Get H1049 Self Employment Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the H1049 Self Employment Form online

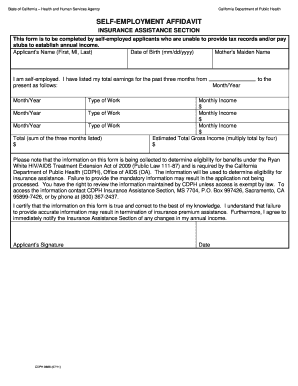

Completing the H1049 Self Employment Form is an essential step for self-employed applicants seeking insurance assistance. This guide provides clear, step-by-step instructions to help you fill out the form accurately online.

Follow the steps to successfully complete the form.

- Click ‘Get Form’ button to retrieve the H1049 Self Employment Form and access it in the editor.

- Begin by entering your personal details in the provided fields. You will need to fill in your name (first, middle initial, last) and your date of birth in the format mm/dd/yyyy. Additionally, include your mother’s maiden name.

- Indicate your self-employment status by checking the designated box. This confirms that you are unable to provide tax records and/or pay stubs for establishing your annual income.

- For the last three months, list your total earnings. Enter the month and year followed by the type of work performed for each period. Be thorough to ensure accurate reporting.

- Calculate your total earnings from the three months listed, and input this figure in the designated section.

- Provide your estimated monthly income for each of the three months by entering the amounts in the respective fields.

- To arrive at your estimated total gross income, multiply your total earnings by four and enter this figure in the appropriate box.

- Review your entries for accuracy and completeness. Ensure that all required information is provided to avoid delays in processing.

- Sign and date the form to certify that the information provided is true and correct. This is crucial as inaccurate information may lead to the termination of benefits.

- Once you have completed the form, save your changes, and choose to download, print, or share the form as needed for your records.

Start filling out your H1049 Self Employment Form online today to take the next step in securing your insurance assistance.

As a self-employed individual, you typically need to file a tax return that includes your income and expenses. The H1049 Self Employment Form simplifies this task by consolidating information necessary for accurate reporting. Always consult with a tax professional to ensure you meet all your obligations and benefit from any deductions.

Fill H1049 Self Employment Form

To provide a method for households to report self-employment income and expenses, if accurate tax or business records are not available. If you use this form to show your self-employment income: • Answer all questions and sign and date at the bottom. Texas Health and Human Form H1049. This is an Official Government Record. This form is designed specifically for self-employed persons to accurately compute and report their monthly income. Complete this form for the LAST THREE (3) MONTHS for the self-employed household member(s). Make sure to include your name,. SELF-EMPLOYMENT FORM. Use Schedule SE (Form 1040) to figure the tax due on net earnings from selfemployment. Statement from Payment provider or IRS Form 1099.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.