Compensation Fair Labor Standards Act With Example

Description

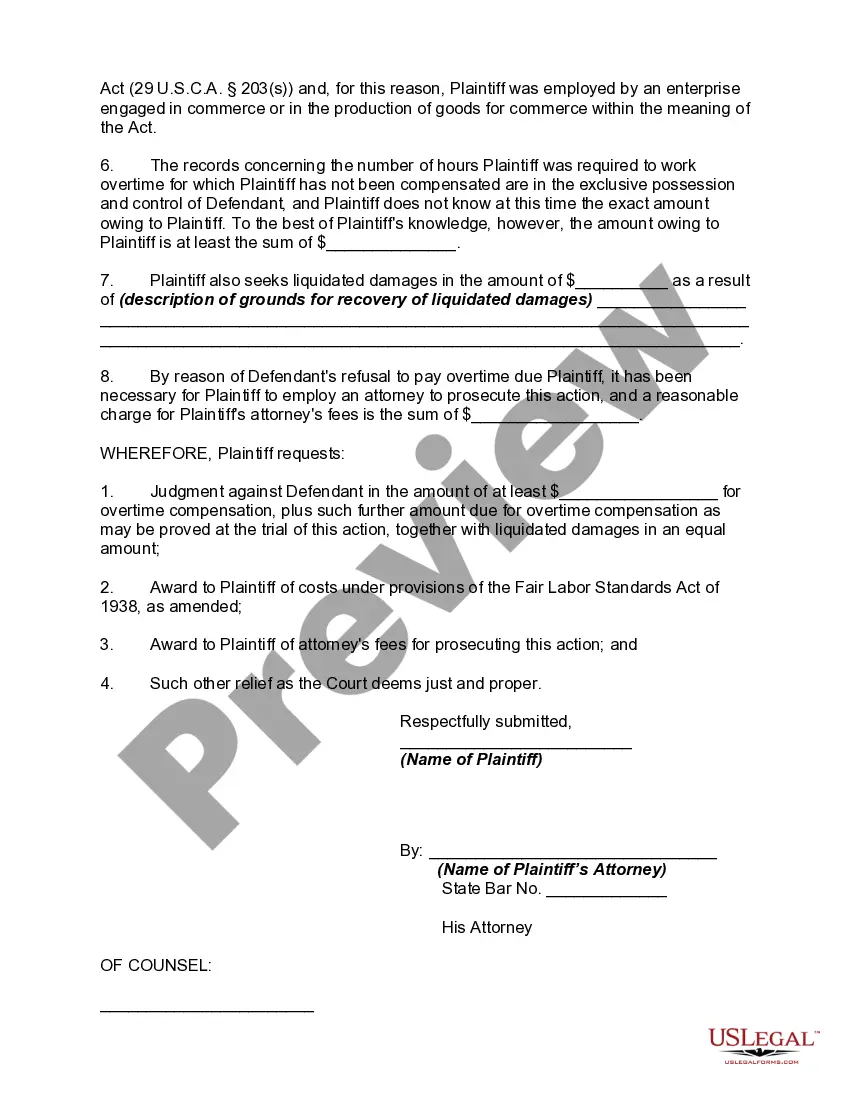

How to fill out Complaint To Recover Overtime Compensation Or Wages In State Court Under Section 16(b) Of Fair Labor Standards Act?

Managing legal documentation and processes can be a lengthy addition to your schedule.

Compensation Fair Labor Standards Act With Example and similar forms often necessitate that you search for them and comprehend how to fill them out accurately.

Thus, if you are addressing financial, legal, or personal affairs, having a comprehensive and accessible online directory of forms at your disposal will greatly assist.

US Legal Forms is the premier online service for legal templates, featuring over 85,000 state-specific forms and a variety of resources to facilitate your paperwork effortlessly.

Is this your first time using US Legal Forms? Register and create an account in just a few minutes, granting you access to the form directory and Compensation Fair Labor Standards Act With Example. Follow the steps below to complete your form: Ensure you have the correct form using the Preview feature and reviewing the form description. Click Buy Now when ready, and select the monthly subscription plan that suits your needs. Hit Download and then fill out, eSign, and print the form. US Legal Forms has 25 years of experience helping users manage their legal documentation. Find the form you need today and simplify any process without breaking a sweat.

- Browse the directory of relevant documents available with just one click.

- US Legal Forms offers you state- and county-specific forms that can be downloaded anytime.

- Safeguard your document management processes with a top-notch service that allows you to prepare any form in a matter of minutes without incurring additional or concealed charges.

- Simply Log In to your account, locate Compensation Fair Labor Standards Act With Example, and download it right away from the My documents section.

- You can also access forms you have previously downloaded.

Form popularity

FAQ

Example: An employee paid $8.00 an hour works 44 hours in a workweek. The employee is entitled to at least one and one-half times $8.00, or $12.00, for each hour over 40. Pay for the week would be $320 for the first 40 hours, plus $48.00 for the four hours of overtime - a total of $368.00.

Compute the ?hourly regular rate of pay? by dividing the ?total remuneration? paid to an employee in the workweek by the number of hours in the workweek for which such compensation is paid.

For example, a $12 hourly rate will bring, for an employee who works 46 hours, and receives a production bonus of $46 for the week, a new regular rate of pay of $13 an hour (46 hours at $12 yields $552; the addition of the $46 bonus makes a total of $598; this total divided by 46 hours yields a regular rate of $13).

The Fair Labor Standards Act (FLSA) establishes minimum wage, overtime pay, recordkeeping, and youth employment standards affecting employees in the private sector and in Federal, State, and local governments.

The regular rate of pay is the total earning by the employee divided by the total number of hours worked in the workweek. REGULAR RATE OF PAY = Divide the total earnings for the workweek, including earnings during overtime hours, by the total number of hours worked that workweek.