North Carolina Bylaws Withholding

Description

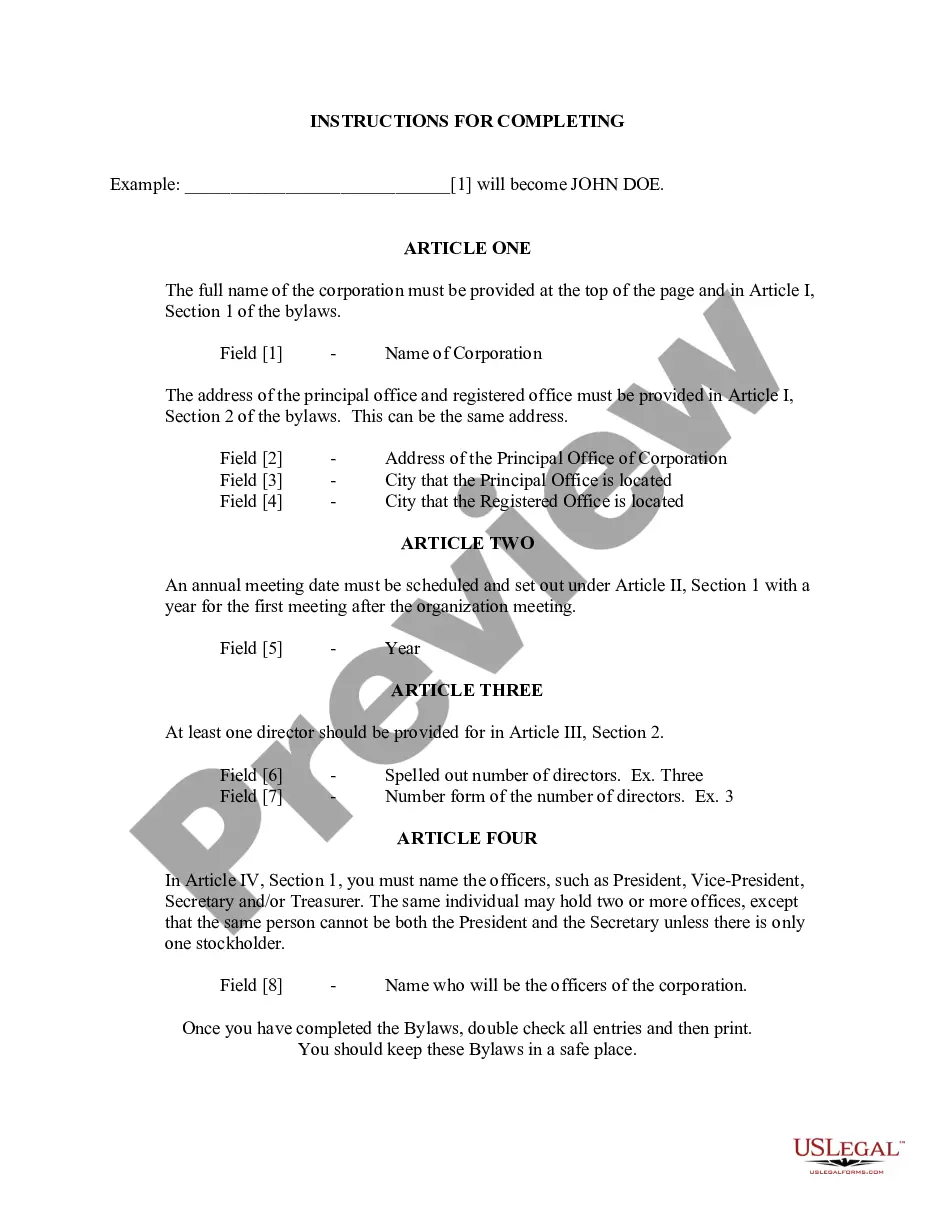

How to fill out North Carolina Bylaws For Corporation?

Drafting legal paperwork from scratch can often be a little overwhelming. Some cases might involve hours of research and hundreds of dollars spent. If you’re searching for a simpler and more affordable way of preparing North Carolina Bylaws Withholding or any other documents without jumping through hoops, US Legal Forms is always at your fingertips.

Our virtual catalog of over 85,000 up-to-date legal forms addresses almost every aspect of your financial, legal, and personal matters. With just a few clicks, you can quickly access state- and county-specific templates diligently put together for you by our legal experts.

Use our platform whenever you need a trustworthy and reliable services through which you can easily locate and download the North Carolina Bylaws Withholding. If you’re not new to our website and have previously created an account with us, simply log in to your account, locate the template and download it away or re-download it at any time in the My Forms tab.

Don’t have an account? No problem. It takes minutes to set it up and navigate the catalog. But before jumping directly to downloading North Carolina Bylaws Withholding, follow these tips:

- Review the form preview and descriptions to make sure you are on the the form you are looking for.

- Make sure the form you choose conforms with the requirements of your state and county.

- Pick the best-suited subscription option to get the North Carolina Bylaws Withholding.

- Download the form. Then fill out, sign, and print it out.

US Legal Forms has a spotless reputation and over 25 years of experience. Join us now and transform form completion into something easy and streamlined!

Form popularity

FAQ

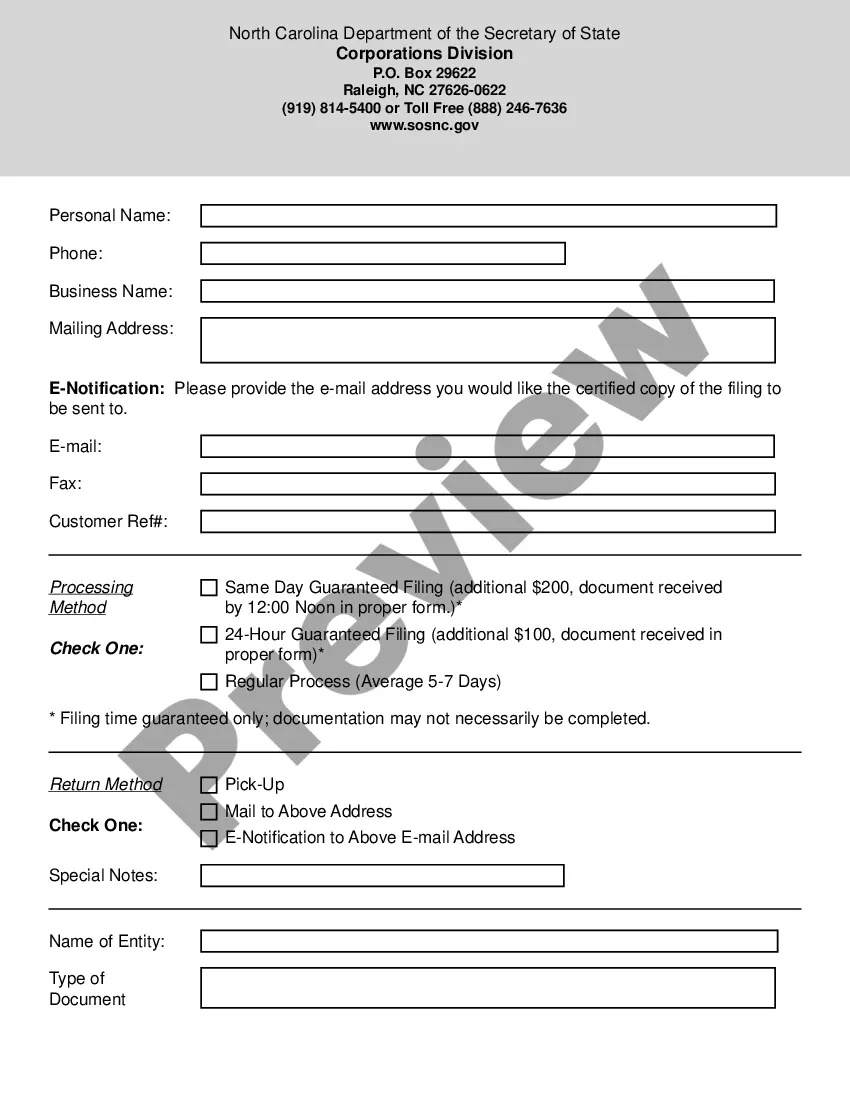

How do I register for a NC Withholding Tax Identification Number? You must submit a completed business registration application, Form NC-BR, Business Registration Application for Income Tax Withholding, Sales and Use Tax, and Other Taxes and Service Charge, to obtain a withholding tax identification number.

The Form W-4 in Depth Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number. ... Step 2: Indicate Multiple Jobs or a Working Spouse. ... Step 3: Add Dependents. ... Step 4: Add Other Adjustments. ... Step 5: Sign and Date Form W-4.

North Carolina Median Household Income Every taxpayer in North Carolina will pay 4.99% of their taxable income for state taxes.

FORM NC-4 EZ - You may use Form NC4-EZ if you plan to claim either the N.C. Standard Deduction or the N.C. Child Deduction Amount (but no other N.C. deductions), and you do not plan to claim any N.C. tax credits. FORM NC-4 NRA - If you are a nonresident alien you must use Form NC-4 NRA.

State Withholding Taxes To register with the State of North Carolina, complete an Application for Income Tax Withholding (Form NC-BR), apply online or contact the Department of Revenue at (877) 252-3052.