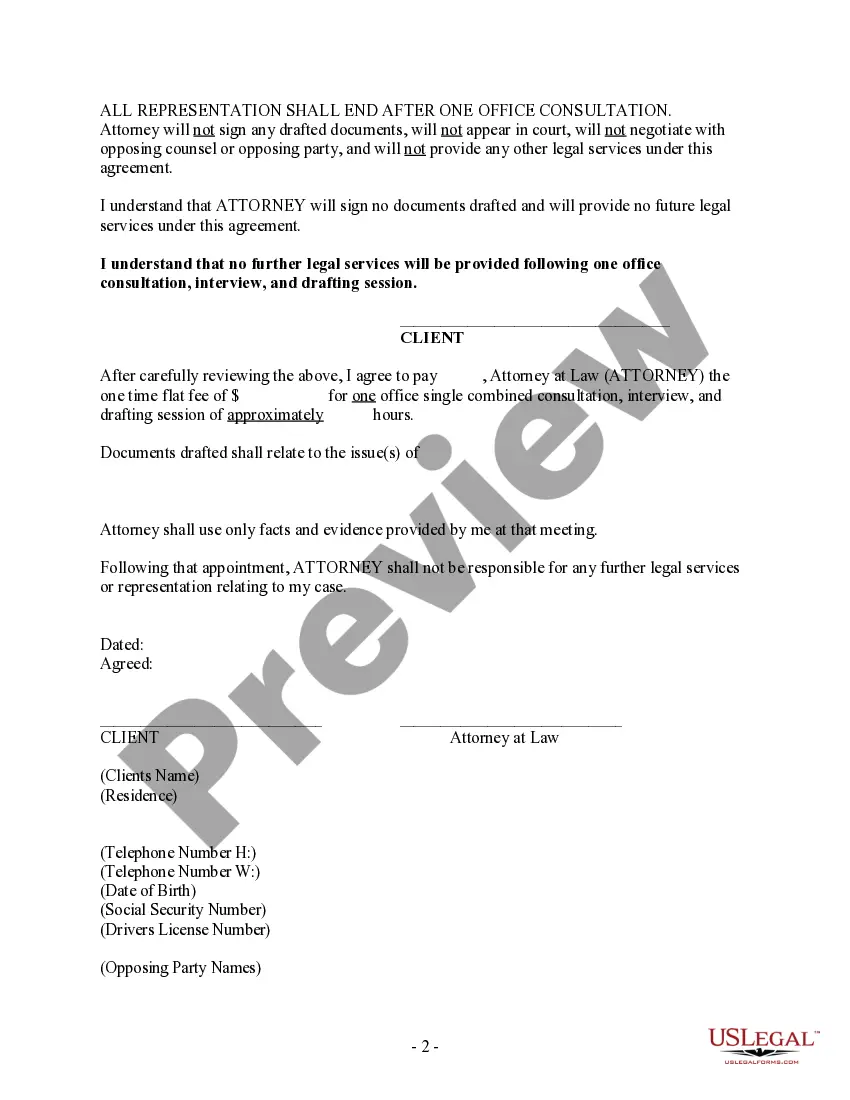

How to fill out Sample Letter Regarding Employment Agreement For Limited Task And Waiver Of Liability?

Whether for business purposes or for individual affairs, everybody has to deal with legal situations sooner or later in their life. Filling out legal paperwork demands careful attention, starting with choosing the proper form sample. For example, if you choose a wrong version of the Sample Email For Job Application With Attachment, it will be turned down once you send it. It is therefore important to get a dependable source of legal papers like US Legal Forms.

If you need to obtain a Sample Email For Job Application With Attachment sample, stick to these simple steps:

- Get the template you need by utilizing the search field or catalog navigation.

- Look through the form’s description to make sure it suits your case, state, and county.

- Click on the form’s preview to see it.

- If it is the incorrect document, go back to the search function to find the Sample Email For Job Application With Attachment sample you need.

- Get the file when it meets your needs.

- If you already have a US Legal Forms account, click Log in to gain access to previously saved files in My Forms.

- In the event you do not have an account yet, you can download the form by clicking Buy now.

- Pick the appropriate pricing option.

- Finish the account registration form.

- Pick your transaction method: use a credit card or PayPal account.

- Pick the file format you want and download the Sample Email For Job Application With Attachment.

- Once it is downloaded, you are able to fill out the form by using editing software or print it and complete it manually.

With a substantial US Legal Forms catalog at hand, you never have to spend time searching for the right template across the web. Use the library’s simple navigation to find the proper template for any occasion.

Form popularity

FAQ

Utah LLC Processing Times Normal LLC processing time:Expedited LLC;Utah LLC by mail:3-7 business days (plus mail time)2 business days ($75 extra)Utah LLC online:2 business daysNot available

Starting an LLC in Utah will include the following steps: #1: Name Your LLC. #2: Nominate Your Registered Agent. #3: File Your Certificate of Organization. #4: Get Your Business Licensed. #5: Create Your Operating Agreement. #6: Get Your EIN. #7: Keep Your LLC Active.

To start an LLC in Utah, you'll need to choose a Utah registered agent, file business formation paperwork with the Utah Department of Commerce, Division of Corporations and Commercial Code, and pay a $54 filing fee.

Setting Up Your LLC in Utah: Submitting Paperwork The filing fee for both in-state and out-of-state entities forming LLCs is $70.

To start an LLC, you need to file the Utah Certificate of Organization. This gets filed with the Utah Department of Commerce ? Division of Corporations. The Utah Certificate of Organization costs $54 if you file online. This is a one-time fee to create your LLC.

You can find out if the name you want to use is available by doing a business name availability search . You may also contact our office to verify that the name you want to use is available.

The filing fee for both in-state and out-of-state entities forming LLCs is $70. Remittance should be made payable to the state of Utah. It costs $75 to expedite the process. You may submit documents online, directly to the Division of Corporations and Commercial Code, or mail them to P.O. Box 146705.

Is an operating agreement required in Utah? Utah doesn't specifically require LLCs to enter into an operating agreement. However, in the absence of one, your LLC will be governed by the Utah Revised Uniform Limited Liability Company Act.