Loading

Get P40201701f - Wv State Tax Department

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the P40201701F - WV State Tax Department online

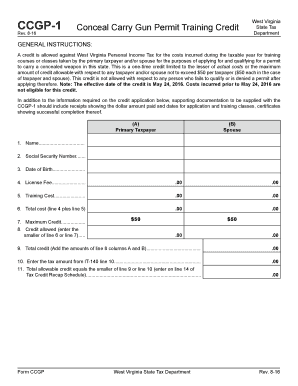

Filling out the P40201701F form for the West Virginia State Tax Department is a straightforward process that can be completed online. This guide provides clear instructions on how to accurately complete each section of the form to ensure you maximize your tax credit.

Follow the steps to successfully complete your tax form.

- Press the ‘Get Form’ button to obtain the P40201701F form and access it in your document editor.

- In section (A), input the primary taxpayer's name, social security number, and date of birth. This information is essential for identifying the taxpayer.

- Enter the license fee in line 4 of section (A). This amount represents the fee associated with obtaining a concealed carry permit.

- Record the training cost in line 5 of section (A), detailing any expenses incurred for training courses related to the concealed carry permit.

- Calculate the total cost by adding the amounts in lines 4 and 5. Enter this total in line 6 of section (A).

- Identify the maximum credit allowable in line 7, which is capped at $50 for the primary taxpayer.

- In line 8, enter the smaller of the totals from line 6 or line 7 to determine the credit allowed for the primary taxpayer.

- Repeat steps 1 to 7 in section (B) for the spouse, ensuring all details are accurately filled in.

- Add the amounts from line 8 of sections (A) and (B) to calculate the total credit for both taxpayers in line 9.

- Input the tax amount from line 10 of the IT-140 form into line 10 of the P40201701F.

- Determine the total allowable credit in line 11 by entering the smaller amount from line 9 or line 10. This figure should be transferred to line 14 of the Tax Credit Recap Schedule.

- Once all fields are completed and checked for accuracy, save your changes, download the form, and print or share it as required.

Complete your forms online for a smoother filing experience and to ensure you receive your eligible tax credits.

If you are domiciled in West Virginia and spent more than 30 days in the state, you must file a resident return and report all of your income to West Virginia.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.