Shareholder Stock For The Future

Description

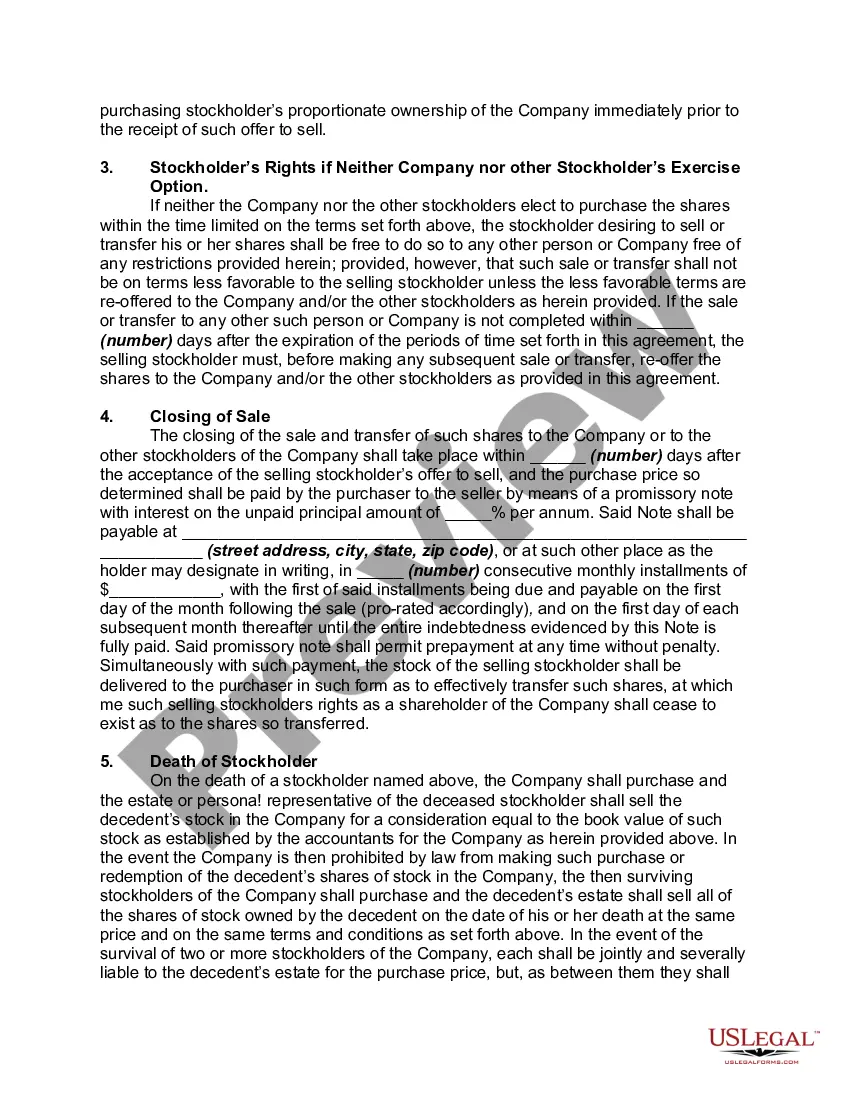

How to fill out Stock Agreement - Buy Sell Agreement Between Shareholders And Corporation?

- For returning users, simply log into your US Legal Forms account and download the required template by clicking the Download button. Ensure your subscription is active; if it's not, renew it based on your payment plan.

- If you are using US Legal Forms for the first time, start by checking the Preview mode and form description. Make sure to select the appropriate document that aligns with your needs and complies with your local jurisdiction.

- If you find that the document doesn't meet your requirements, utilize the Search tab to find a more suitable template. Once you've found the perfect match, proceed to the purchase step.

- Click on the Buy Now button to select your preferred subscription plan. Remember, you will need to create an account to access the extensive library.

- Complete your payment by providing your credit card information or using your PayPal account.

- Finally, download your completed form and save it to your device so you can easily manage it through the My Forms section of your profile.

US Legal Forms equips individuals and attorneys with a robust selection of legal documents, enabling smooth execution of essential paperwork. With over 85,000 customizable forms available, users can efficiently tackle their legal needs.

In conclusion, leveraging US Legal Forms ensures that you are well-equipped for your future shareholder transactions. Don't hesitate to get started today and experience the convenience it offers!

Form popularity

FAQ

Shareholder stock basis indicates the amount invested in a company's shares, impacting your tax obligations and financial strategy. It serves as a foundation for calculating gains or losses during stock sales. Maintaining an accurate understanding of your stock basis is essential for cultivating your shareholder stock for the future, ensuring you maximize your investment potential.

To report the sale of S-Corp stock on your tax return, you generally must use Schedule D and Form 8949. These forms allow you to detail the sale and its associated gain or loss. Accurate reporting ensures compliance with tax regulations and protects your shareholder stock for the future.

In a Section 351 transaction, shareholders receive stock in exchange for their property or assets, and their basis is usually equal to the basis of the property transferred. This is crucial for establishing the foundation of your shareholder stock for the future. Understanding this concept helps prevent complications during the reporting of future transactions.

You do not need to fill out a 1099-B for every stock transaction, but you must report significant transactions involving the sale of stocks. This form informs the IRS of the proceeds from the sale, which is vital for tracking your shareholder stock for the future. Keeping accurate records can help streamline this process.

Shareholder's stock basis represents the investment an individual has in a company's stock, reflecting their financial stake. It is crucial for calculating gain or loss when stocks are sold. By understanding your stock basis, you can better plan for the future and ensure maximized returns on your investment in the company.

Filling out Form 7203 is necessary if you need to report your stock basis adjustments and other related information for S Corporation shareholders. This form ensures accurate reporting for the IRS and helps maintain your shareholder stock for the future. If you are unsure about your requirement, consult a tax professional for guidance.

Stock basis and retained earnings are not the same. Stock basis refers to the amount of investment a shareholder has in a company’s stocks, while retained earnings are the accumulated profits that a company has reinvested. Understanding the distinction is crucial for managing shareholder stock for the future. You can use this knowledge to make informed decisions regarding your investments.

Growing shareholders' equity requires a focused approach on enhancing company profits and strategic investments. By increasing revenue streams and managing costs wisely, you can elevate shareholder stock for the future. Encouraging retention of earnings rather than distributing all profits to shareholders can also help build a stronger equity position. It's about creating sustainable growth over time.

Predicting the future of a stock involves analyzing market trends, financial reports, and economic indicators. While no method guarantees certainty, informed predictions can guide you toward acquiring shareholder stock for the future. Keeping up with industry news and employing analytical tools can help in making educated guesses. Stay proactive and informed to navigate the stock market effectively.

To convince shareholders to invest, present a solid business strategy with clear projections for growth. Highlight how their investment will enhance shareholder stock for the future, which can yield substantial returns. Transparency about the company's performance and future plans will build trust and encourage investment. Effective communication can motivate shareholders to commit their resources.