Llc Operating Agreement Arizona Withholding

Description

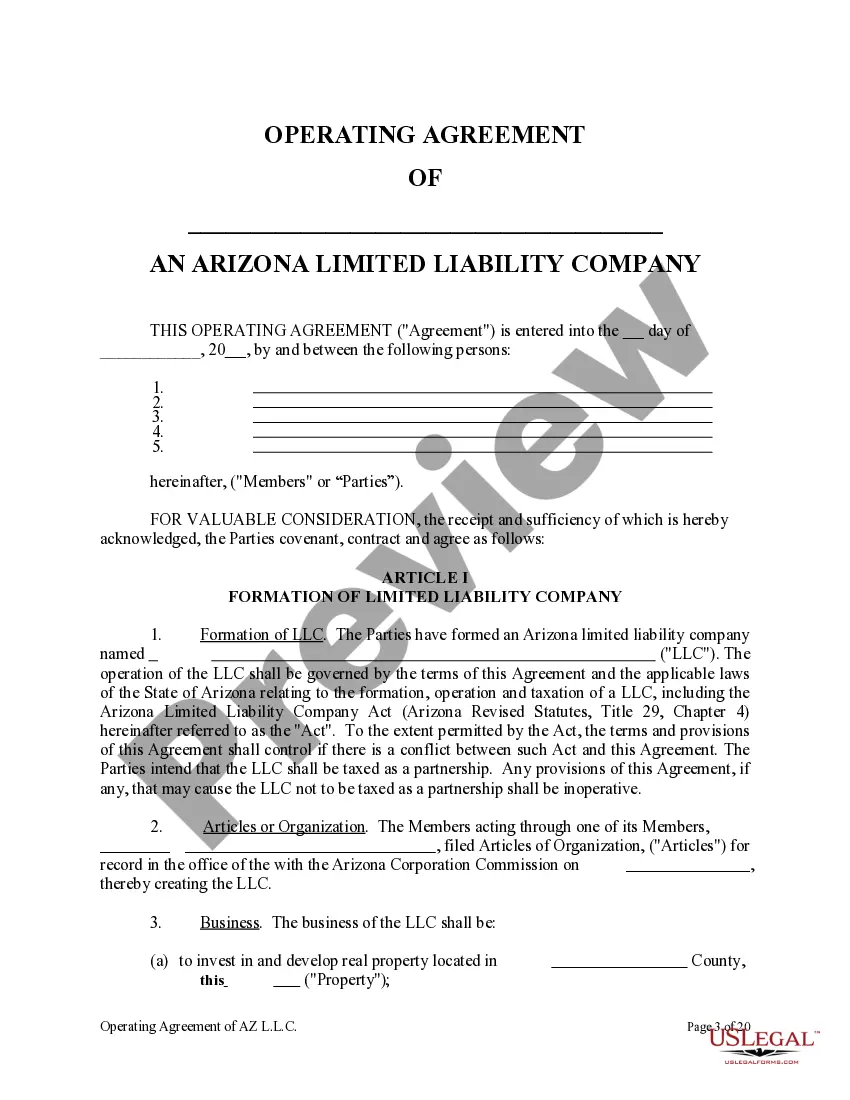

How to fill out Arizona Limited Liability Company LLC Operating Agreement?

Creating legal documents from the ground up can frequently feel overwhelming.

Some situations may require extensive research and significant financial expenditure.

If you’re looking for a simpler and more economical method for drafting Llc Operating Agreement Arizona Withholding or any other forms without dealing with complications, US Legal Forms is always available to assist you.

Our online collection of over 85,000 current legal documents encompasses nearly every aspect of your financial, legal, and personal matters.

Check the form preview and descriptions to confirm you’ve found the document you are looking for.

- With just a few clicks, you can effortlessly obtain state- and county-specific templates meticulously prepared by our legal professionals.

- Utilize our platform whenever you require dependable and trustworthy services to easily find and download the Llc Operating Agreement Arizona Withholding.

- If you are familiar with our website and have previously registered an account, simply Log In to your account, locate the template, and download it or re-download it at any time from the My documents section.

- No account? No issue. Setting one up is quick and easy, and browsing the catalog is straightforward.

- Before directly downloading the Llc Operating Agreement Arizona Withholding, be sure to follow these guidelines.

Form popularity

FAQ

Your withholding percentage should reflect your expected total income and tax obligations to avoid over- or under-withholding. You need to take into account any deductions, credits, or changes in your financial situation. Tools on uslegalforms can help you calculate an accurate withholding percentage that aligns with your LLC operating agreement Arizona withholding.

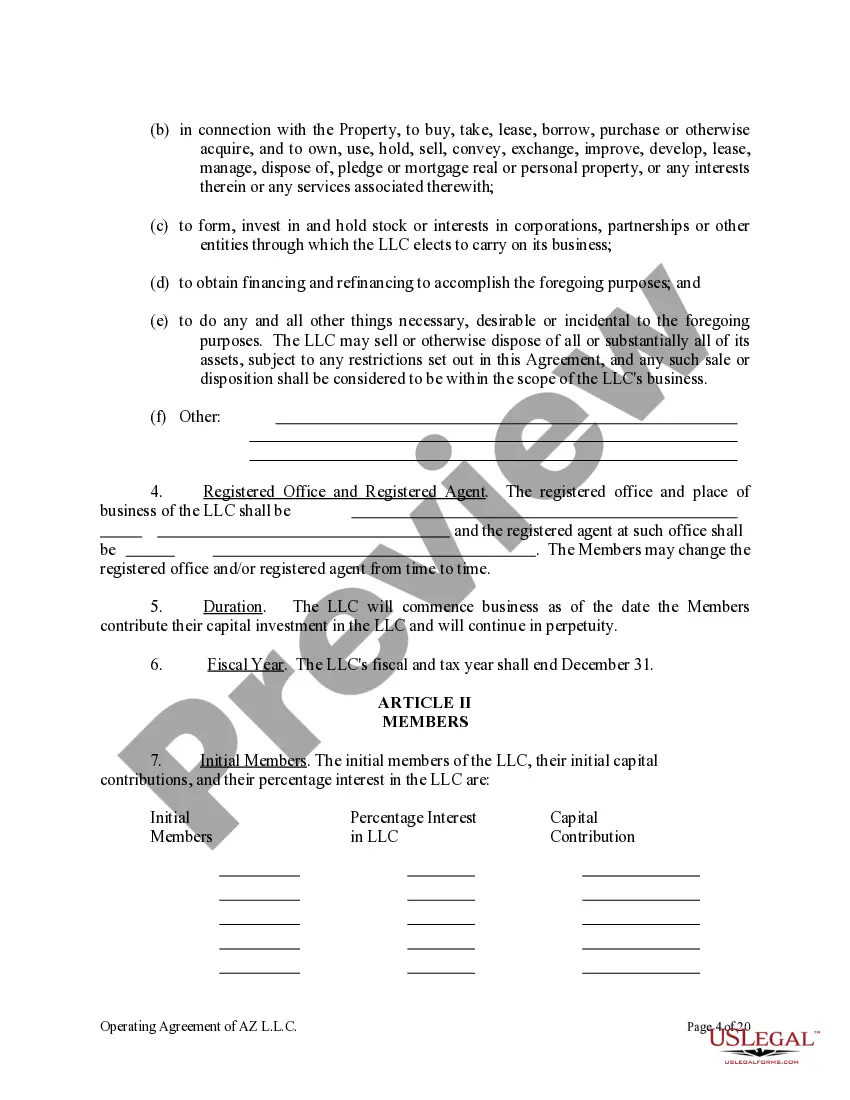

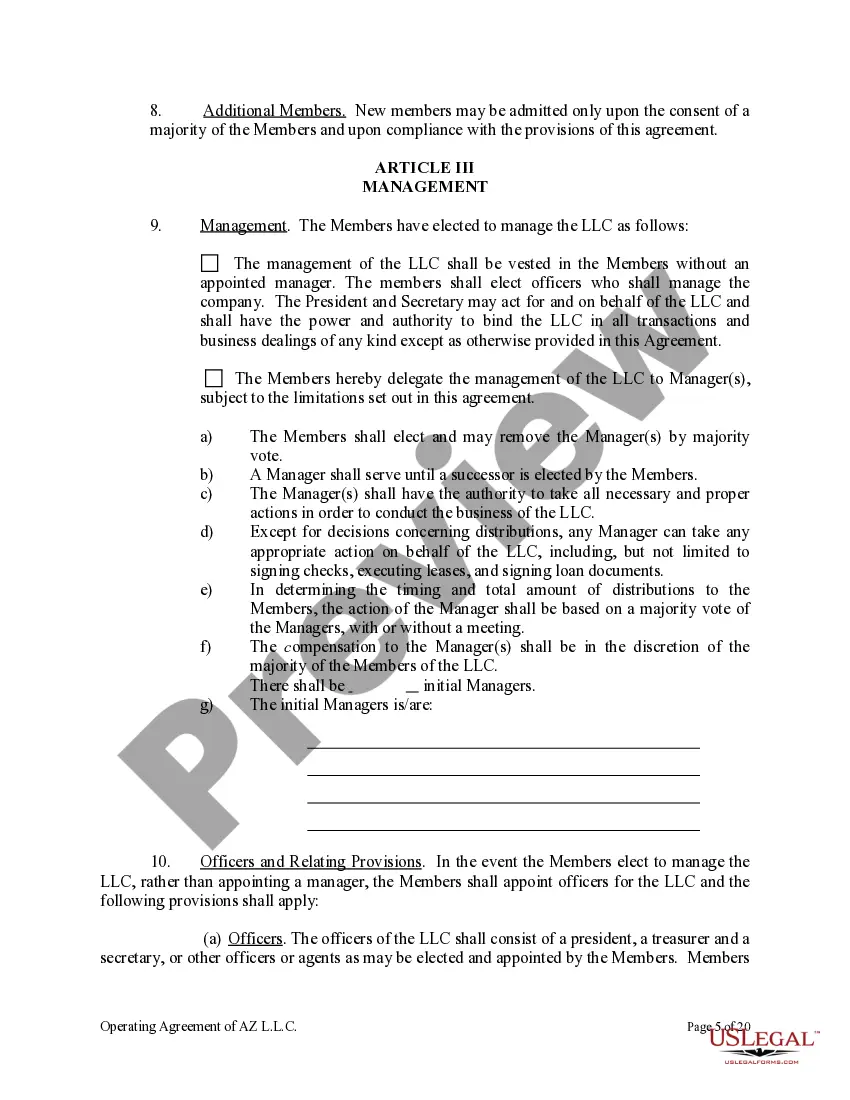

While Arizona law does not mandate an operating agreement for LLCs, having one offers clarity and can protect your business's integrity. An operating agreement outlines the rights and responsibilities of members, further defining financial and operational procedures. It becomes especially crucial if you're managing withholding. Uslegalforms can guide you in drafting an effective LLC operating agreement Arizona withholding.

Arizona taxes take out a percentage from your paycheck based on your earnings and the prevailing rates set forth by the state. Usually, this involves both state income tax and possibly local taxes. Understanding these rates helps prevent surprises during tax season. Utilize resources like uslegalforms to navigate the nuances of LLC operating agreement Arizona withholding.

Withholding for AZ state taxes typically associates with your total annual income and filing choices. Arizona employs a progressive tax rate system that can affect your withholdings. To get the best results and avoid underpayment, use tools from uslegalforms that assist in determining the right withholding percentage within your LLC operating agreement Arizona withholding.

The percentage to take out for Arizona state taxes may vary depending on your income level and tax bracket. The Arizona Department of Revenue provides guidelines to help you gauge this accurately. For a clearer view, consider reviewing the withholding tables or calculators available on uslegalforms. This will aid you in drafting a precise LLC operating agreement Arizona withholding.

Determining your Arizona withholding percentage is vital for appropriate tax management. Generally, the percentage reflects your expected income and filing status. For instance, if your income is lower, you might select a lower withholding percentage. You can also consult resources or tools provided by uslegalforms to ensure accuracy in your LLC operating agreement Arizona withholding.

Electing an Arizona withholding percentage of zero means that no state tax will be withheld from payments made to your LLC members. However, this election may impact your tax liabilities later, so understanding the LLC operating agreement Arizona withholding implications is crucial. It's advisable to consult resources or experts, like those provided by USLegalForms, to ensure you are making an informed decision.

Yes, an Arizona LLC generally needs to file a tax return. The specific requirements depend on the structure and income of your LLC. It is vital to incorporate the methods for handling LLC operating agreement Arizona withholding in your financial planning. Using a reputable platform like USLegalForms can assist you in navigating these tax requirements efficiently.

Yes, Arizona requires residents and businesses to use a state withholding form for tax purposes. This form helps report the income that is subject to withholding. When managing your LLC, remember that understanding the LLC operating agreement Arizona withholding details is essential for compliance. You can find resources and templates on platforms like USLegalForms to simplify this process.

If your LLC lacks an operating agreement, you may face issues in managing operations and resolving disputes among members. Without this document, the state default rules may apply, which might not align with your business needs. This gap can complicate matters related to Arizona withholding, so consider using resources like US Legal Forms to craft a suitable operating agreement.