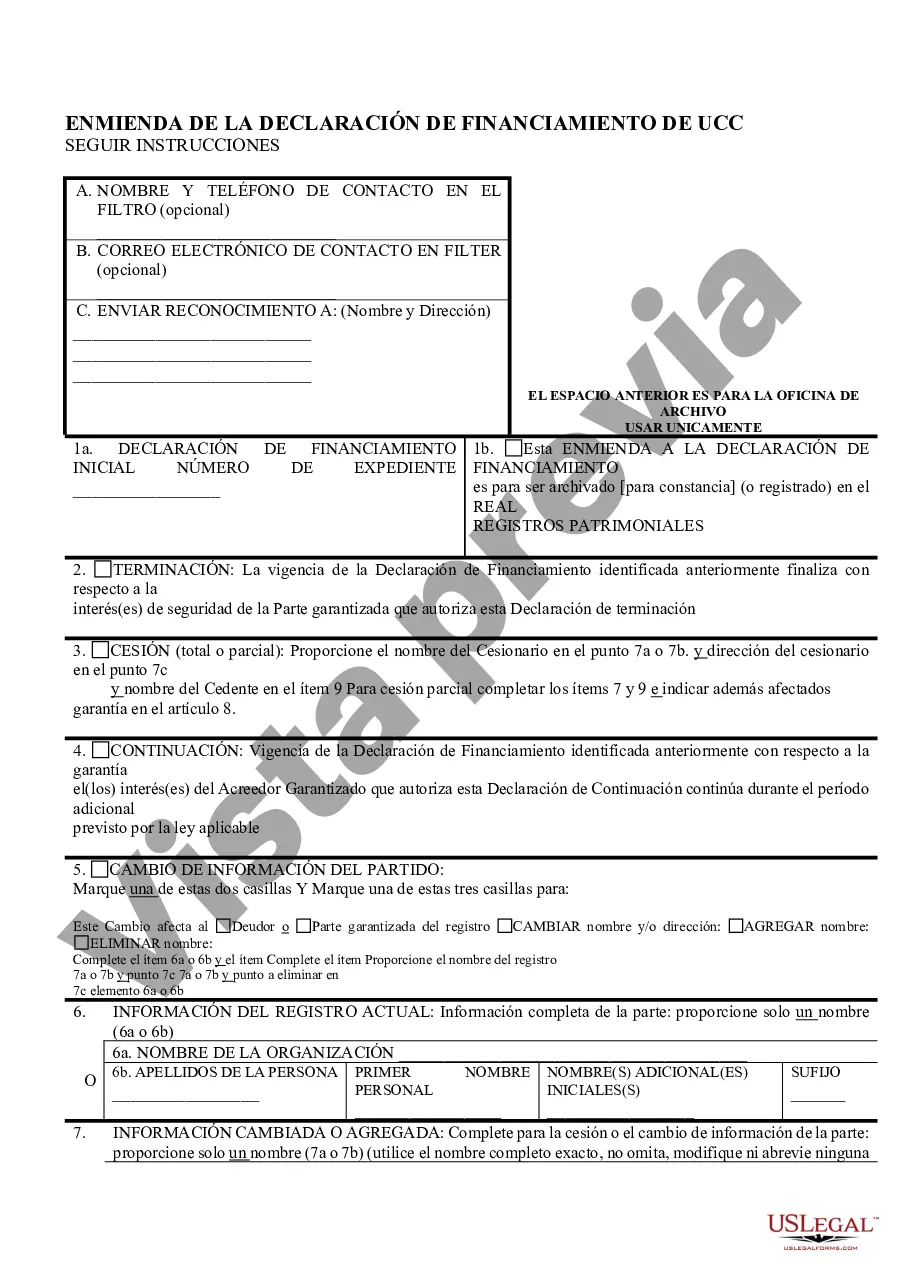

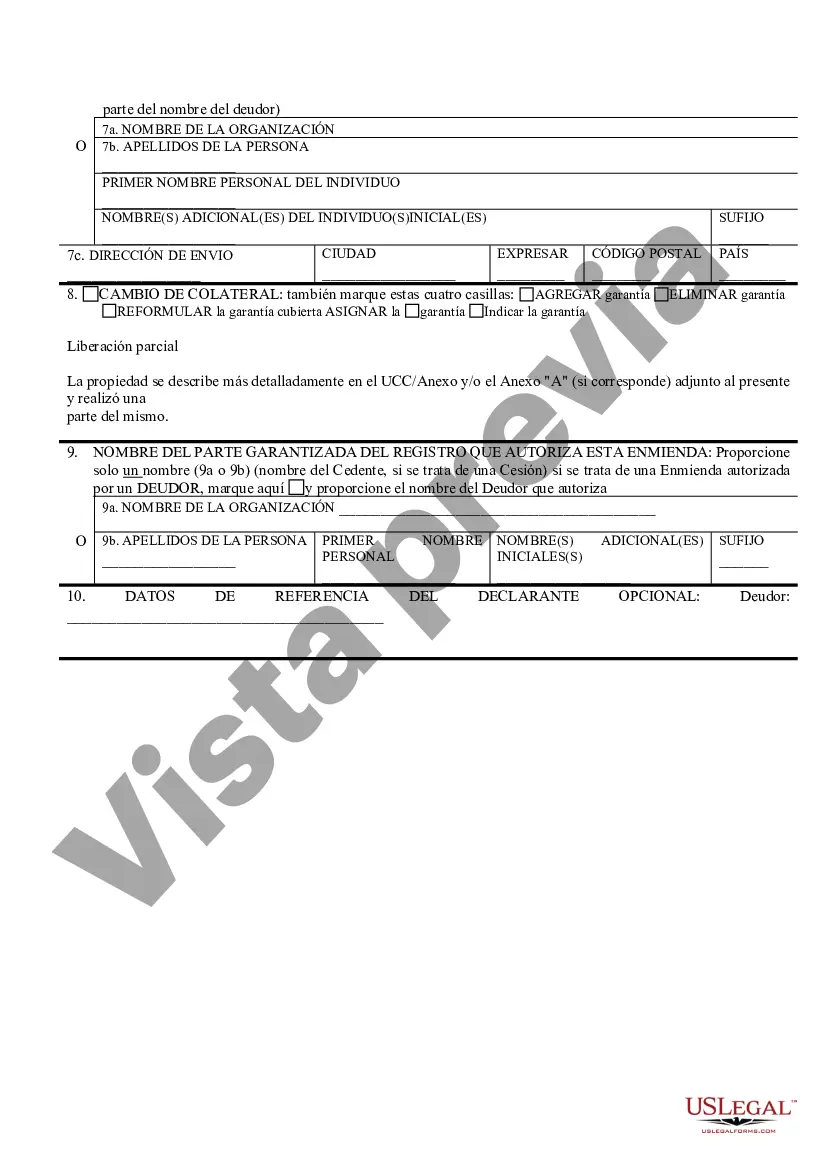

Anchorage Alaska UCC Financing Statement Amendment is a legal document that is filed to make changes or corrections to an existing Uniform Commercial Code (UCC) Financing Statement in Anchorage, Alaska. This amendment is necessary when there are modifications to the original filing, such as updating debtor information, adding or removing collateral, or correcting any errors made in the initial filing. The purpose of filing an Anchorage Alaska UCC Financing Statement Amendment is to provide accurate and up-to-date information about the secured party's interest in the collateral. It ensures that potential creditors, buyers, and other interested parties have access to accurate information regarding the status of the collateral and any obligations associated with it. In Anchorage, Alaska, there are several types of UCC Financing Statement Amendments available: 1. Name Amendment: This type of amendment is required when there are changes to the debtor's legal name, such as due to marriage, divorce, or legal name change. It helps maintain the accuracy and integrity of the financing statement by reflecting the updated information. 2. Collateral Amendment: If there are changes in the collateral description, either by adding or removing certain assets, this amendment is necessary. It allows the secured party to modify the financing statement to accurately describe the collateral and specify any revisions made. 3. Assignment Amendment: In cases where the secured party transfers their interest in the collateral to another party, an assignment amendment is filed. This document reflects the change in ownership and ensures that the new party is properly identified as the current secured party. 4. Termination Amendment: When the security interest or obligation is fully satisfied or no longer exists, a termination amendment is filed. This document serves to mark the end of the financing statement and remove the secured party's interest from the public records, providing clarity and transparency regarding the status of the collateral. It is important to note that filing an Anchorage Alaska UCC Financing Statement Amendment involves completing specific forms, providing the correct information, and paying any associated fees. Accuracy and completeness are crucial to ensure that the amendment is legally valid and properly recorded. In summary, an Anchorage Alaska UCC Financing Statement Amendment is a crucial legal document that allows parties to modify or correct information in an existing UCC Financing Statement. It ensures accuracy and transparency in describing debtors, collateral, and the secured party's interest. Various types of amendments, such as name, collateral, assignment, and termination amendments, cover different scenarios, ensuring that the UCC Financing Statement remains up-to-date and reflects the current state of the collateral and obligations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Anchorage Alaska Enmienda a la Declaración de Financiamiento de UCC - Alaska UCC Financing Statement Amendment

Description

How to fill out Anchorage Alaska Enmienda A La Declaración De Financiamiento De UCC?

Finding validated templates tailored to your local statutes can be challenging unless you utilize the US Legal Forms repository.

It’s a digital compilation of over 85,000 legal documents for both personal and business requirements and various real-life scenarios.

All the files are accurately organized by area of application and jurisdictional regions, making the search for the Anchorage Alaska UCC Financing Statement Amendment as swift and simple as one-two-three.

Maintaining paperwork orderly and in compliance with legal stipulations is crucial. Take advantage of the US Legal Forms repository to always have vital document templates for any requirements right at your fingertips!

- Examine the Preview mode and document description.

- Ensure you’ve selected the correct one that satisfies your needs and aligns fully with your local jurisdiction standards.

- Search for another template, if necessary.

- If you notice any discrepancies, utilize the Search tab above to find the appropriate one.

- Proceed to the next step if it meets your expectations.

Form popularity

FAQ

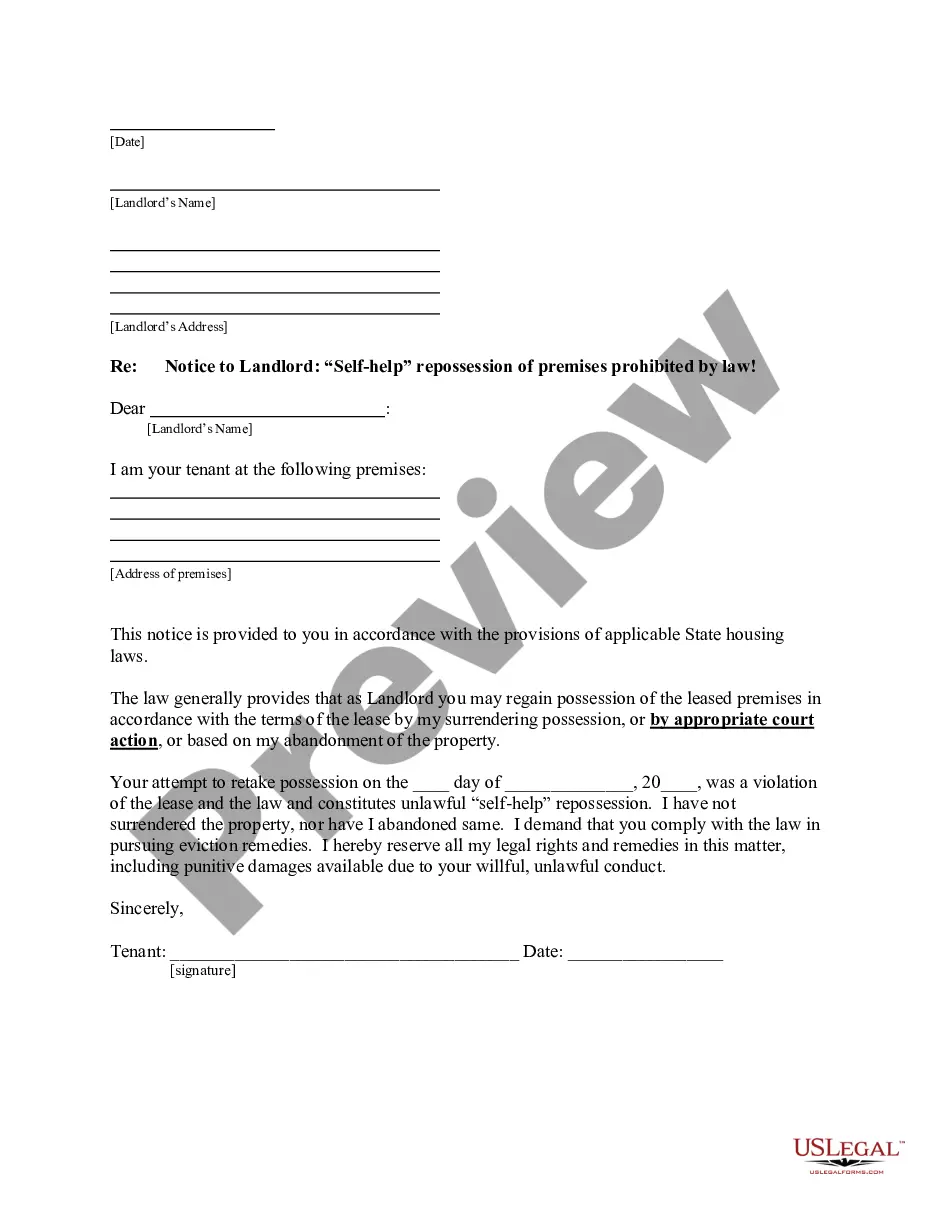

How do I get rid of a UCC filing? You can remove a UCC filing when you've repaid your business loan in full. Once you repay the debt, the lender should remove the lien from your business assets. If not, you may request that the lender files a UCC-3 to terminate the lien.

The Uniform Commercial Code (UCC) was established to protect all individuals engaged in business. It was created in order to standardize commerce between states, whether that commerce occurs between individuals or businesses.

The UCC clearly permits a creditor to use successive, timely filed, continuation statements to maintain perfection for an unlimited period of time?all the creditor has to do is keep filing a continuation every five years.

Summary. The Uniform Commercial Code (UCC) is a comprehensive set of laws governing all commercial transactions in the United States. It is not a federal law, but a uniformly adopted state law. Uniformity of law is essential in this area for the interstate transaction of business.

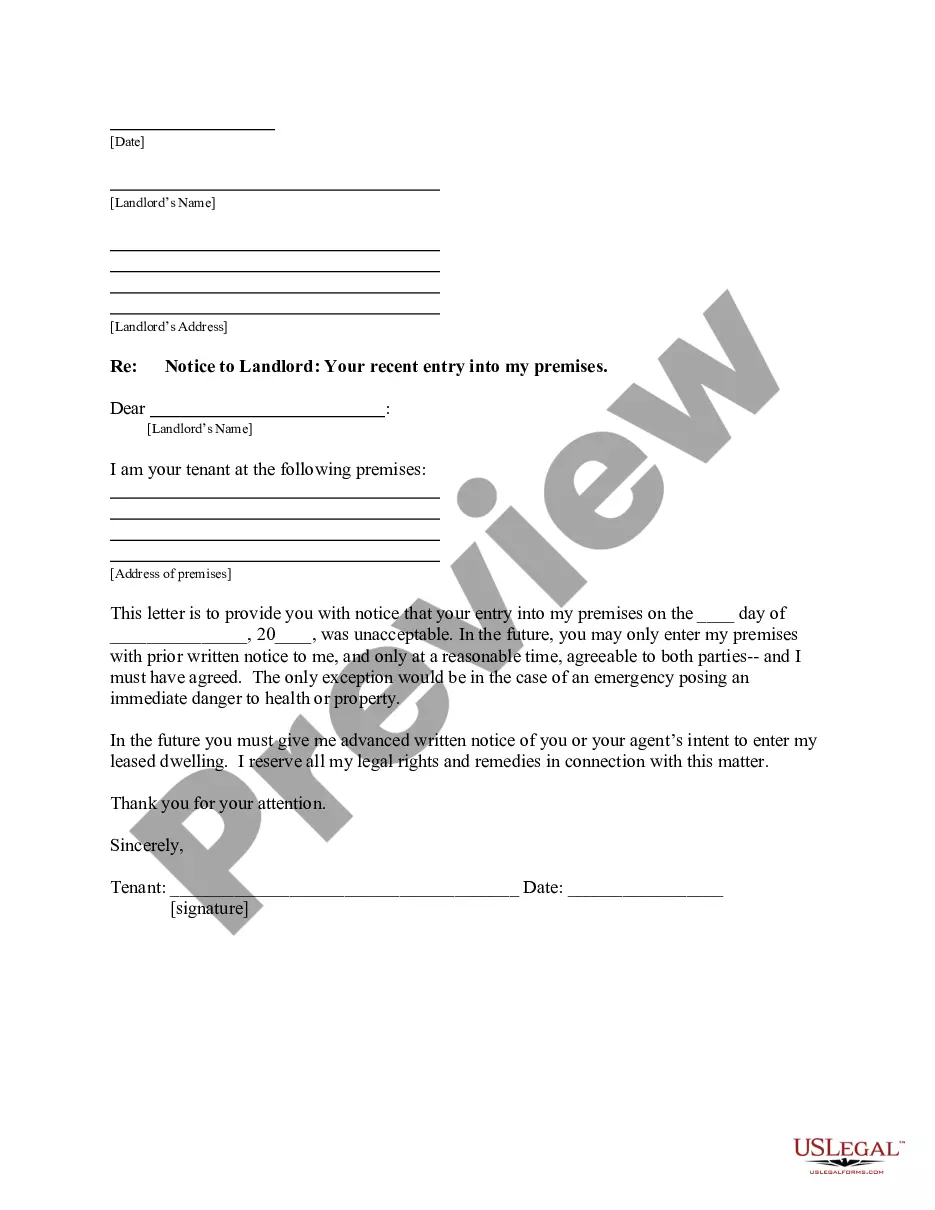

The second method Article 9 provides for dealing with unauthorized filings involves Section 9-518. This section, entitled ?Claim Concerning Inaccurate or Wrongfully Filed Record?, provides a non-judicial means for a debtor to correct a UCC record that was inaccurate or wrongfully filed.

The UCC-1 Financing Statement must be recorded in the local recording office and one must be filed in the central (State) recording office. Recording in the local recording office is not required when using AHFC form MF-LND-7 dated 01/13.

What information is required for a UCC-3 filing? Form UCC3 is used to amend (make changes to) a UCC1 filing. The required information is: An acknowledgement name and address.

A UCC3 is a change statement to a UCC1. It's an amendment filing to an original UCC1 financing statement that changes or adds information to the originally filed UCC1. It's a filing tool secured parties use to manage their UCC portfolio to maintain their perfected security interests.

To do so you will generally need to make a trip in person down to your secretary of state's office. Once there, you will be able to swear under oath that you've satisfied the debt in full and wish to request for the UCC-1 filing to be removed.

More info

If this is an amended filing, the new borrower must be a member of and not owe any other credit card or other finance charges to this borrower (such as a loan, overdraft, payment plan installment). This does not include loans that are not secured by any real property. A new borrower cannot apply for a credit card under a consumer credit plan unless the card is an “advance” in accordance with the credit card provider's standard terms. The new borrower will be considered as having no outstanding obligation to the institution to be considered in good standing and the institution will not charge interest on any new line of credit extended under a Consumer Lending Plan, even if the amount is higher than the original line of credit. The original creditor can choose to treat the new borrower as an unpaid bill and charge the outstanding balance.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.