Loading

Get R-6922es Declaration Of Estimated Tax For Composite Partnerships - Revenue Louisiana

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the R-6922ES Declaration Of Estimated Tax For Composite Partnerships - Revenue Louisiana online

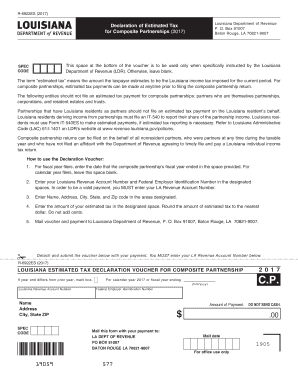

The R-6922ES Declaration of Estimated Tax for Composite Partnerships is an essential form for managing tax obligations for partnerships in Louisiana. This guide provides clear, step-by-step instructions for users to fill out the form accurately and efficiently online.

Follow the steps to complete the form successfully.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- For fiscal year filers, enter the date that the composite partnership’s fiscal year ended in the designated space. If you are a calendar year filer, leave this space blank.

- Input your Louisiana Revenue Account Number and Federal Employer Identification Number in the respective fields. Ensure that you enter your LA Revenue Account Number, as it is mandatory for a valid payment.

- Fill in the Name, Address, City, State, and Zip code in the specified areas to ensure accurate identification of your partnership.

- Enter the amount of your estimated tax in the appropriate space. Round the estimated tax amount to the nearest dollar and do not include cents.

- Mail the voucher and payment to Louisiana Department of Revenue, P. O. Box 91007, Baton Rouge, LA 70821-9007. Be sure to detach and submit the voucher with your payment. Your LA Revenue Account Number must also be included on the voucher.

Complete and submit your R-6922ES Declaration of Estimated Tax for Composite Partnerships online today to ensure compliance with Louisiana tax regulations.

A composite return is filed so the partner(s) don't have to file the same state's return for themselves. So no double taxation. But you can still claim a deduction of federal schedule A and a credit on your home state.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.