Notice Of Assessment Form 11

Description

How to fill out Notice Of Lien To A Condominium Unit Owner For Unpaid Assessment Fees?

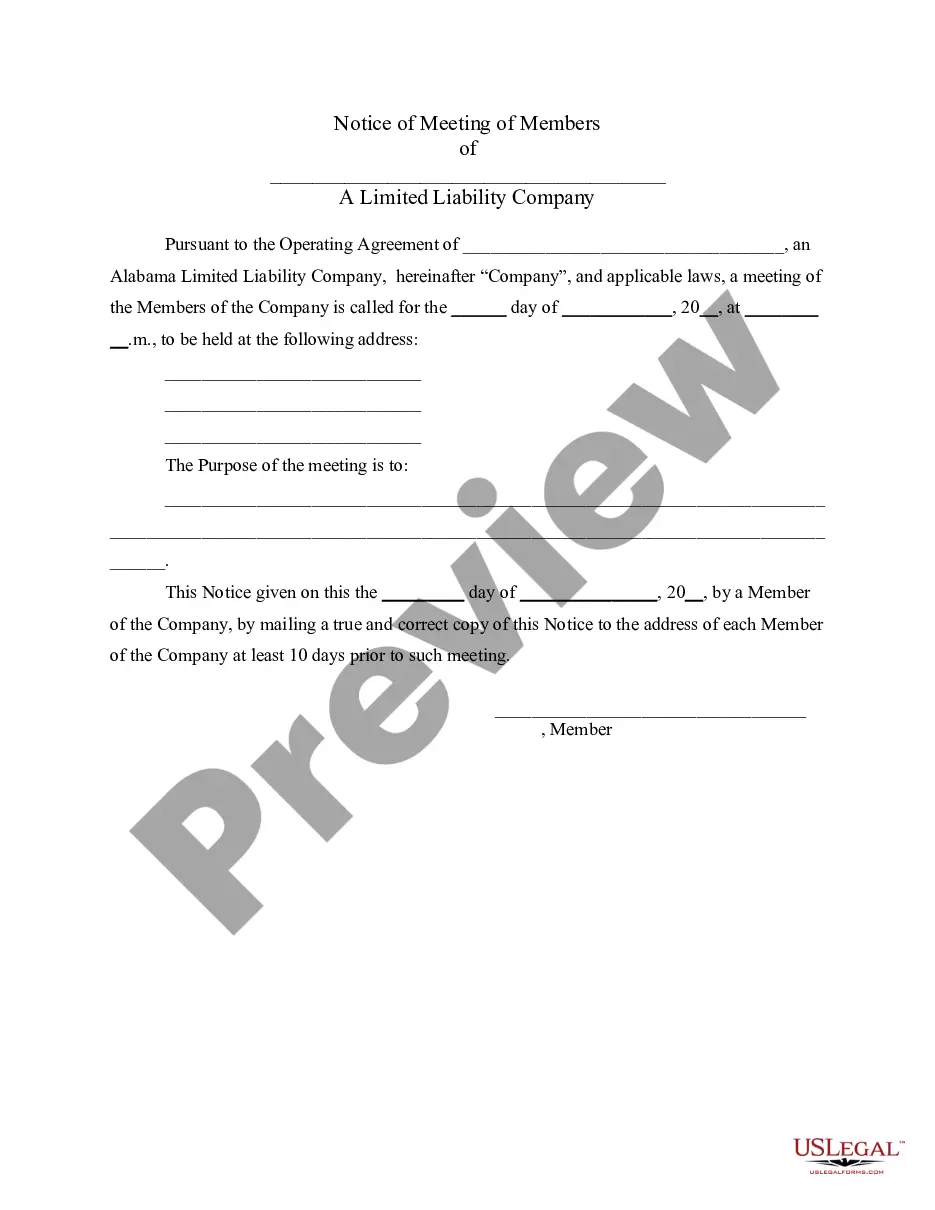

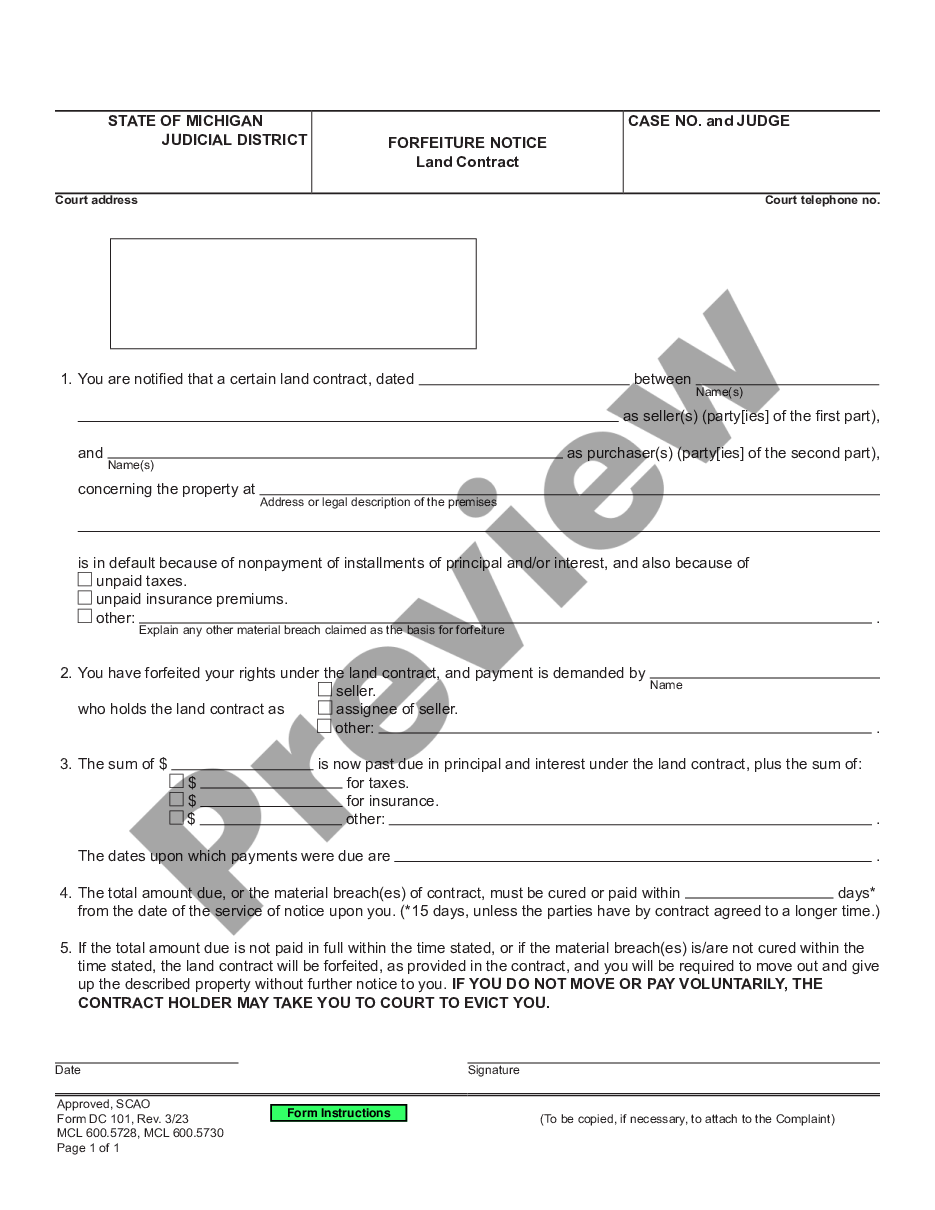

The Notice Of Assessment Form 11 you see on this page is a reusable formal template drafted by professional lawyers in compliance with federal and state regulations. For more than 25 years, US Legal Forms has provided people, companies, and legal professionals with more than 85,000 verified, state-specific forms for any business and personal occasion. It’s the quickest, most straightforward and most trustworthy way to obtain the documents you need, as the service guarantees the highest level of data security and anti-malware protection.

Obtaining this Notice Of Assessment Form 11 will take you only a few simple steps:

- Browse for the document you need and review it. Look through the file you searched and preview it or check the form description to confirm it satisfies your needs. If it does not, utilize the search bar to find the right one. Click Buy Now when you have found the template you need.

- Subscribe and log in. Opt for the pricing plan that suits you and create an account. Use PayPal or a credit card to make a quick payment. If you already have an account, log in and check your subscription to continue.

- Get the fillable template. Choose the format you want for your Notice Of Assessment Form 11 (PDF, DOCX, RTF) and download the sample on your device.

- Fill out and sign the document. Print out the template to complete it manually. Alternatively, use an online multi-functional PDF editor to quickly and precisely fill out and sign your form with a valid.

- Download your paperwork one more time. Utilize the same document once again anytime needed. Open the My Forms tab in your profile to redownload any previously downloaded forms.

Sign up for US Legal Forms to have verified legal templates for all of life’s situations at your disposal.

Form popularity

FAQ

Related Links Change the Mailing Address for Your Property Tax Bill. ... Apply for a Homestead Deduction. ... Apply for Over 65 Property Tax Deductions. ... Appeal a Property Assessment: Subjective. ... Apply for Blind or Disabled Person's Deduction. ... Apply for Disabled Veteran, Surviving Spouse Deduction.

An appeal begins with filing a Form 130 ? Taxpayer's Notice to Initiate an Appeal with the local assessing official. The appeal should detail the pertinent facts of why the assessed value is being disputed. A taxpayer may only request a review of the current year's assessed valuation.

If no Form 11 is sent, the tax bill serves as the notice of assessment and you should initiate an appeal not later than May 10 of the year or 45 days after the date of the tax bill, whichever is later.

If you disagree with the decision of the IBTR, you may file a petition with the Indiana Tax Courts. You must file the petition within 45 days of receiving the IBTR's decision. You may also file a petition with the Indiana Tax Court if you do not receive a decision from the IBTR within 90 days of your hearing.

The Notice of Assessment of Land and Improvements (Form 11) is an assessment notice that is sent to taxpayers by the county or township assessor. The assessed value on the Form 11 is the starting point for calculating annual property tax payments.