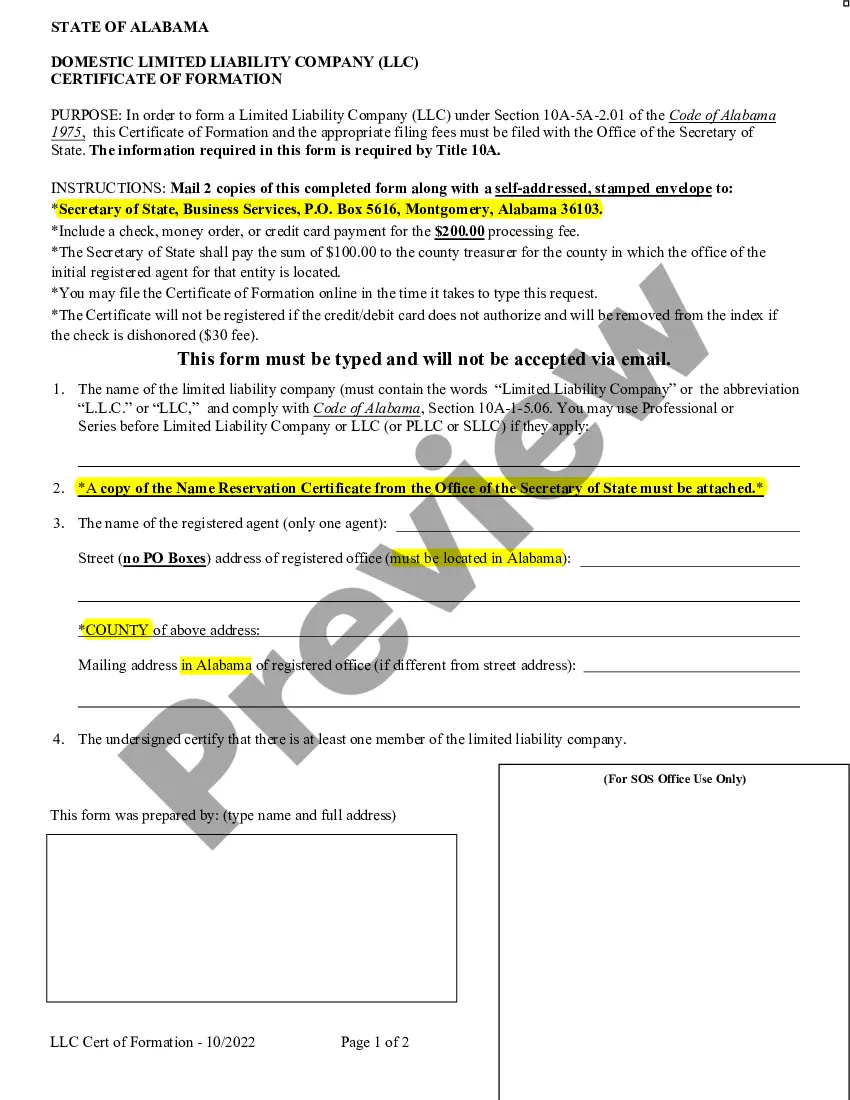

This state-specific Articles of Incorporation form must be filed with the appropriate state agency in compliance with state law in order to create a new corporation. The form contains basic information concerning the corporation, normally including the corporate name, number of shares to be issued, names of the incorporators, directors and/or officers, purpose of the corporation, corporate address, registered agent, and related information.

Articles Of Incorporation Alabama Withholding

Description

How to fill out Alabama Articles Of Incorporation For Domestic For-Profit Corporation?

It's clear that you cannot transform into a legal expert right away, nor can you comprehend how to swiftly prepare Articles Of Incorporation Alabama Withholding without a specialized knowledge.

Assembling legal paperwork is a time-consuming task that necessitates specific education and expertise.

Therefore, why not entrust the development of the Articles Of Incorporation Alabama Withholding to the professionals.

You can access your documents again from the My documents section at any time.

If you are a returning customer, you can simply Log In and find and download the template from the same section.

- Locate the document you require by utilizing the search bar at the top of the site.

- Preview it (if this feature is available) and review the additional description to verify whether Articles Of Incorporation Alabama Withholding is what you need.

- If you need an alternative template, begin your search anew.

- Create a complimentary account and select a subscription plan to acquire the template.

- Select Buy now. After the payment is completed, you can obtain the Articles Of Incorporation Alabama Withholding, fill it out, print it, and forward or send it to the appropriate individuals or entities.

Form popularity

FAQ

Alabama is one of many states which impose a state tax on personal income. State withholding tax is the money an employer is required to withhold from each employee's wages to pay the state income tax of the employee.

To obtain a withholding tax account number, employers must complete the Application available online at MyAlabamaTaxes.alabama.gov. (MAT) Please go to ?I Want To? then ?Obtain a new Tax Account?.

You can find your Withholding Tax Account Number and your E-File Sign-On ID and Access Code on the notification letter you received from the Alabama Department of Revenue. If you have misplaced this letter, please get in touch with the Alabama Department of Revenue at (334) 242-1300 for withholding tax assistance.

Income Tax Payment Options Pay via Credit/Debit card and ACH online with MyAlabamaTaxes or Pay Bill. Mail your payment. Payments for Billing Letters, Invoices or Assessments should be mailed to the address found on the letter, invoice or assessment. Mailing Addresses.

Go to . You may also choose to use your Discover/Novus, Visa, Master Card, or American Express card. Call Official Payments Corporation at 1-800-272-9829 or visit .officialpayments.com.