Get Rtn Federal Credit Union Member Business Credit Application 2003-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the RTN Federal Credit Union Member Business Credit Application online

Completing the RTN Federal Credit Union Member Business Credit Application online can be a straightforward process if you follow the steps outlined in this guide. This application is essential for businesses seeking financial support, and this guide will provide you with the necessary details to fill it out accurately and effectively.

Follow the steps to complete your application seamlessly.

- Click ‘Get Form’ button to access the application form and open it in your editor.

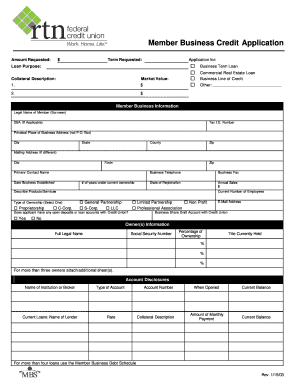

- In the 'Amount Requested' field, enter the specific dollar amount you are requesting in the appropriate box.

- In the 'Term Requested' section, specify the duration for which you require the loan.

- Indicate the 'Loan Purpose' by selecting one of the options provided, such as Business Term Loan or Commercial Real Estate Loan.

- Provide a 'Collateral Description' if applicable, along with its 'Market Value'.

- Fill out the 'Member Business Information' section with the legal name of the member or borrower, including the DBA if applicable, and ensure to enter the Tax I.D. Number.

- Complete the primary business address, including the city, state, county, and zip code.

- If the mailing address differs from the primary address, input that information in the designated fields.

- List the primary contact's name, the date the business was established, and the number of years under current ownership.

- Record the business telephone and fax numbers, along with the state of registration and annual sales figures.

- Describe the products or services your business offers in the respective field.

- Select the type of ownership from the options provided, ensuring to select only one.

- Indicate the current number of employees your business has.

- In the 'Owner(s) Information' section, fill in the full legal names and social security numbers of each owner along with their respective ownership percentage and title. Remember to attach additional sheets if there are more than three owners.

- Complete the 'Account Disclosures' section by entering the name of the institution or broker, account type, and details of current loans including lender names, interest rates, account numbers, collateral descriptions, when the accounts were opened, current balances, and monthly payment amounts. Use the Member Business Debt Schedule for more than four loans.

- Provide necessary 'Additional Information', including whether the applicant has obtained credit under another name, if there are any contingent liabilities, legal proceedings, tax obligations, or significant customer/supplier dependencies.

- Ensure you sign and date the form at the 'Signatures' section, certifying that all information provided is true, accurate, and complete.

- Attach any required documentation, such as business tax returns and financial statements, as specified in the 'Additional Requirements' section.

- After ensuring all sections are accurately completed, users can save changes, download, print, or share the completed form.

Begin your application process today by completing the RTN Federal Credit Union Member Business Credit Application online.

Yes, you can obtain a business credit card even if you are launching a startup. The RTN Federal Credit Union Member Business Credit Application provides options tailored for new businesses, allowing you to build credit and manage expenses effectively. Additionally, having a dedicated credit card can help separate personal and business finances, making it easier to track expenses. So, take advantage of the tools that RTN Federal Credit Union offers for your startup.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.