Guam Manufacturer Analysis Checklist

Description

How to fill out Manufacturer Analysis Checklist?

Are you in a situation where you require documents for either business or personal needs almost every day? There are numerous legal document templates accessible online, but finding reliable forms can be challenging.

US Legal Forms provides thousands of form templates, including the Guam Manufacturer Analysis Checklist, designed to meet state and federal requirements.

If you are already familiar with the US Legal Forms website and have an account, simply Log In. Then, you can download the Guam Manufacturer Analysis Checklist template.

Choose a convenient file format and download your copy.

Access all the document templates you have purchased in the My documents menu. You can obtain an additional copy of the Guam Manufacturer Analysis Checklist at any time. Click the desired form to download or print the document template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it pertains to your specific city/region.

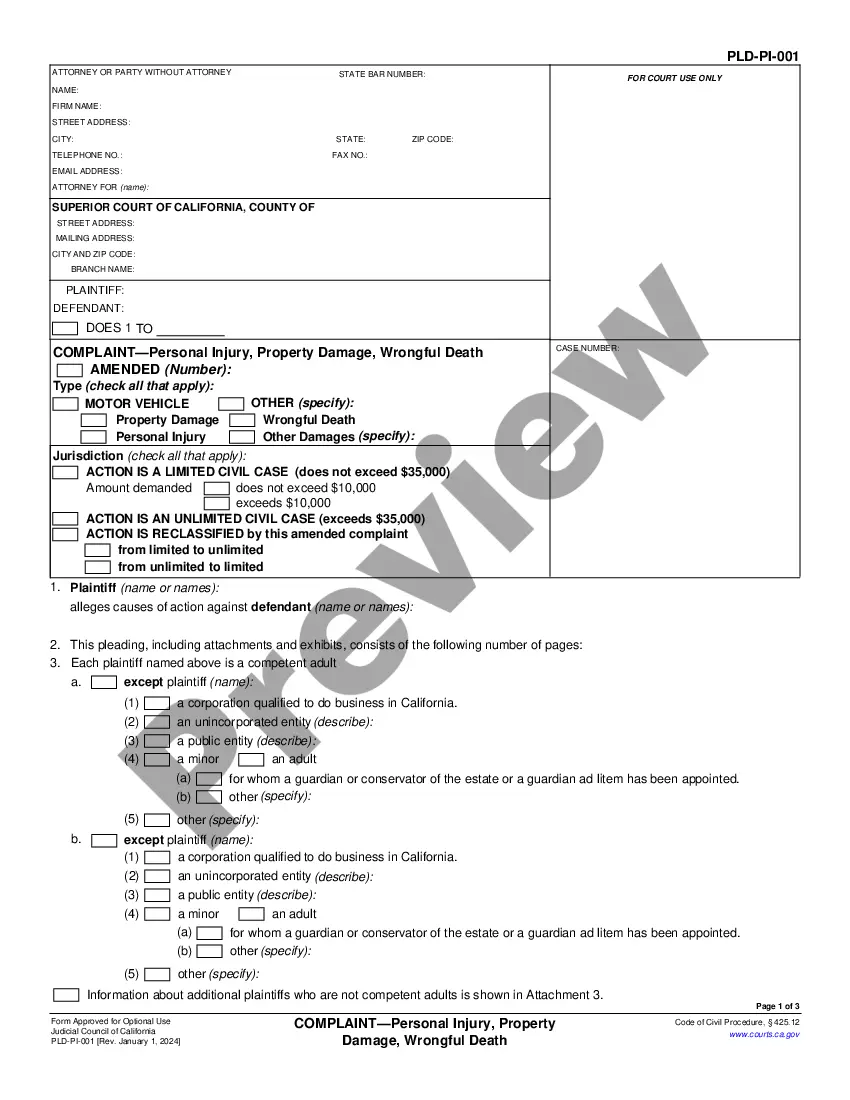

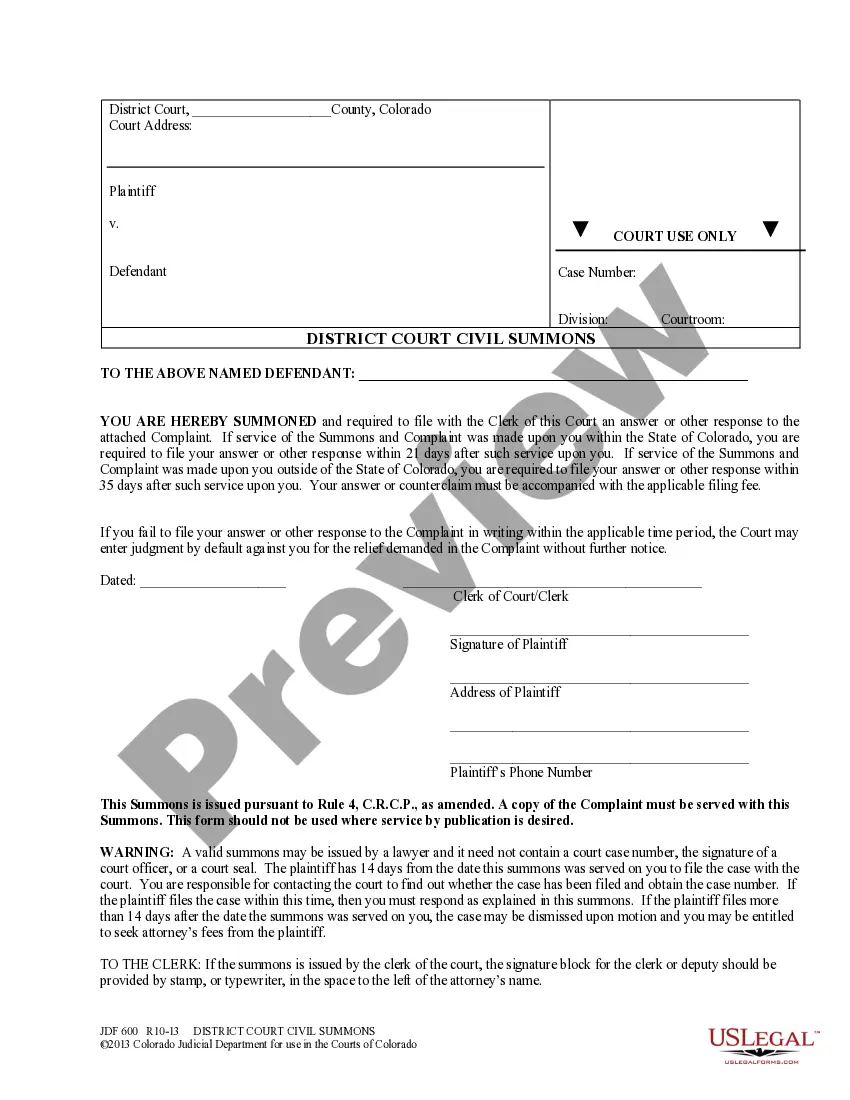

- Utilize the Preview button to examine the document.

- Read the description to ensure you have selected the correct form.

- If the form does not meet your needs, use the Lookup field to find the form that satisfies your requirements.

- Once you find the appropriate form, click Buy now.

- Select the payment plan you prefer, fill out the necessary information to create your account, and pay for the order using your PayPal or credit card.

Form popularity

FAQ

Citizens earning above a certain income level must file a tax return in Guam. This requirement also includes any individual who generated income through various sources, such as employment or business activities. The Guam Manufacturer Analysis Checklist will make it easier for you to identify if you fall within this category and what steps to take.

All individuals earning income in Guam must consider filing a Guam tax return. This requirement extends to both residents and non-residents who have generated revenue in the territory. You can refer to the Guam Manufacturer Analysis Checklist for detailed guidance on what you need to file properly.

Those required to file a return generally include individuals who meet specific income thresholds, businesses generating revenue, and other entities defined by Guam tax regulations. Understanding your obligations can be complicated, so using the Guam Manufacturer Analysis Checklist can help clarify your filing responsibilities.

Individuals and entities that earn income in Guam typically have an obligation to file a tax return. This includes residents, non-residents, and businesses. To be certain of your filing requirements, refer to the Guam Manufacturer Analysis Checklist to simplify the process.

The BPT, or Business Privilege Tax, in Guam applies to businesses generating income within the territory. This tax is calculated as a percentage of the gross revenue earned. If you're a business owner in Guam, you should include this information in your Guam Manufacturer Analysis Checklist to ensure compliance with local tax laws.

Whether you need to file Guam taxes depends on your income and residency status. Most individuals earning income in Guam, including residents and non-residents, will have filing obligations. It’s essential to review your financial situation carefully and consult the Guam Manufacturer Analysis Checklist to determine your requirements.

Yes, you can conveniently file your Guam tax online. Using an online platform simplifies the process and reduces errors. Ensure you have all necessary documentation ready, as you will need this information to complete your Guam Manufacturer Analysis Checklist accurately.