Loading

Get Bc 1040 Booklet - Battlecreekmi

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the BC 1040 Booklet - Battlecreekmi online

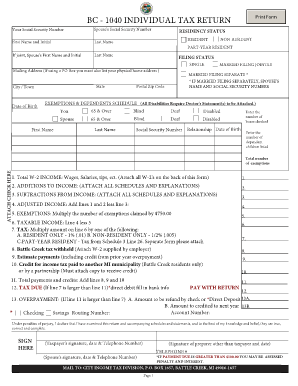

Filling out the BC 1040 Booklet is an essential step for residents and non-residents of Battle Creek, Michigan, who need to file their taxes. This guide provides clear and supportive instructions to help you navigate through the form online with ease.

Follow the steps to fill out the BC 1040 Booklet online.

- Click the ‘Get Form’ button to obtain the form and open it in an online editor.

- Enter your social security number and, if applicable, your spouse's social security number. Complete the first names and last names for yourself and your spouse if filing jointly.

- Select your residency status by checking the appropriate box: part-year resident, non-resident, or resident.

- Indicate your filing status by selecting from the options provided, such as single or married filing jointly/separately.

- Input your mailing address, including city, state, and postal zip code. If using a PO Box, also include your physical home address.

- Fill in your date of birth. Ensure that you enter this information accurately to avoid processing delays.

- Complete the exemptions and dependents schedule by listing the first names, last names, and social security numbers of any dependents. Indicate any applicable disabilities.

- Provide your total W-2 income from all sources, ensuring to attach all W-2s on the back of the form.

- Detail any additions to your income and provide the necessary schedules or explanations as attachments.

- Outline any subtractions from your income and attach relevant schedules or explanations.

- Calculate your adjusted income by adding your total income and additions, then subtracting any subtractions.

- Determine your exemptions by multiplying the number of exemptions you are claiming by $750.

- Calculate your taxable income by subtracting total exemptions from your adjusted income.

- Calculate your tax by following the instructions based on your residency status.

- Fill in the amounts for Battle Creek tax withheld, estimated payments, and other relevant credits.

- Add the lines for total payments and credits to find out if you owe tax or are due for a refund.

- If applicable, provide bank information for direct debit if tax is due.

- Sign the document and ensure that all required information, including dates and telephone numbers, is filled out correctly.

- Once all sections are complete, save your changes, and proceed to download, print, or share the form as required.

Complete your BC 1040 Booklet online now and ensure your taxes are filed accurately and efficiently.

Personal computer users may download forms and publications from the IRS Web site at .irs.gov/forms_pubs/index.html. This site also has links to state tax forms and to forms that you can fill in online and then print.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.