Loading

Get Ny Dtf It-201 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY DTF IT-201 online

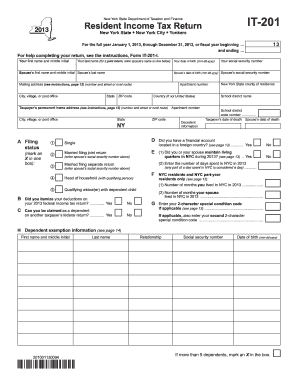

Filling out the NY DTF IT-201 online can simplify the process of submitting your state income tax return. This guide will provide you with clear, step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to fill out the NY DTF IT-201 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Review your personal information. Ensure your name, address, and Social Security number are entered correctly in the respective fields.

- Provide your filing status by selecting the appropriate box. Options typically include single, married filing jointly, married filing separately, head of household, or qualifying widow(er).

- Complete the income section. Report all sources of income including wages, salaries, tips, and any additional income as required.

- Fill out the deductions section. Here, you can enter any eligibility for deductions or credits, such as standard deduction or itemized deductions.

- Review the tax calculation area to ensure the correct tax amount is calculated based on the information you provided.

- Check for any additional credits you may qualify for, and fill them in the appropriate section.

- Finish by reviewing your entire form for accuracy and completeness. Make any necessary adjustments.

- Once you are satisfied with the form, save your changes, download, print, or share the completed form as necessary.

Start filing your documents online today.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

NYS DTF sales tax is the tax imposed on the sale of goods and certain services in New York State. It is collected by sellers from buyers at the point of sale and remitted to the state. Understanding your responsibilities regarding sales tax is critical for compliance and business success. The NY DTF IT-201 offers guidance on how to handle sales tax efficiently, and uslegalforms can support you with the necessary documentation.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.