Complaint For Work

Description

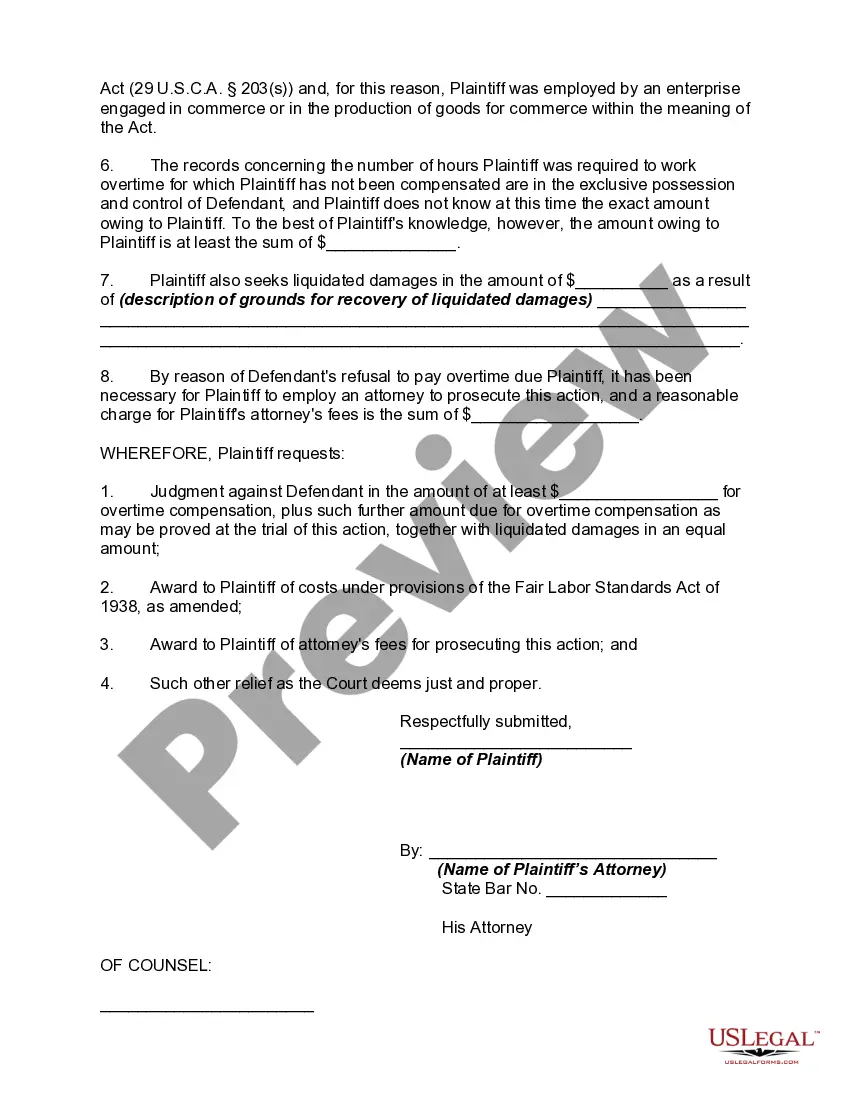

How to fill out Complaint To Recover Overtime Compensation Or Wages In State Court Under Section 16(b) Of Fair Labor Standards Act?

Handling legal documents and processes can be a lengthy addition to one’s day.

Complaints for employment and similar forms usually necessitate that you search for them and navigate the steps to fill them out accurately.

Therefore, if you are managing financial, legal, or personal issues, utilizing a detailed and straightforward online index of forms when required will significantly help.

US Legal Forms is the premier online service for legal templates, featuring over 85,000 region-specific forms and a variety of tools that will aid you in completing your documents swiftly.

Simply Log In to your account, find Complaint For Work and download it instantly from the My documents section. You can also access previously saved documents.

- Explore the directory of relevant documents available to you with just one click.

- US Legal Forms provides state- and county-specific documents which can be accessed anytime for download.

- Safeguard your document management processes with a reliable service that enables you to create any form within minutes without any additional or concealed fees.

Form popularity

FAQ

A will in your own handwriting must be witnessed by two disinterested persons (persons who are not named in the written will). Your will should be signed and dated. If you type your own will or use a computer software program to print your will you must also have two disinterested witnesses sign it.

The entire estate of the person who died, after subtracting liens and encumbrances, is not worth more than $50,000. No application or petition for the appointment of a personal representative for this estate is pending or has been granted by any court.

An estate skips probate in Montana if it's less than $50,000. Avoiding the probate process could be beneficial for an estate's heirs, as the probate process in Montana can be long and expensive.

Under Montana's probate laws, you can distribute certain types of property and assets without a probate court's approval. They include: Accounts with a named beneficiary, such as life insurance policies and retirement funds. Assets and property that is held in a living trust.

Under Montana statute, where as estate is valued at less than $50,000, an interested party may, thirty (30) days after the death of the decedent, issue a small estate affidavit to to demand payment on any debts owed to the decedent. Montana Requirements: Montana requirements are set forth in the statutes below.

In Montana, the following assets are subject to probate: Solely-owned property: Any asset that was solely owned by the deceased person with no designated beneficiary is subject to probate. This could include bank accounts, cars, houses, personal belongings, and business interests.

All that is necessary is an affidavit to be presented to the court, but the estate must be worth less than $50,000. Formal probate is lengthier and more complex, but it also has two categories: supervised and unsupervised. With supervised probate, the court will oversee all actions of the executor.

Your property can be transferred to your beneficiaries without entering probate, and this is possible in a few ways. Common methods include transferring your property to a living trust, gifting property before you pass on or making a beneficiary a joint owner of your property.