Get American Board Of Certification General Bankruptcy Law - Multiple Choice

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the American Board of Certification General Bankruptcy Law - Multiple Choice online

Filling out the American Board of Certification General Bankruptcy Law - Multiple Choice form online can be a straightforward process if you follow a few simple steps. This guide offers clear instructions to help you understand each part of the form, ensuring a smooth experience.

Follow the steps to successfully complete the form:

- Select the ‘Get Form’ button to access the form and open it for editing.

- Begin by entering your personal information in the designated fields at the top of the form. This usually includes your name, address, and contact information.

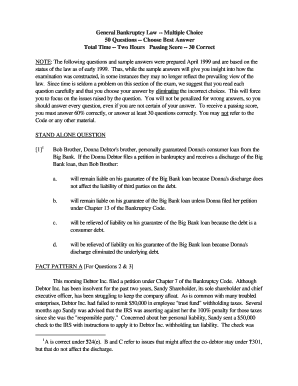

- Read through the instructions carefully once you have opened the form. This will provide clarity on how to approach the questions and the time allotted for completion.

- Review each question presented in the form. Answer them by choosing the best possible option from the provided choices. It is important to read all options thoroughly before making a selection.

- Keep track of your answers as you work through the questions. If necessary, use a separate notepad to jot down thoughts or elimination of options you find incorrect.

- Once all questions have been answered, review your selections. Ensure that all questions have been attempted as there is no penalty for incorrect answers.

- After reviewing, save your progress. You may have options to download, print, or share the form at this stage depending on your preference.

Start filling out the American Board of Certification General Bankruptcy Law - Multiple Choice form online today for a successful completion.

Related links form

IBC stands for Insolvency and Bankruptcy Code, which is designed to streamline the process for resolving insolvency issues in the U.S. This code provides a comprehensive legal framework that facilitates the orderly resolution of insolvency cases. When you learn about IBC through the lens of the American Board of Certification General Bankruptcy Law - Multiple Choice, you'll appreciate how it helps improve the financial landscape by enabling quicker resolutions and better outcomes for all parties involved.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.