Form A Limited Liability Company With The Ability To Establish Series

Description

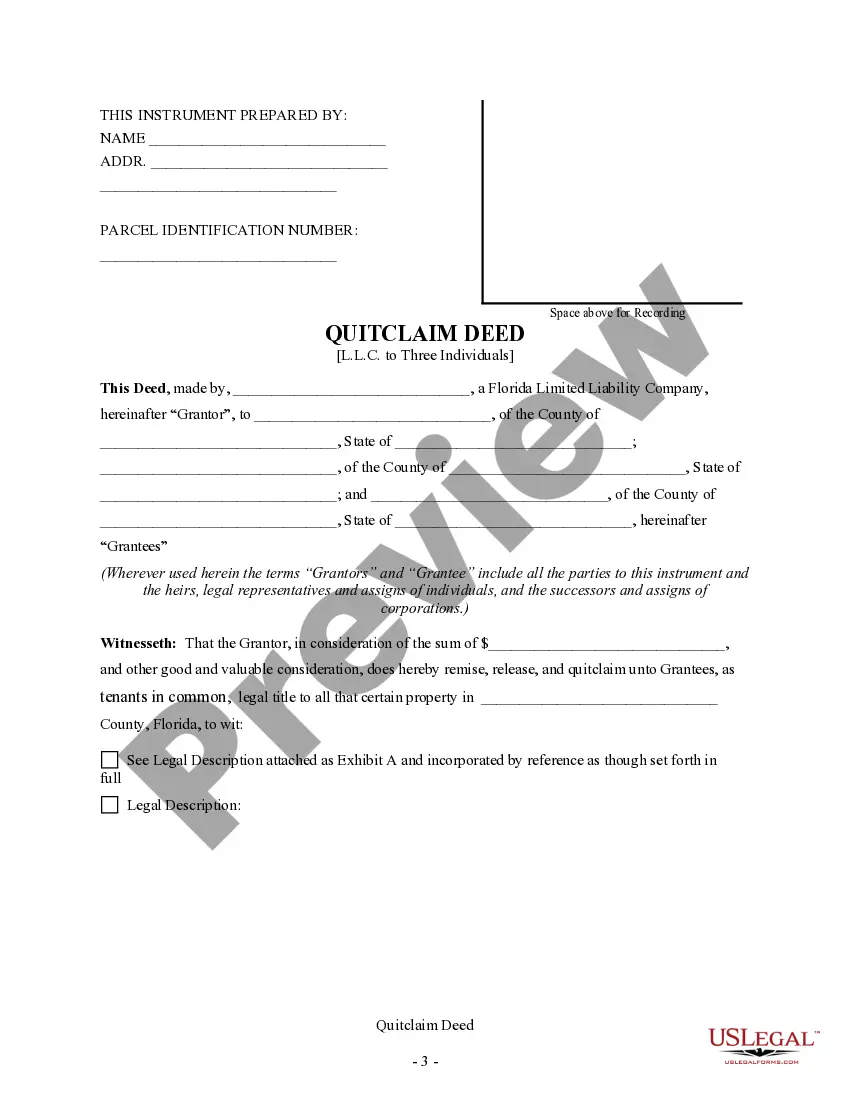

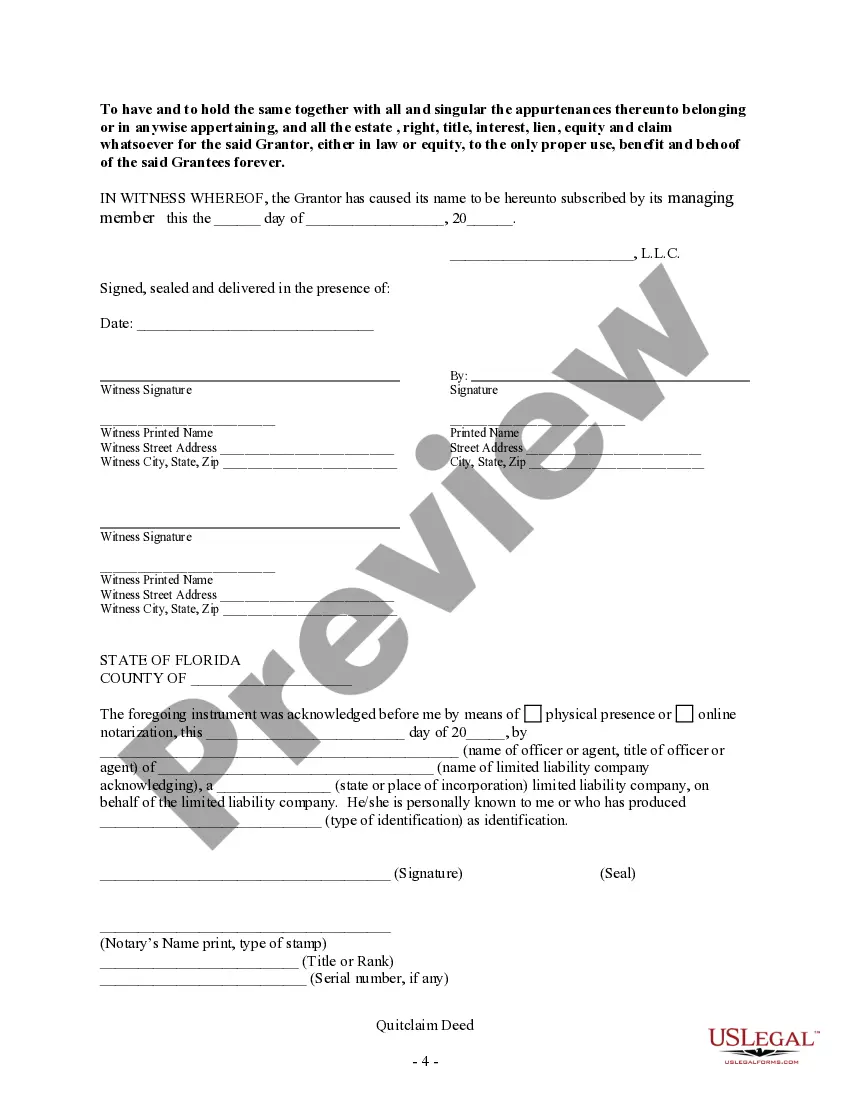

How to fill out Florida Quitclaim Deed - Limited Liability Company To Three Individuals?

- If you are a returning user, simply log in to your account to access your templates. Ensure your subscription is active; renew it if necessary.

- For new users, begin by exploring the Preview mode and form descriptions. Make sure you select the relevant template that complies with your local regulations.

- If the template isn't suitable, utilize the Search tab to find the correct document that meets your needs.

- Proceed to purchase the document by clicking the Buy Now button. You'll have to create an account to avail of their extensive resource library.

- Complete your transaction using a credit card or PayPal to secure your subscription.

- Download the legal form to your device for completion and manage it conveniently from the My Forms section in your profile.

With US Legal Forms, you gain access to a vast catalog of over 85,000 fillable legal documents, providing both individuals and attorneys with a reliable way to create precise legal documents.

Don't miss out on the opportunity to streamline your legal document preparation. Start forming your LLC today!

Form popularity

FAQ

When filing taxes for a Series LLC, the process is similar to filing for a traditional LLC, but with additional considerations for each series. Each series may need to file separately depending on its activities and income. Ensure that you keep distinct records for each series to accurately report income and expenses. Seeking guidance from a tax professional familiar with Series LLCs can help you navigate the filing process.

No, when you form a limited liability company with the ability to establish series, you generally do not file LLC and personal taxes together. The LLC files taxes separately depending on its classification, while you report your personal income on your tax return. Be sure to maintain clear records for both personal and LLC finances to simplify the tax filing process.

Yes, you can change your LLC to a series LLC if you want to form a limited liability company with the ability to establish series. This process typically involves amending your existing LLC's operating agreement and filing the appropriate documents with your state. Always check your state’s specific requirements, as they may vary. Consulting a legal professional can streamline the transition.

While forming a limited liability company with the ability to establish series provides flexibility, there are some disadvantages. One challenge is that not all states recognize series LLCs, which can create complications. Additionally, the legal protections and liabilities may vary between series, sometimes leading to confusion. It's crucial to research your state’s rules and consider consulting legal experts.

When you form a limited liability company with the ability to establish series, your tax requirements depend on your income rather than a specific minimum amount. Regardless of earnings, the IRS requires LLCs to file taxes. Ensure you maintain accurate records and consult a tax professional. This approach helps ensure compliance and allows you to take advantage of available deductions.

Yes, an LLC can establish a series when you choose to form a limited liability company with the ability to establish series. This enables you to create separate sub-entities under the main LLC, each with its own assets and liabilities. This structure provides flexibility in managing different business ventures while maintaining liability protection. Make sure to check your state’s rules for specific requirements when setting up these series.

When you form a limited liability company with the ability to establish series, you should consider certain downsides. First, many states have complex laws regarding Series LLCs, which can lead to confusion. Additionally, potential challenges in securing financing may arise, as some lenders are unfamiliar with Series LLCs. Lastly, liability protections can vary by state, which may complicate your legal structure.

Yes, you can change your LLC to a Series LLC by following the necessary legal steps. Start by reviewing your current operating agreement and then file the appropriate documents with your state legislature. This modification allows for better asset management and liability protection for separate aspects of your business, ultimately helping you form a limited liability company with the ability to establish series.

A limited liability company that has the ability to establish series, known as a Series LLC, permits the creation of multiple, distinct series under one master LLC. Each series can have its own assets, members, and operations while being protected from liabilities of other series. This structure can significantly enhance your business’s flexibility and risk management when you form a limited liability company with the ability to establish series.

To make your LLC a Series LLC, you will need to file specific documents with your state that announce your intent to create a Series LLC. This usually requires updating your Articles of Organization and drafting an operating agreement that details the structure of each series. By taking these steps, you create a flexible business structure that allows for asset protection and operational efficiency when you form a limited liability company with the ability to establish series.