Loading

Get Form Fwv Application For Farm Wineries And Vineyards Tax Credit - Tax Virginia

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form FWV Application For Farm Wineries And Vineyards Tax Credit - Tax Virginia online

Filling out the Form FWV Application For Farm Wineries And Vineyards Tax Credit can seem daunting, but this guide will assist you in navigating the process with ease. Follow the steps below to ensure your application is completed accurately and submitted on time.

Follow the steps to fill out the form correctly.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

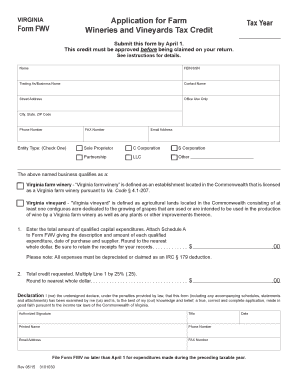

- Enter the tax year at the top of the form. This section is crucial as it indicates the period for which you are applying for the credit.

- Fill in your name and FEIN or SSN in the respective fields. Ensure that the details are accurate to avoid processing delays.

- Provide the trading as or business name of your winery or vineyard. Include the contact name for correspondence.

- Complete your street address, city, state, and ZIP code for accurate identification.

- You will need to select the entity type by checking one of the following options: sole proprietor, C Corporation, S Corporation, partnership, LLC, or other.

- Indicate whether your business qualifies as a Virginia farm winery or vineyard, using the definitions provided in the application.

- Enter the total amount of qualified capital expenditures. Be sure to attach Schedule A, detailing the description and amount of each qualified expenditure, along with the date of purchase and supplier information.

- Calculate and enter the total credit requested by multiplying Line 1 by 25%. Round to the nearest whole dollar.

- Sign and date the declaration section, confirming that you have reviewed the information and that it is correct to the best of your knowledge.

- Finally, review all entries for accuracy, save your changes, and then download, print, or share the filled form as needed. Ensure you submit it by the April 1 deadline.

Complete your application for the Farm Wineries and Vineyards Tax Credit online today!

Virginia State Code requires a minimum of five (5) contiguous (unimproved or more) acres.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.