Loading

Get Nj 1st Quarter Payroll Tax Statement 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NJ 1st Quarter Payroll Tax Statement online

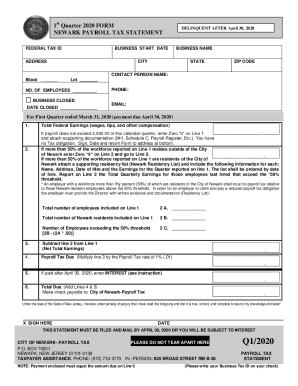

The NJ 1st Quarter Payroll Tax Statement is an essential document for employers in Newark to report payroll taxes for the first quarter of the year. This guide provides comprehensive, step-by-step instructions to assist users in completing the form accurately online.

Follow the steps to complete your NJ 1st Quarter Payroll Tax Statement online

- Press the ‘Get Form’ button to access the NJ 1st Quarter Payroll Tax Statement and open it in your preferred online editor.

- Fill in your Federal Tax ID in the designated field. This number is crucial for identifying your business within the tax system.

- Enter your business start date. This information helps establish your payroll history and tax obligations.

- Provide your business name, address, city, state, and ZIP code in the respective fields. Ensure that all information matches your business registration records.

- Identify a contact person for your business by filling in their name and phone number. You may also include an email address for future correspondence.

- Report the total federal earnings (wages, tips, and other compensation) on Line 1. If this amount does not exceed $2,500.00 for the quarter, enter ‘0’ and attach supporting documentation to confirm this, such as Form 941 or a payroll register.

- For Line 2, determine if more than 50% of your workforce reported on Line 1 resides outside the City of Newark. If so, enter ‘0’ on Line 2 and proceed to Line 3.

- If more than 50% of your workforce are residents of Newark, prepare and attach a Newark residency list containing the names, addresses, dates of hire, and earnings of those employees. Report the total quarterly earnings for those who exceed the 50% threshold on Line 2.

- On Line 3, calculate the total number of employees reported on Line 1. Record this information accurately as it impacts your payroll tax obligation.

- Complete Line 4 by reporting the total number of Newark residents included in Line 1.

- Calculate Line 5 by subtracting Line 2 from Line 1 to determine your net total earnings.

- For Line 6, multiply the amount on Line 5 by the payroll tax rate of 1% (.01) to find the payroll tax due.

- If payment occurs after April 30, 2020, include any applicable interest based on the provided instructions.

- Sum lines 6 and 7 to determine the total amount due. Make your payment check payable to the City of Newark-Payroll Tax.

- Finally, sign and date the form to verify that the information provided is true and accurate to the best of your knowledge. The completed statement must be filed and mailed by April 30, 2020, to avoid interest penalties.

Complete your NJ 1st Quarter Payroll Tax Statement online today for a smooth filing experience.

Social Security Tax Rates Half this tax is paid by the employee through payroll withholding. The other half is paid by the employer. So employees pay 6.2% of their wage earnings up to the maximum wage base, and employers also pay 6.2% of their employee's wage earnings up to the maximum wage base, for a total of 12.4%.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.