Get Standard Bank Business Loans 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Standard Bank Business Loans online

Filling out the Standard Bank Business Loans form online is a straightforward process. This guide will provide you with clear instructions on how to complete each section of the application, ensuring you provide all necessary information to facilitate a smooth loan approval experience.

Follow the steps to successfully complete your application.

- Click ‘Get Form’ button to obtain the form and proceed to fill it out in the online format.

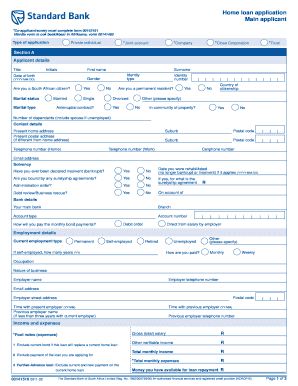

- Begin with entering your applicant details. Fill in the title, initials, first name, surname, date of birth, and gender. Indicate whether you are a South African citizen and provide information regarding your marital status and dependants.

- Provide your contact details. Include your present home address, postal address, and multiple telephone numbers to ensure the bank can reach you.

- Complete the solvency section by answering questions about your financial history, such as any previous insolvencies or suretyship agreements.

- Enter your bank details including your main bank's name, branch, account type, and account number. Specify how you plan to make your monthly bond payments.

- Fill out your employment details. Indicate your current employment status, job title, nature of business, and income information.

- In the loan details section, specify the amount you wish to borrow, the loan term, and the reason for the loan, such as buying an existing home or new construction.

- Provide property details if applicable, including the type and use of the property you intend to purchase with the loan.

- Complete the extra information section if applicable by disclosing any outstanding credit applications or disputes.

- Review the marketing consent and credit agreements. Agree to the necessary consents for credit checks and marketing communications.

- Finally, ensure all information is correct before signing the document. Save your changes, and download or print your completed application.

Start your application now to secure the funding you need.

Related links form

Choosing the right bank for business banking is essential for your financial success. Many entrepreneurs find that Standard Bank offers tailored services and resources that suit their specific needs. With robust online banking features, responsive customer service, and various account types, Standard Bank stands out in the business banking landscape. To make an informed choice, consider what services are most important for your business.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.