Get Fica Taxable Status/wage Change

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FICA taxable status/wage change online

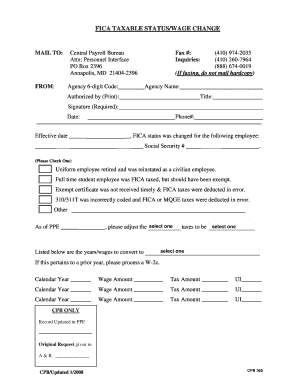

Completing the FICA taxable status/wage change form online is essential for accurately reflecting an employee's tax status. This guide will help you navigate through the form, ensuring all relevant information is correctly entered.

Follow the steps to complete the form accurately

- Click ‘Get Form’ button to access the FICA taxable status/wage change form and open it in your preferred online editor.

- In the 'FROM' section, input the agency's 6-digit code and the agency's name. Include the title of the person completing the form.

- Print the name of the authorized person, sign the form, and enter the date. Make sure to provide a contact phone number for any follow-up inquiries.

- In the 'Effective Date' field, enter the date on which the FICA status change is effective.

- In the section detailing the employee affected, write the employee's name and their Social Security number.

- Check the appropriate box to identify the reason for the FICA status change, such as retirement or incorrect taxation.

- As of PPE, adjust the selection if applicable. Record the relevant years and wages that need to be converted, ensuring to select the correct tax amount.

- If this request pertains to a prior year, indicate that a W-2c must be processed and provide the calendar year, wage amount, and tax amount for each entry.

- Once all fields are completed accurately, save your changes, and choose to download, print, or share the form as needed.

Complete the FICA taxable status/wage change form online to ensure accurate tax processing.

To calculate your FICA taxable status and wage change, you first need to know your gross income. The FICA tax rate is currently set at 7.65%, which includes Social Security and Medicare taxes. Multiply your gross income by this percentage to determine the amount that will be withheld for your FICA contributions. For precise calculations that consider any wage changes or exemptions, you can utilize tools available on the US Legal Forms platform.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.