Loading

Get Rhode Island Schedule K-1 2013 Taxpayer S Share Of ... - Tax Ri

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the rhode island schedule k-1 2013 taxpayer's share of income online

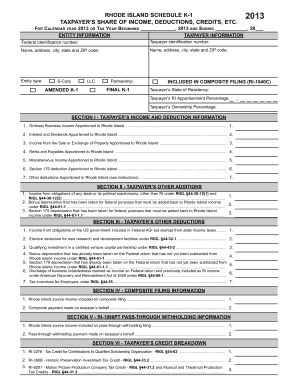

The Rhode Island Schedule K-1 form is an essential document for reporting a taxpayer's share of income, deductions, and credits from pass-through entities. This guide offers a detailed overview of how to accurately fill out this form online, ensuring compliance with state tax regulations.

Follow the steps to fill out the Rhode Island Schedule K-1 accurately.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by completing the entity information section. Enter the federal identification number and taxpayer identification number. Include the name, address, city, state, and ZIP code for both the entity and the taxpayer.

- Indicate the type of entity by selecting from options such as S-Corp, LLC, Partnership, or indicate if it's an Amended K-1 or Final K-1.

- Fill in the taxpayer's state of residency, Rhode Island apportionment percentage, and ownership percentage of the entity. Residents should enter 100% for the apportionment percentage.

- In Section I, report the taxpayer's apportioned income amounts. Include ordinary business income, interest and dividends, and income from the sale or exchange of property, among others. Make sure to enter values based on the entity's federal forms.

- Complete Section II and Section III regarding any additions or deductions specific to Rhode Island regulations. Ensure that all figures are reflected based on the taxpayer's share.

- For Sections IV and V, input information related to composite filing and pass-through withholding, including any amounts related to composite payments or withholding taxes paid on the taxpayer's behalf.

- Finally, move to Section VI to outline any tax credits that apply. Enter the amounts for each credit as passed through from the entity.

- After filling out all applicable sections, review the form for accuracy. Save changes, and then download or print the completed form for submission.

Complete your Rhode Island Schedule K-1 online to ensure timely and accurate tax filing.

If you make $70,000 a year living in Rhode Island you will be taxed $10,281. Your average tax rate is 11.67% and your marginal tax rate is 22%. This marginal tax rate means that your immediate additional income will be taxed at this rate.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.