Official Chapter 11 For Business

Description

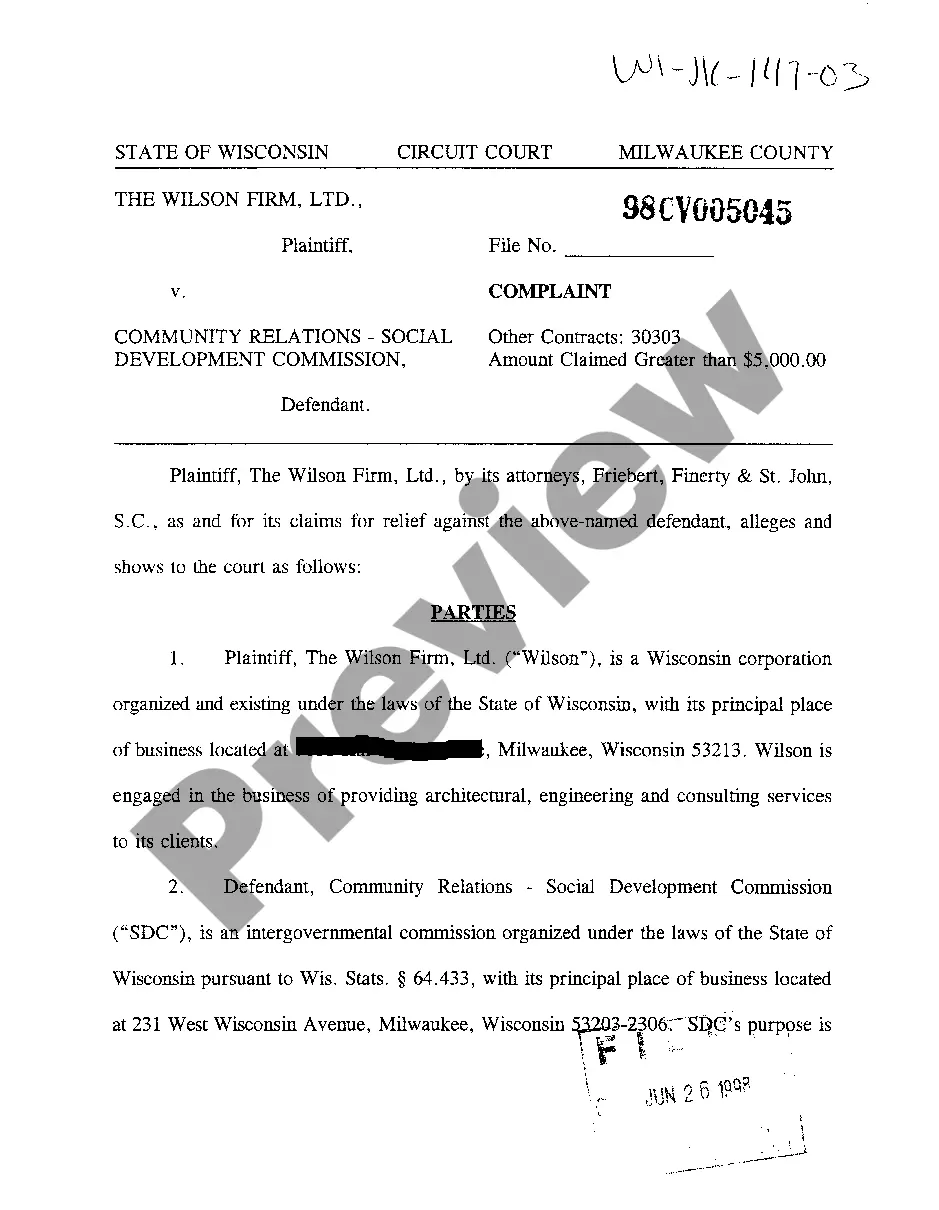

How to fill out List Of Creditors Holding 20 Largest Secured Claims - Not Needed For Chapter 7 Or 13 - Form 4 - Post 2005?

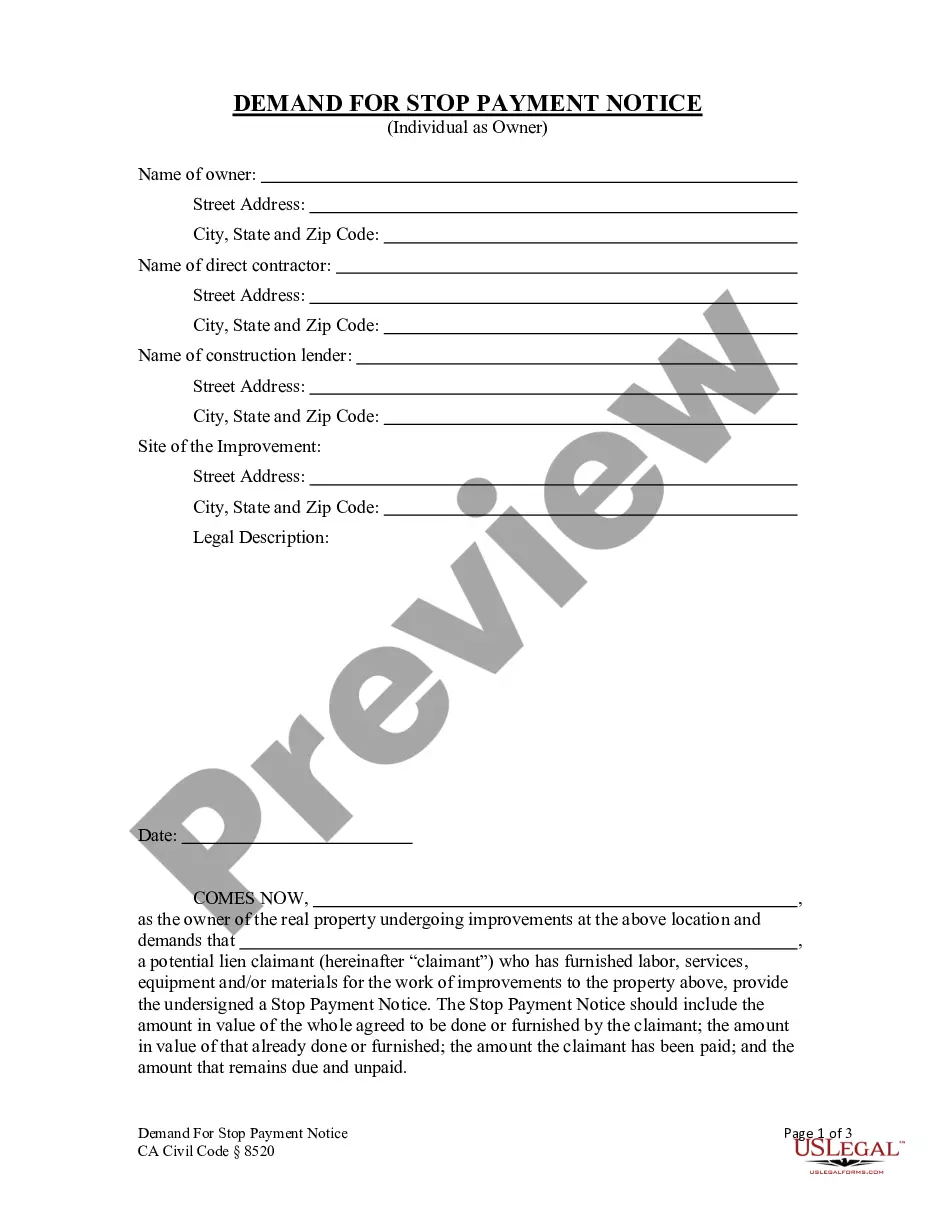

Whether for business purposes or for personal matters, everybody has to manage legal situations sooner or later in their life. Completing legal documents needs careful attention, starting with choosing the appropriate form sample. For example, if you pick a wrong version of the Official Chapter 11 For Business, it will be declined when you send it. It is therefore essential to have a dependable source of legal papers like US Legal Forms.

If you have to get a Official Chapter 11 For Business sample, follow these easy steps:

- Get the sample you need by using the search field or catalog navigation.

- Check out the form’s information to make sure it suits your case, state, and region.

- Click on the form’s preview to view it.

- If it is the wrong document, go back to the search function to find the Official Chapter 11 For Business sample you require.

- Get the template when it meets your needs.

- If you already have a US Legal Forms profile, click Log in to access previously saved files in My Forms.

- If you don’t have an account yet, you can download the form by clicking Buy now.

- Select the proper pricing option.

- Finish the profile registration form.

- Select your transaction method: you can use a bank card or PayPal account.

- Select the file format you want and download the Official Chapter 11 For Business.

- After it is downloaded, you can fill out the form by using editing applications or print it and finish it manually.

With a vast US Legal Forms catalog at hand, you don’t need to spend time searching for the appropriate sample across the internet. Utilize the library’s straightforward navigation to find the appropriate template for any occasion.

Form popularity

FAQ

The main difference between Chapter 11 and Chapter 13 is that a Chapter 13 bankruptcy requires that the debtor pay his or her debts within five years. On the other hand, Chapter 11 allows the filer to extend the five-year period unlike Chapter 13. Another difference is how much the Debtor has to pay creditors.

Background. A case filed under chapter 11 of the United States Bankruptcy Code is frequently referred to as a "reorganization" bankruptcy. Usually, the debtor remains ?in possession,? has the powers and duties of a trustee, may continue to operate its business, and may, with court approval, borrow new money.

Even with recently streamlined procedures, small business bankruptcy is a time-consuming and complex process, and it can also involve significant financial risks and costs. That being said, Chapter 11 may be the best option for your small business to survive and continue operating.

While the average length of a Chapter 11 Bankruptcy case can last 17 months, larger and more complex cases can take up to five years. And following the conclusion of the bankruptcy case, it can still take months for Debtors to begin distributing payouts to the highest priority class of Creditors.

Almost anyone can file for Chapter 11 bankruptcy. This includes individuals, companies, partnerships, joint ventures, and LLCs. The filer doesn't have to meet any debt limits under Chapter 11 rules and there are no limits to file. Chapter 13, on the other hand, is generally used by those with a stable source of income.