Checklist For Buy Back Of Shares

Description

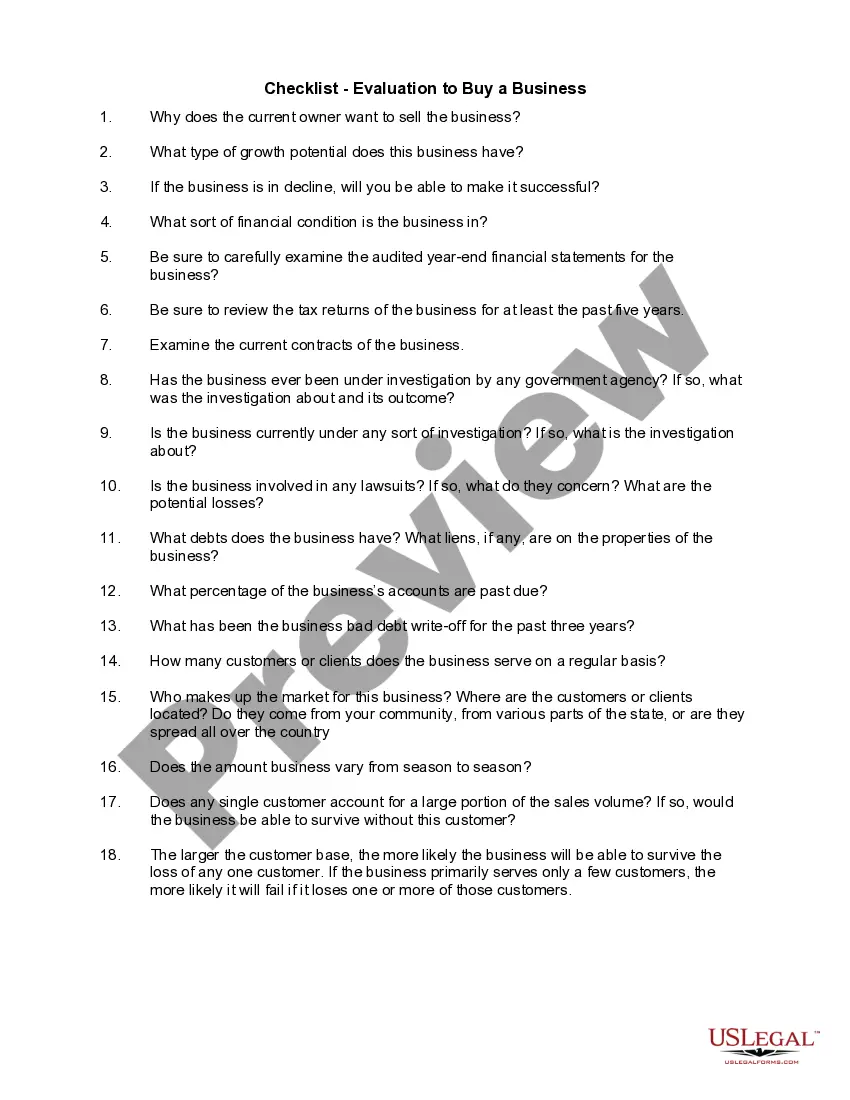

How to fill out Checklist - Evaluation To Buy A Business?

Utilizing legal document examples that adhere to federal and state guidelines is essential, and the internet provides numerous choices to choose from.

However, what is the purpose of spending time searching for the correct Checklist For Buy Back Of Shares example online if the US Legal Forms digital library already consolidates such templates in one location.

US Legal Forms is the largest online legal repository featuring over 85,000 fillable documents prepared by attorneys for a variety of business and personal circumstances. They are straightforward to navigate with all files organized by state and intended use. Our specialists keep abreast of legislative updates, ensuring that your form is always current and compliant when acquiring a Checklist For Buy Back Of Shares from our site.

- Acquiring a Checklist For Buy Back Of Shares is quick and effortless for both returning and new users.

- If you already possess an account with an active subscription, Log In and retrieve the document example you need in the appropriate format.

- If you are new to our site, follow the steps outlined below.

- Examine the template using the Preview feature or through the text description to confirm it meets your requirements.

- If necessary, search for an alternative sample using the search tool at the top of the page.

Form popularity

FAQ

Certified true copy of the special resolution passed at the general meeting. Certified true copy of board resolution authorizing buyback. Balance Sheet of the company. Compliance certificate for the buy-back rules as per the sub-rule (14) of Rule 17 of the Companies (Share Capital and Debenture) Rules, 2014.

Offer Period: The buy-back offer shall remain open for a period of at least 15 days and not more than 30 days from the date of dispatch of the letter of offer to the Shareholders. In case all the members of a company agree, the buy-back offer may remain open for a period of less than 15 days.

There are stages to work through as follows: Background review of the articles and shareholders agreement before the share buy back; Drafting the share buy back documentation; Obtaining shareholder approval; and. Filings with HMRC for stamp duty and Companies House.

(Section 257B, Corporations Act 2001 (Cth).) If the 10/12 limit is exceeded, the company's shareholders must approve the buy-back in general meeting. The exception to this is a selective buy-back, which requires shareholder approval regardless of whether or not it exceeds the 10/12 limit.

Buyback of shares can be done either through the open market or through tender offer route. Under the open market mechanism, the company can buy back its shares from the secondary marker.