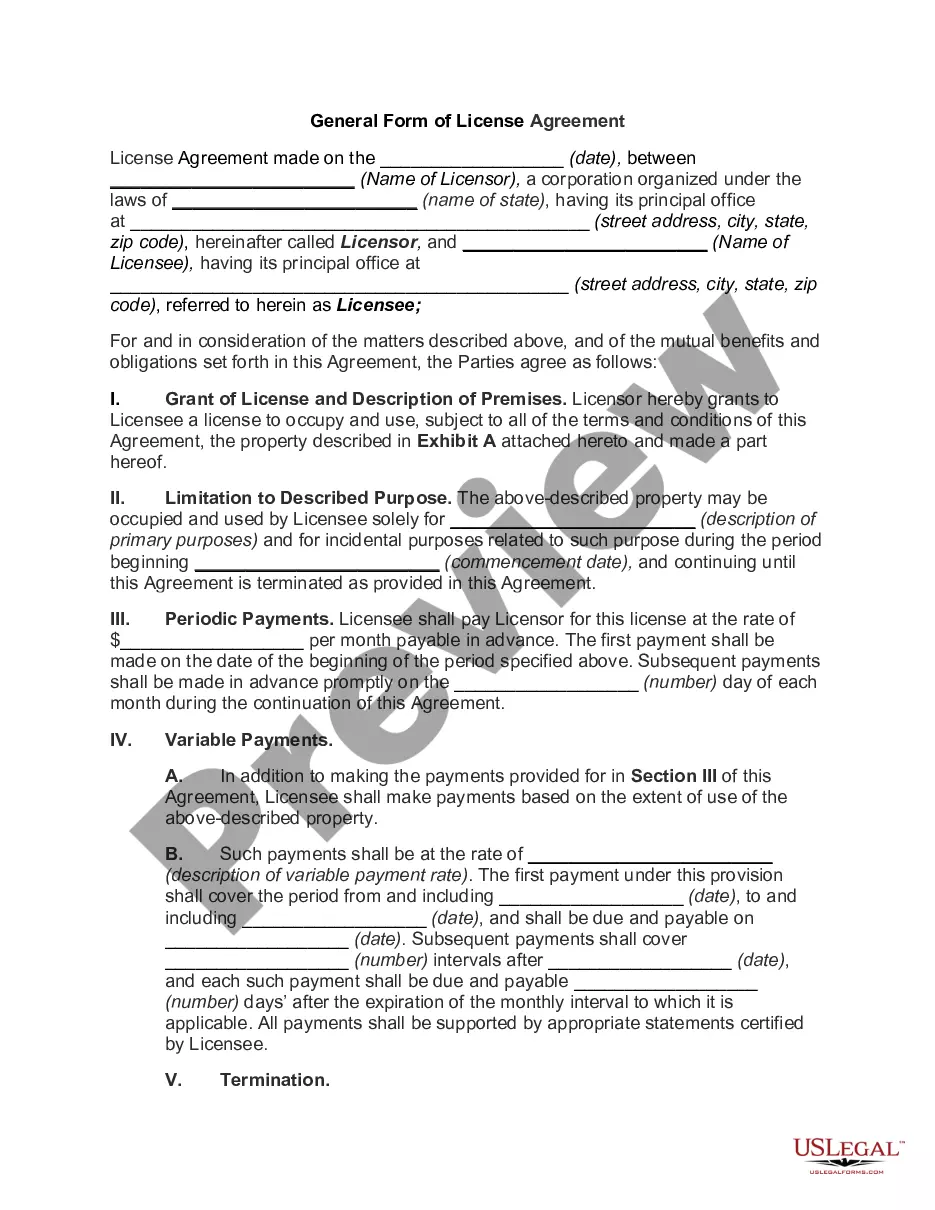

Form with which the secretary of a corporation notifies all necessary parties of the date, time, and place of a special meeting of the board of directors.

Notice Meeting Corporate Form Of Business Organization In Minnesota

Description

Form popularity

FAQ

The Office of the Secretary of State is a constitutional office headed by the independently-elected Secretary of State. As the chief election official in Minnesota, the Secretary of State oversees the administration of elections, and promotes voting and civic engagement.

To form an S Corporation in Minnesota, you'll need to file Articles of Incorporation with the Secretary of State. Once the corporation is established, you'll need to file IRS Form 2553 to elect S Corporation status.

Yes, it is possible to establish an S-corp as a one-person business. While traditionally S corporations are formed with multiple shareholders, the IRS allows a single individual to set up an S corporation. As an individual, you can be the sole shareholder, director, and employee of the S-corp.

To form an S Corporation in Minnesota, you'll need to file Articles of Incorporation with the Secretary of State. Once the corporation is established, you'll need to file IRS Form 2553 to elect S Corporation status.

Only individuals, certain trusts, and estates can be shareholders. This means no partnerships or corporations can own an S Corporation. There's a maximum of 100 shareholders. If you are the only shareholder, this isn't an issue, but it's good to know if you plan to expand.

Step 1: Name Your Minnesota LLC. Step 2: Choose a Registered Agent. Step 3: File the Minnesota Articles of Organization. Step 4: Create an Operating Agreement. Step 5: File Form 2553 to Elect Minnesota S Corp Tax Designation.

How to Form an S Corp in Minnesota Name your Minnesota LLC. Appoint a registered agent in Minnesota. File Minnesota Articles of Organization. Create an operating agreement. Apply for an EIN. Apply for S Corp status with IRS Form 2553.

Minnesota businesses must file renewals every year to remain active. This page contains the instructions to renew your business, or to change your filing if necessary.

If you filed a Certificate of Assumed Name, Minnesota Business Corporation, Foreign Business, or Non-Profit Corporation, or a Cooperative, Limited Liability Company, Limited Liability Partnership or Limited Partnership, you must file an annual renewal once every calendar year, beginning in the calendar year following ...