Agree Paid Wage Withholding Tax Return

Description

How to fill out California On Duty Meal Period Agreement?

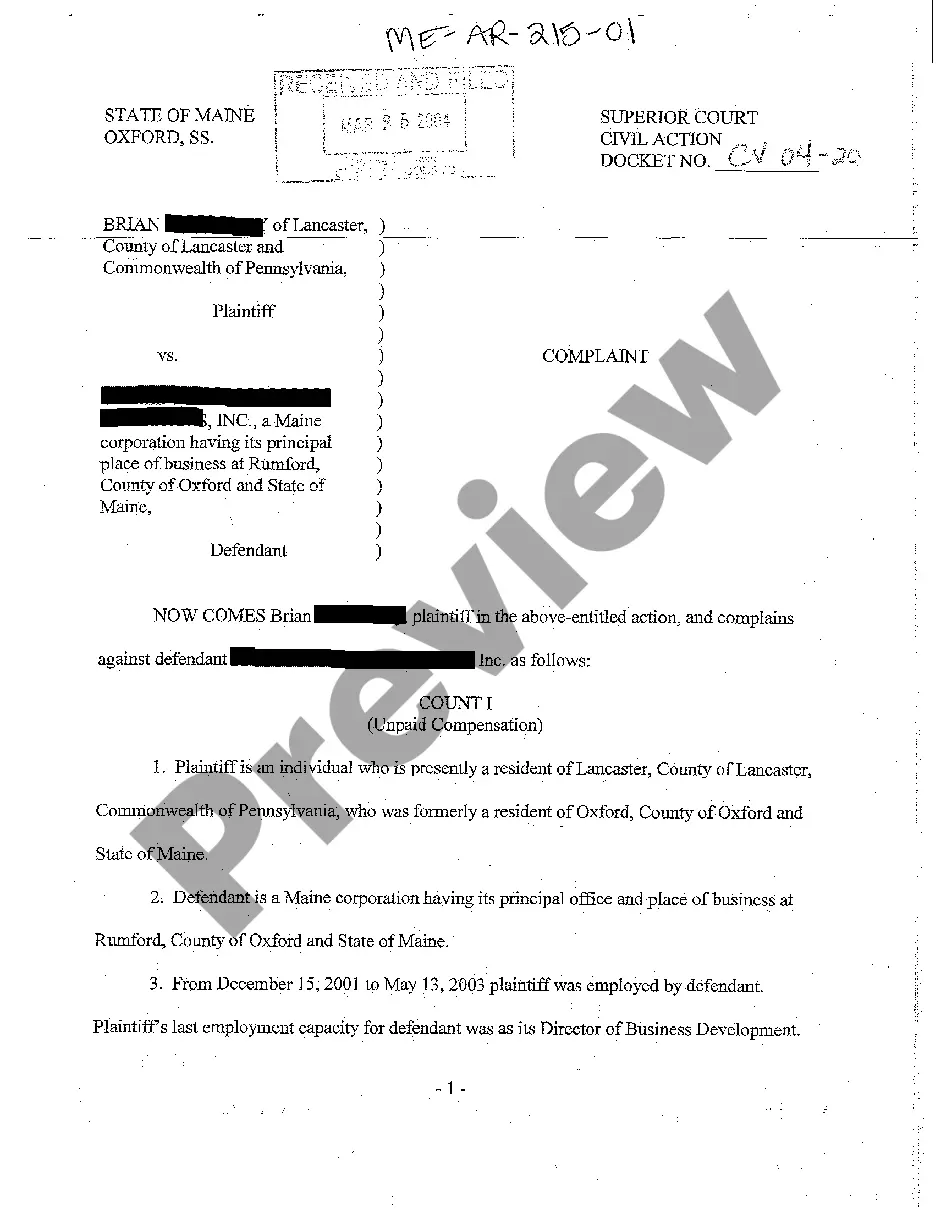

Whether for business purposes or for individual matters, everybody has to manage legal situations at some point in their life. Filling out legal paperwork requires careful attention, beginning from picking the right form sample. For example, if you select a wrong edition of the Agree Paid Wage Withholding Tax Return, it will be turned down when you submit it. It is therefore crucial to have a trustworthy source of legal files like US Legal Forms.

If you have to get a Agree Paid Wage Withholding Tax Return sample, follow these simple steps:

- Get the template you need by using the search field or catalog navigation.

- Examine the form’s description to make sure it suits your situation, state, and county.

- Click on the form’s preview to examine it.

- If it is the incorrect form, go back to the search function to locate the Agree Paid Wage Withholding Tax Return sample you need.

- Download the file when it matches your needs.

- If you have a US Legal Forms account, click Log in to access previously saved documents in My Forms.

- If you do not have an account yet, you may obtain the form by clicking Buy now.

- Select the appropriate pricing option.

- Complete the account registration form.

- Select your transaction method: use a bank card or PayPal account.

- Select the document format you want and download the Agree Paid Wage Withholding Tax Return.

- When it is saved, you can complete the form by using editing software or print it and complete it manually.

With a vast US Legal Forms catalog at hand, you never have to spend time looking for the appropriate template across the web. Utilize the library’s straightforward navigation to get the correct template for any situation.

Form popularity

FAQ

By placing a ?0? on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period. 2. You can choose to have no taxes taken out of your tax and claim Exemption (see Example 2).

Simply add an additional amount on Line 4(c) for "extra withholding." That will increase your income tax withholding, reduce the amount of your paycheck and either jack up your refund or reduce any amount of tax you owe when you file your tax return.

You can claim anywhere between 0 and 3 allowances on the W4 IRS form, depending on what you're eligible for. Generally, the more allowances you claim, the less tax will be withheld from each paycheck. The fewer allowances claimed, the larger withholding amount, which may result in a refund.

How you fill out a W-4 can have a major effect on whether taxes are owed or a refund is given. Step 1: Enter your personal information. Step 2: Account for multiple jobs. Step 3: Claim dependents, including children. Step 4: Refine your withholdings.

Claiming 1 reduces the amount of taxes that are withheld from weekly paychecks, so you get more money now with a smaller refund. Claiming 0 allowances may be a better option if you'd rather receive a larger lump sum of money in the form of your tax refund.