Loading

Get Original Application For Ad Valorem Tax Exemption Polk County ... - Polkpa

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

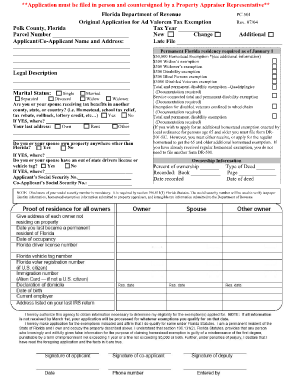

How to fill out the Original Application for Ad Valorem Tax Exemption Polk County online

This guide provides a clear and comprehensive overview of how to fill out the Original Application for Ad Valorem Tax Exemption for Polk County. Follow the instructions to successfully complete and submit your application online.

Follow the steps to fill out the application form accurately.

- Press the ‘Get Form’ button to access the application form and open it for completion.

- Indicate the tax year at the top of the form and enter your parcel number. Make sure this information is accurate to avoid any delays.

- Select whether this is a new application, a change request, or an additional application by marking the appropriate option.

- Provide the applicant and co-applicant names along with their addresses. Ensure that the details entered reflect permanent Florida residency required as of January 1.

- If applicable, document any late filings in the designated area. Follow this by selecting the exemptions you wish to apply for. This can include the $50,000 homestead exemption, among others.

- Fill in the legal description of the property and indicate marital status by selecting the relevant option: single, married, separated, divorced, widow, or widower.

- Answer the questions regarding any tax benefits received in other counties, states, or countries and provide details if applicable.

- State whether the applicant or co-applicant owns property outside of Florida and provide the necessary information.

- Enter the social security numbers for both the applicant and co-applicant in the spaces provided. Remember that disclosing social security numbers is mandatory under Florida law.

- Fill out the ownership information, including the percent of ownership, type of deed, and the recorded book and page numbers. Also, note the dates of recording and the deed.

- Review the completed application for accuracy and completeness before submission. You can then save changes, download, print, or share the filled-out form as needed.

Complete your application online today to ensure you receive the tax exemption benefits you qualify for.

Related links form

Property Tax Exemptions and Additional Benefits Further benefits are available to property owners with disabilities, senior citizens, veterans and active duty military service members, disabled first responders, and properties with specialized uses.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.