Get 1996 Ca 540 Form 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1996 CA 540 form online

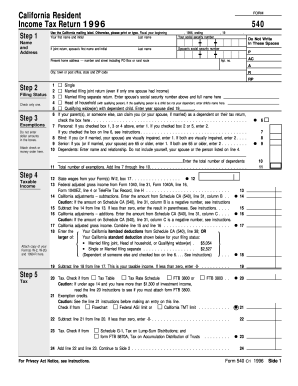

Filing your income tax can be a complex process, but understanding how to fill out the 1996 CA 540 form online can simplify your experience. This guide provides step-by-step instructions to help you navigate each section of the form with confidence.

Follow the steps to successfully complete the 1996 CA 540 form online.

- Press the ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your name and address. If you are filing a joint return, include your partner’s information, including their name and social security number.

- Choose your filing status. Check the box that corresponds to your situation: single, married filing joint, married filing separate, head of household, or qualifying widow(er).

- Complete the exemptions section. Enter the number of personal exemptions based on your filing status and any applicable exemptions for blindness or age.

- Report taxable income. Attach copies of relevant Forms W-2 and 1099. Include your state wages and federal adjusted gross income on the appropriate lines.

- Calculate tax owed using the tax tables or schedules provided, and determine any exemption credits.

- Provide information for any other taxes owed, including alternative minimum tax or penalties, if applicable.

- Input any payments made, including tax withheld or estimated tax payments.

- Determine if you have an overpayment or tax due. Follow the provided lines to calculate these values.

- Sign and date the form. Ensure both spouses sign if filing jointly, and provide contact information.

- Once all sections are completed, save your changes, download, print, or share the form as needed.

Start completing your 1996 CA 540 form online today to ensure a smooth filing process.

To obtain a copy of your California tax return, reach out to the California Franchise Tax Board through their website. You may need to confirm your identity by providing specific details. Consider using accessible online resources, as they make it easier to retrieve copies of your returns. Utilizing platforms like US Legal Forms can enhance your experience by offering straightforward solutions for managing tax documents.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.