South Carolina Llc Annual Filing Requirements

Description

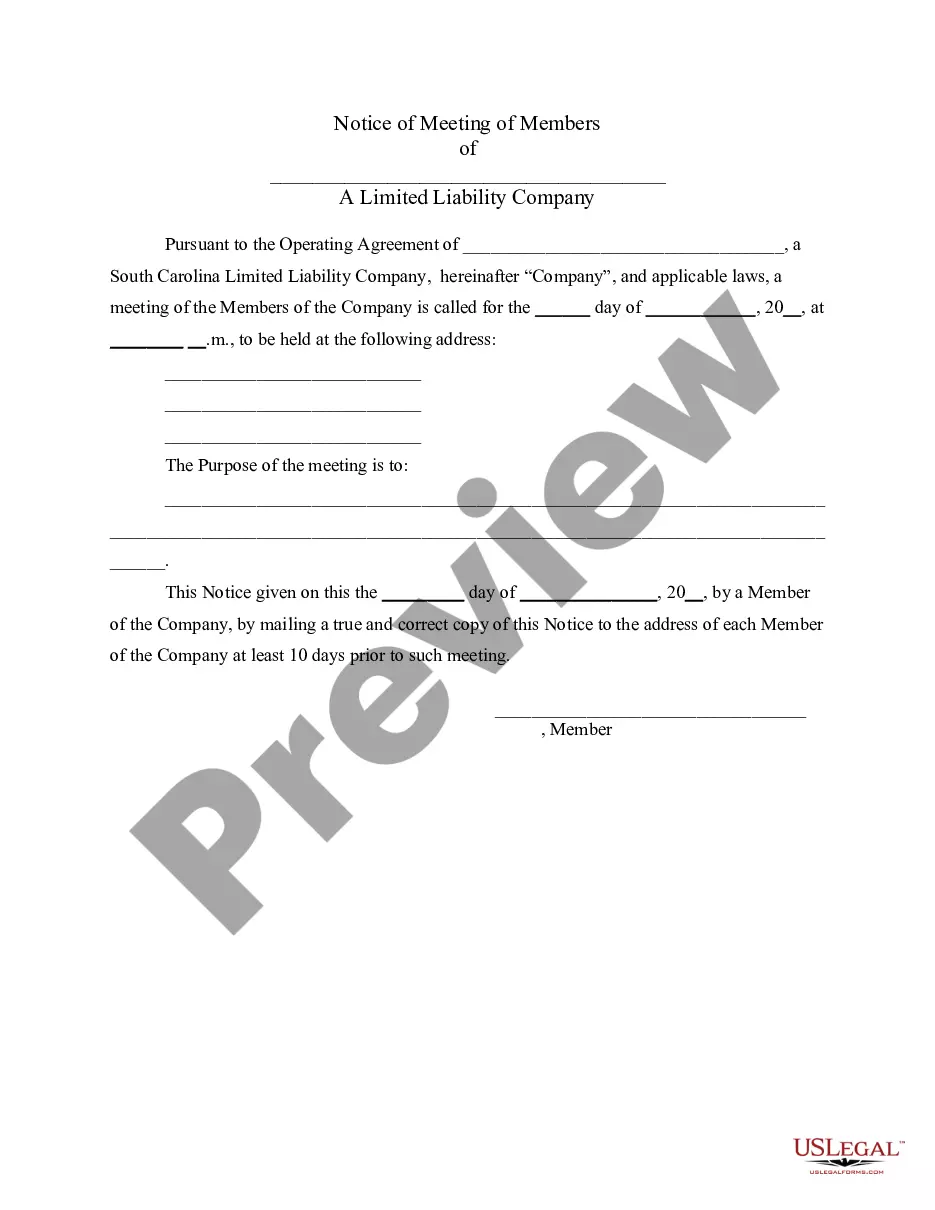

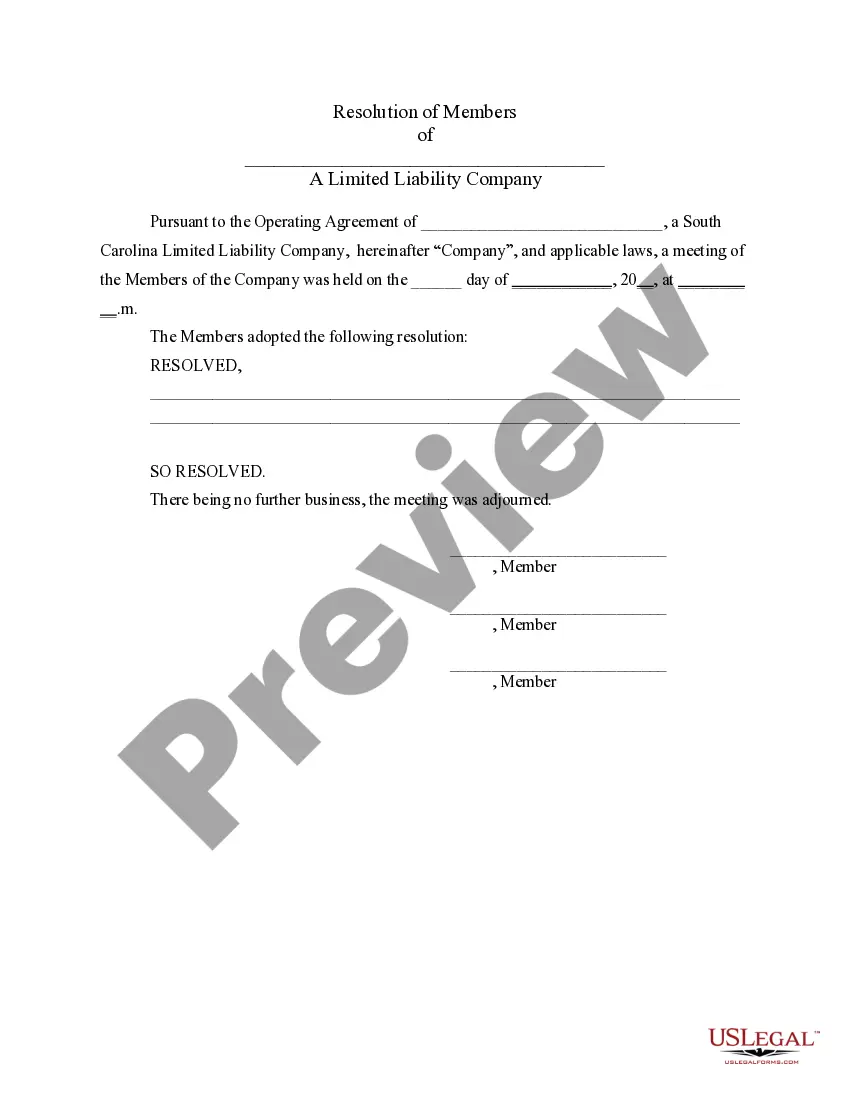

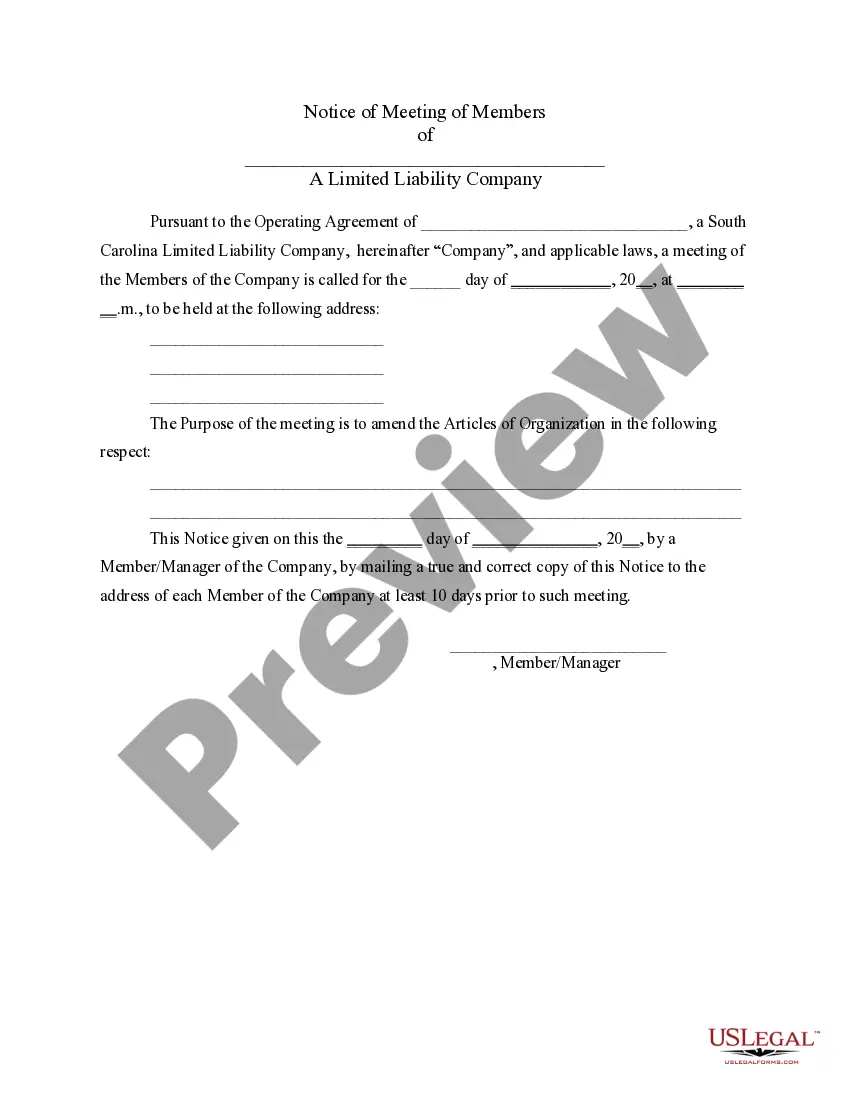

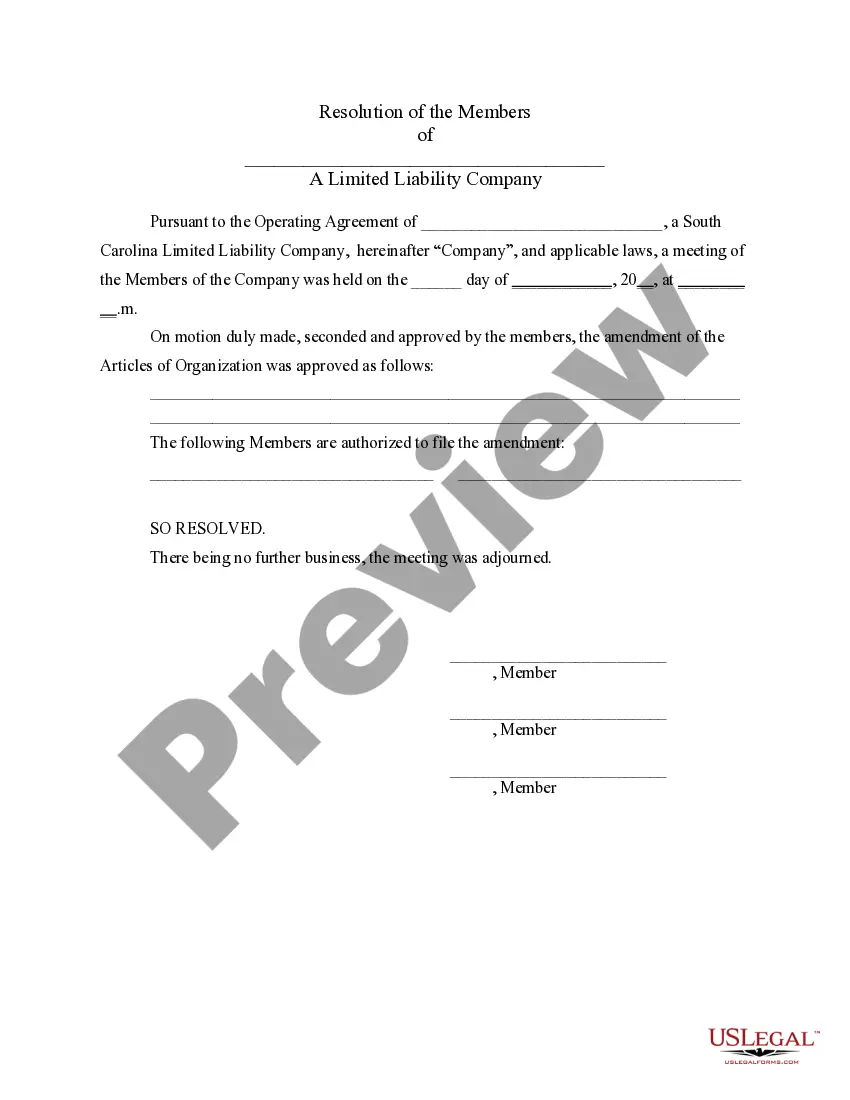

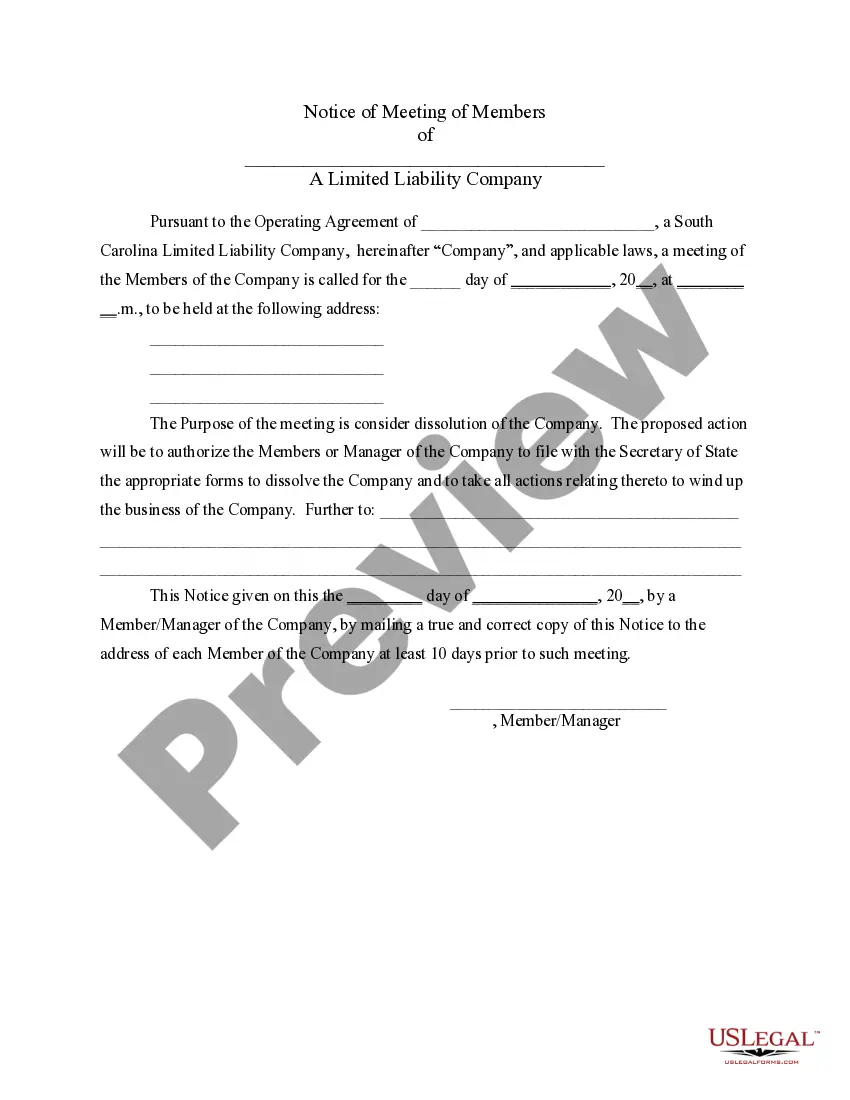

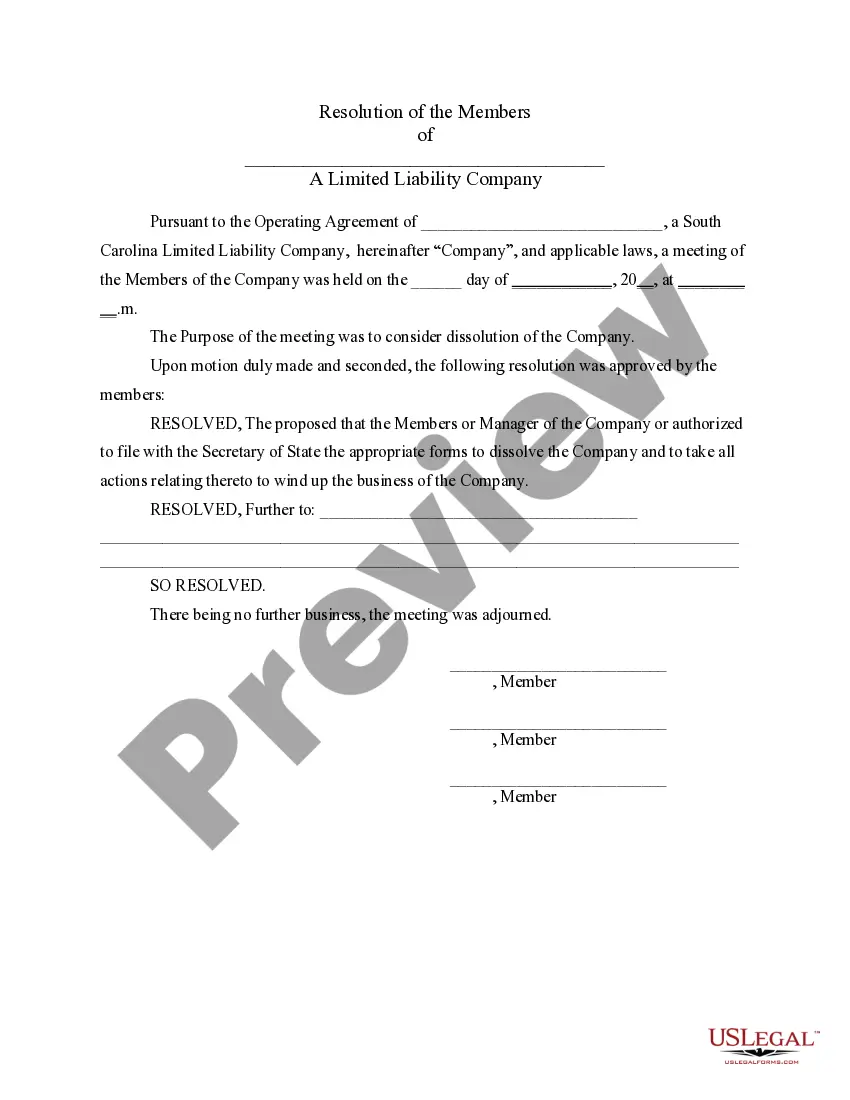

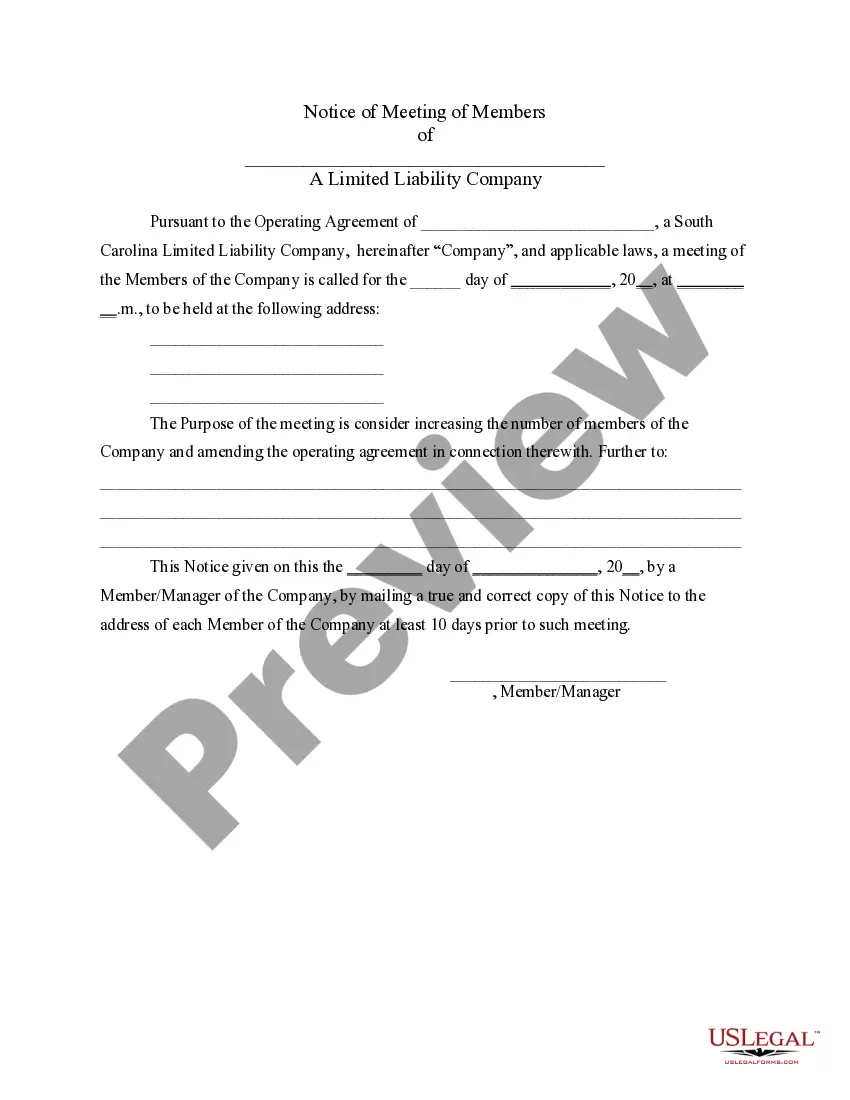

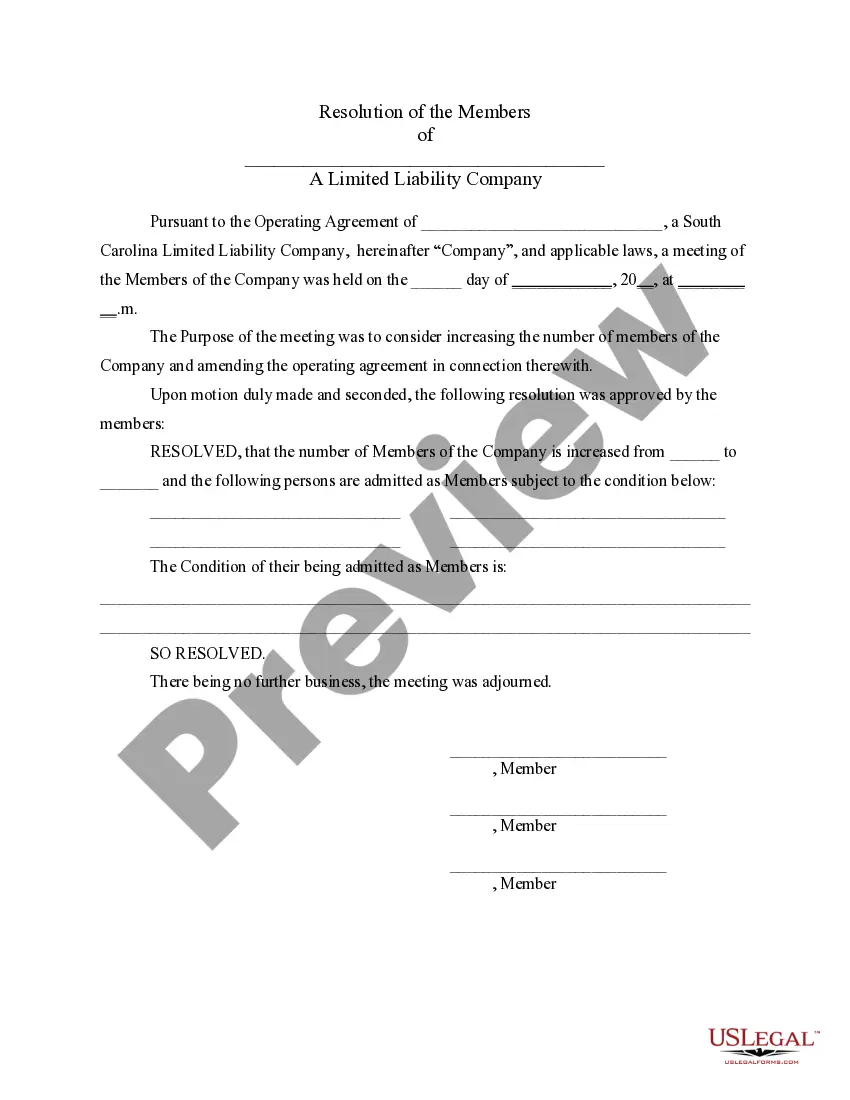

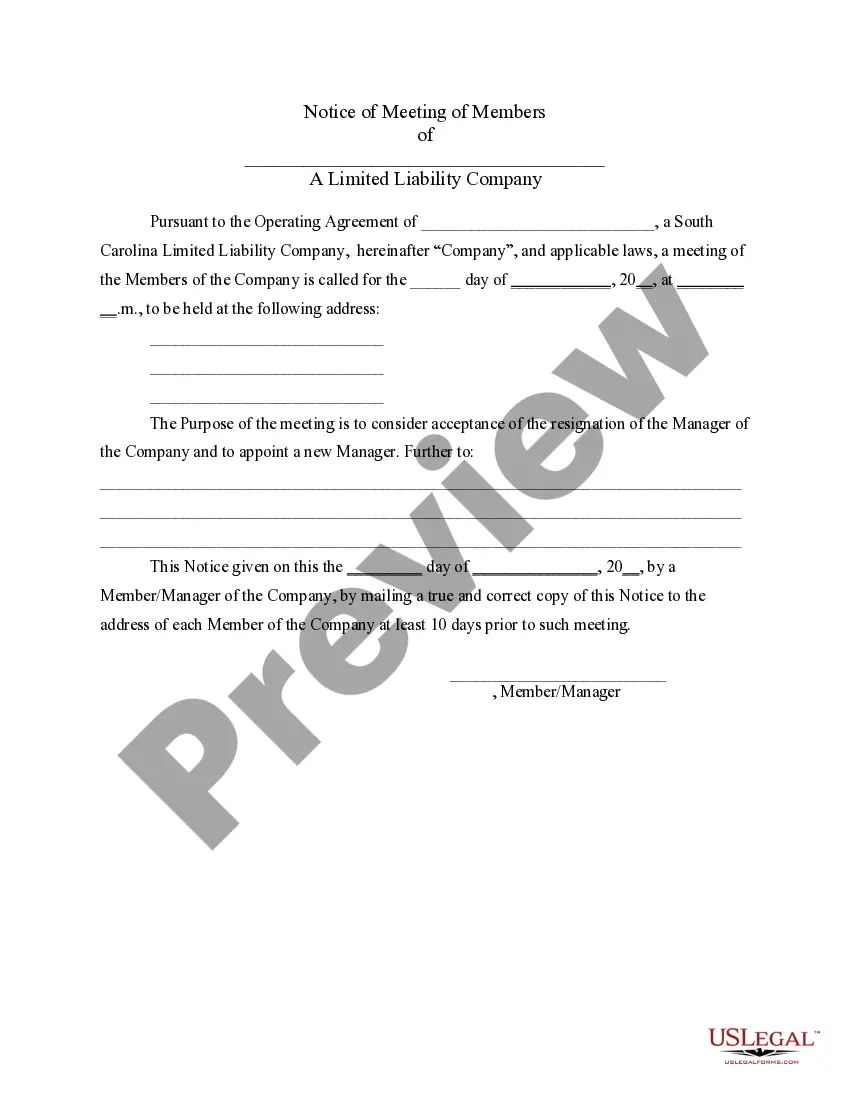

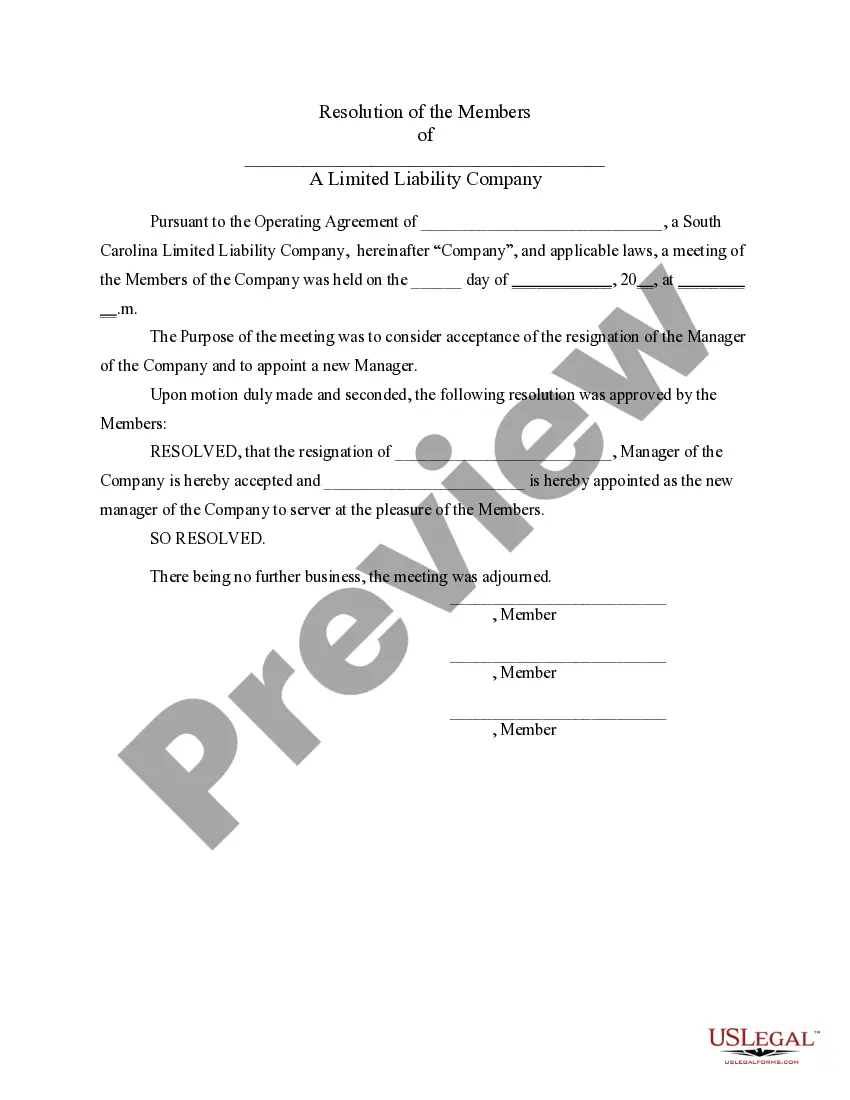

How to fill out South Carolina LLC Notices, Resolutions And Other Operations Forms Package?

Whether for business purposes or for personal matters, everyone has to manage legal situations sooner or later in their life. Completing legal paperwork demands careful attention, starting with selecting the appropriate form sample. For instance, when you pick a wrong version of the South Carolina Llc Annual Filing Requirements, it will be declined when you submit it. It is therefore important to have a dependable source of legal documents like US Legal Forms.

If you need to get a South Carolina Llc Annual Filing Requirements sample, follow these easy steps:

- Get the template you need using the search field or catalog navigation.

- Examine the form’s information to ensure it matches your case, state, and region.

- Click on the form’s preview to view it.

- If it is the wrong form, go back to the search function to locate the South Carolina Llc Annual Filing Requirements sample you require.

- Download the template when it matches your needs.

- If you have a US Legal Forms profile, just click Log in to access previously saved documents in My Forms.

- If you do not have an account yet, you can obtain the form by clicking Buy now.

- Select the correct pricing option.

- Finish the profile registration form.

- Choose your transaction method: you can use a credit card or PayPal account.

- Select the file format you want and download the South Carolina Llc Annual Filing Requirements.

- After it is downloaded, you are able to fill out the form with the help of editing applications or print it and finish it manually.

With a substantial US Legal Forms catalog at hand, you don’t have to spend time seeking for the appropriate template across the web. Make use of the library’s easy navigation to find the proper form for any occasion.

Form popularity

FAQ

You must file Form SC1040 with the Secretary of State to pay your default LLC tax filings. LLCs taxed as S-corps file Form SC-1120s, while LLCs with C-corp status file Form SC1120. C-corp LLCs pay the state's low corporate income tax of 5%.

For the State of South Carolina, LLCs are not required to file an annual report every year. If your LLC has elected to be taxed as an S Corp however, you'll have to file form SC 1120S to the Department of Revenue.

How to file Your South Carolina Annual Report Determine your due date and filing fees. Complete your report online ? using tax preparation software OR download a paper form. File your report with the South Carolina Department of Revenue (SCDOR).

South Carolina LLCs filing as LLCs pay the state's graduated income tax rate that ranges from 0% to 7%. The rates are dependent on your taxable income. You must file Form SC1040 with the Secretary of State to pay your default LLC tax filings.

South Carolina does not require LLCs to file an annual report. Taxes. For complete details on state taxes for South Carolina LLCs, visit Business Owner's Toolkit or the State of South Carolina . Federal tax identification number (EIN).