Loading

Get Pa Dced Clgs-32-1 2016-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PA DCED CLGS-32-1 online

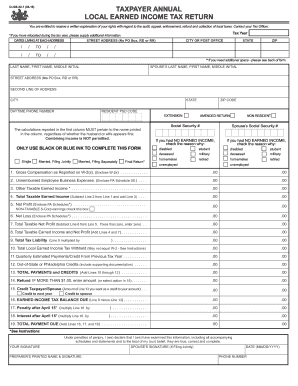

Filling out the PA DCED CLGS-32-1 form online is essential for accurately reporting your local earned income tax. This guide offers a step-by-step approach to assist users in completing the form effectively, ensuring all necessary sections and fields are understood.

Follow the steps to complete the PA DCED CLGS-32-1 online.

- Click the ‘Get Form’ button to access the PA DCED CLGS-32-1 form and open it for editing.

- Begin by entering your tax year at the top of the form. This indicates the reporting period for your local earned income tax.

- In the section for your address, provide the street address without using a P.O. box. Include city, state, and zip code.

- If you have changed your residence during the tax year, list the dates for living at each address. You may need to provide additional information if there are multiple addresses.

- Enter your name and the name of your spouse, if applicable. Ensure that all names are recorded accurately, including the first name, last name, and middle initial.

- Fill in the daytime phone number for contact purposes and ensure that the Resident PSD code is also entered.

- Indicate whether this is an amended return and provide the Social Security number corresponding to each name listed.

- Complete the income section by reporting gross compensation as indicated on your W-2 forms. Remember to enclose the W-2s when submitting the form.

- Input any unreimbursed employee business expenses and attach the necessary documentation such as the PA Schedule UE.

- Continue through the income calculations by detailing other taxable earned income. Make sure that all amounts are correctly totaled.

- Calculate your total tax liability by following the lines provided in the form and ensuring all additions and subtractions are accurate.

- Once all calculations are completed, review the payments and credits section and accurately record the total payments and credits.

- Lastly, sign the form, as well as have your spouse sign if filing jointly. Include the date and preparer’s information if applicable.

- After completing the form, you can save the changes made, download a copy for your records, print it, or share it as needed.

Complete your PA DCED CLGS-32-1 form online today to ensure timely and accurate filing.

Forgetting to file local taxes in Pennsylvania can result in penalties and interest on any unpaid tax balance. It is essential to file your tax return regardless of the delay. Look into the PA DCED CLGS-32-1 for further guidance on corrective actions. For assistance in completing your filings, uslegalforms offers valuable tools to support you.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.